- Patsy : rdramahistorian

- 2

- 9

No, it's not about that Indian b-word ruining Scooby Doo, this is far more interesting.

On 5 February 2018, the Chicago Board Options Exchange (Cboe) Volatility Index (VIX), after nearly a year of low market volatility, increased more than 100% in a single day—from 18.44 at open to 37.32 at close. This sudden spike led to sharp losses for short-term volatility investors who had bet that the VIX would remain low. Several high-profile exchange-traded products (ETPs) that deliver short volatility exposure destabilized or collapsed. Questions remain as to what may have led to the crash on a day that eventually came to be dubbed “Volmageddon”.

Short volatility ETPs had grown extremely popular in the preceding few years because they had profited from sustained low market volatility. Leveraged and inverse ETPs experienced rapid 30% annual growth over the previous decade, exceeding the 20% annual growth of the wider ETP space. The underlying VIX futures market for short volatility ETPs was very volatile. The average 90-day trailing volatility of the S&P 500 VIX Short-Term Futures Index was, on average, 64.0% between January 2007 and December 2017, compared with 17.4% for the S&P 500 Index. Also in late 2017, S&P 500 volatility reached historical lows, at approximately 6.8%.

The two most popular examples of inverse VIX ETPs at the time were the VelocityShares Daily Inverse VIX short-term exchange-traded note (XIV) and the ProShares Short VIX short-term futures exchangetraded fund (SVXY). Both ETPs tracked the inverse performance of the S&P 500 VIX Short-Term Futures Index (henceforth, “VIX Futures Index”).

Following particularly low volatility in 2017, the combined AUM of these funds had rapidly grown to $3.5 billion by early February 2018. In the 5th February price crash VIX rose by 102% and the VIX Futures Index rose by 72%. The two inverse ETPs that tracked the inverse performance of the VIX Futures Index (i.e., the XIV and SVXY) collapsed in the afternoon and suffered abrupt losses. Their prices crashed in the run-up to 4:15 p.m. Eastern time, the daily settlement time of the VIX futures market and the time when ETPs calculate their net asset values (NAVs). The ETP prices continued falling in the after-hours market. By the open of the next day, ETPs had fallen by 97%, according to Bloomberg data.

Many analysts had already argued that the rise of ETFs increased the volatility of the underlying assets as a result of noise. Crowded trades and volatility premium also played a part.

The Value Proposition of Inverse Volatility Products

The VIX approximately tracks the volatility implied by near-term options on the S&P 500 Index. Investing in VIX futures contracts enables investors to take a long or a short position on the future level of the VIX. The VIX Futures Index measures the returns of a portfolio of short-term VIX futures contracts with a weighted average maturity of one month to expiration. Inverse volatility ETPs offer investors the ability to take short positions against future values of the VIX by offering a return equal to the inverse return of the S&P 500 VIX Short-Term Futures Index. Investors in such ETPs profit from unexpected decreases in the VIX and lose from unexpected increases in it. Investors also typically profit in the absence of unexpected changes in the VIX. The reason is that the existence of a volatility risk premium, as well as the negative correlation between VIX movements and stock market movements, implies that futures are typically upwardly biased estimates of future VIX values.

Indeed, by January 2018, the two largest inverse volatility ETPs were the SVXY and the XIV, with total AUM of, respectively, $1.7 billion and $1.9 billion.

The SVXY was structured as an ETF, and the XIV, as an ETN. Both ETNs and ETFs sell shares to outside investors and promise the return performance of an index that they track. An ETF typically purchases and sells assets directly to track an index performance. In contrast, an ETN promises an index's return performance without the mandate to directly invest in assets that are related to the index it tracks. Thus, the ETN is more likely to offer a return profile without tracking error. As such, it relies on the issuer's ability to issue such returns and thus the issuer's creditworthiness. One of the main advantages of an ETN over an ETF for investors is, therefore, that an ETN typically pays out the exact index return rather than the return of the ETF's asset basket. One of its main disadvantages, in turn, is that the ETN is more vulnerable to the issuer's credit risk.

The popularity and interest in inverse and levered volatility ETPs may be surprising considering the view that these products are not well suited for buy-and-hold investors and hedging purposes. A key reason is that inverse ETFs and ETNs must maintain the same “–1×” exposure to their benchmarks every day. Analysts had also proved and showed that the associated daily rebalancing creates compounding mechanics that can lead to poor long-run performance. Accordingly, prospectuses of inverse ETPs specifically note that these products are not appropriate for providing the desired risk exposure for periods longer than a day.

However, these products may provide value to investors through strategies. Many noted that investors may invest in short volatility ETPs because they are seeking to diversify, are reaching for yield, or are chasing positive return performance.

The Ball Gets Rolling

A VIX ETP issuer who sells a short volatility product to investors will typically hedge by taking short posit ions in VIX futures contracts. Doing so ensures the issuer of a neutral position. Normally, the issuer will match the futures exposure with the cash received from investors (or its AUM). Because the fund seeks to deliver returns equal to –1× the benchmark index every day, the issuer needs to rebalance its position each day to ensure that the mark-to-market value of its short futures contracts matches the value of the fund's AUM.

The XIV ETN.

The XIV ETN sought to provide investors with a return mirroring the inverse performance of the S&P 500 VIX Short-Term Futures Index (VIX Futures Index).

In early February 2018, the value of the XIV's AUM stood at $1.86 billion. As a counterparty to buyers of the XIV, the XIV issuer effectively had a long exposure to volatility equivalent to a notional amount of $1.86 billion. To hedge the full exposure and remain neutral, the issuer took a short position in VIX futures with a total market value of $1.86 billion. This procedure would ensure that any change in the value of the liability to investors would be offset by markto-market changes in the value of the hedge position. Suppose, for example, that the VIX Futures Index rose by 10%. The value of the XIV's AUM would fall from $1.86 billion to $1.86 billion × (1 – 10%) = $1.674 billion, implying a reduced liability for the issuer. The issuer's short VIX futures position would also suffer mark-to-market losses and fall from $1.86 billion to $1.674 billion. Overall, the issuer's gain from a reduced XIV liability would be offset by an equivalent loss on its hedge position. Going forward, however, the issuer would not be neutral and would need to rebalance its hedge as specifically, the notional exposure of the issuer's short futures position increased from $1.86 billion to $1.86 billion × (1 + 10%) = $2.046 billion, and the issuer would need to reduce the exposure of the short position to $1.674 billion.

The issuer would need to buy futures because the value of its liability became $1.674 billion, not $2.046 billion. In the absence of trade, the issuer would have a mismatch on its balance sheet, with a short position in VIX futures that was too large relative to its XIV liability ($2.046 billion ≠ $1.674 billion).

As a result, the issuer would need to close out existing positions through the purchase of new VIX futures contracts to remain neutral. In our hypothetical scenario, the issuer would need to lower its short volatility exposure by buying VIX futures contracts for an amount of $2.046 billion – $1.674 billion = $372 million.

In case of a drop in volatility, the issuer would need to rebalance its hedged position by selling additional VIX futures contracts.

The SVXY ETF.

Like the XIV ETN, the SVXY ETF sought to provide investors with a return mirroring the inverse performance of the VIX Futures Index. To do so, the fund sold VIX futures with a notional exposure equal to the fund's AUM. For example, in early February 2018, the value of the SVXY's AUM stood at $1.7 billion and the fund was short VIX futures with a notional exposure of $1.7 billion. The value of the fund then fluctuated in line with the mark-to-market gains and losses on the short futures position.

A rise of 10% in the VIX Futures Index. The mark-to-market losses on the fund's short VIX futures positions would equal $1.7 billion × (–10%) = –$170 million, and the fund's NAV would accordingly fall to $1.53 billion. However, the notional exposure of the fund would have increased from $1.7 billion to $1.7 billion × (1 + 10%) = $1.87 billion.

Thus, even though the XIV and the SVXY differ in their structures—an ETN and ETF, respectively—both funds feature a need to rebalance their hedge posit ions each day. The fundamental reason is that both funds are leveraged, in the sense that the notional exposure of the fund does not fluctuate in line with the value of the fund. Ie like leverage from a bank and playing it in the markets your exposure and assets do not move in synchronicity. In this case it even diverges more and more 😴😴😴

Volmageddon

The disproportionately large market share in VIX futures contracts held by leveraged ETPs (e.g., XIV and SVXY) amplified the February 2018 volatility shock through their rebalancing mechanism and contributed to their collapse through a feedback loop,

On 5 February 2018, the VIX increased more than 100%, from 18.44 at open to 37.32 at close. This increase is one of the largest daily jumps in the history of the VIX and came after several years of low volatility.

Concurrently, the VIX Futures Index rose throughout the day.

As discussed in the previous wordsX3 sections, this increase in volatility led to a drop in the value of inverse volatility ETPs' AUM and a simultaneous increase in the notional exposure of their short VIX futures positions. To remain market neutral, the SVXY fund and XIV issuer needed to buy VIX futures contracts to match their short volatility exposure with the reduced value of their fund's AUM. In deep markets with sufficient investors, the purchases of VIX futures contracts by ETP issuers with similar rebalancing needs would have had a minimal impact on the prices of VIX futures.

However, in January 2018, the XIV, the SVXY, and other ETPs with similar rebalancing needs after market hours jointly held a significant portion of the market. The market concentration was so significant that the purchase of VIX futures contracts as a result of rebalancing created further upward pressure on VIX futures prices and a feedback loop that would ultimately reduce the value of the ETPs' AUM significantly. Specifically, the purchase of VIX futures would have significant positive effects on futures prices and lead to further drops in the SVXY's and the XIV's AUM. The result would be the need for more rebalancing that would lead to even further drops in AUM.

Lesson for r-slurs:

Why do they mean by rebalancing. 😵💫😵💫😵💫

You have given me $10 (your net worth) to short shares. I short 10 shares of $1 and receive $10. My liability to you is $10, my assets under management/exposure (since I have to buy them back within a time frame) is $10.

Now let's suppose the share prices rise by 10%. So the 10 shares I have sold now would cost $11 to buy back. Accordingly I would exhaust the $10 I have got from short selling those shares and use $1 of your money. So your assets (my liability) take a hit of 10% (you're only left with $9) 😭😭😭 and my exposure increases to $11. This is why even though I haven't taken any loan, I am leveraged, since my AUM and exposure diverge more and more.

If you want to learn more, DM me, I'll send you some adderall

Anyway,

The ETPs traded from a 9:30 a.m. open to a 4:00 p.m. close, and by 4:00 p.m., the VIX Futures Index had increased by 39%. As noted previously, both ETPs tracked the inverse of the performance of the VIX Futures Index. Therefore, the increase in the VIX Futures Index increased the value of the combined short volatility exposure of the ETPs from $3.5 billion to $4.8 billion (+39%) by 4:00 p.m. At the same time, the AUM of the SVXY went down from $1.68 billion to $1.04 billion and the underlying value of the XIV went down from approximately $1.86 billion to $1.15 billion (–39%). The value of their combined AUM at 4:00 p.m. was, therefore, approximately $2.2 billion ($1.04 billion + $1.15 billion).

By this time, it was apparent that both ETPs would need to trade a significant number of contracts to remain hedged. Indeed, at 4:00 p.m. prices, the total short exposure in VIX futures contracts that the ETPs would need to close out amounted to $4.8 billion – $2.2 billion = $2.6 billion. In light of this, fund managers would have begun rebalancing before 4:15 p.m., the time when the funds calculate their NAVs and when the VIX futures market closes. This additional demand for futures contracts resulting from hedge and leverage rebalancing likely contributed to the significant increase in futures prices between 4:00 p.m., following the market close for the XIV and SVXY, and the close of the VIX futures market.

It didn't help that the needed number of contracts represented a significant fraction of open interest and volume. For example, in January 2018, the VIX futures market recorded a total open interest of 600,000 contracts, with an average daily trading volume of 400,000 contracts recorded over the five days preceding 5 February 2018 (Cboe 2020). Thus, the contracts needed for hedging and leverage rebalancing represented about 23% (93,000/400,000) of the average daily trading volume in volatility futures contracts and nearly 16% of every contract outstanding (93,000/600,000).

The rebalancing activities of other ETPs, such as 2× volatility futures funds, likely contributed additional upward pressure on VIX futures prices.

AI may also have kicked volatility dabblers in the nuts as High-frequency trading (HFT) also potentially contributed to the crash of short volatility ETPs, especially considering that the average holding period for short volatility ETPs is about 0.88 day.

Conclusion

In February 2018, a spike in market volatility led to a one-day loss of more than 90% for investors in inverse volatility ETPs. This even shows how leverage and hedge rebalancing, coupled with large market concentrations, can lead to sudden collapses of levered investment structures and significant losses for outside investors.

Post Script (Not my words)

Uninformed investors might assume that the leverage returns are generated on a continuous basis, so that if an underlying index is up 5% for a month, the double-leveraged ETF will be up 10% for the same month; if the index is up 10% for 6 months, the ETF will be up 20%, and so forth. That is absolutely not the case. The leverage is determined on a daily basis and the returns for any other period usually will not be double or triple the underlying index.

In order for the leveraged funds to achieve appropriate levels of assets so they can provide their implied leverage, they have to rebalance daily. In the case of an ETF providing long 2-times leveraged exposure, they would typically attain exposure to a notional set of assets equal to 2 times their NAV. An example would be an ETF that takes in 100 units in assets that does a swap with a counterparty to provide exposure to 200 units in performing assets. The rebalancing activity of these funds will almost always be in the same direction as the market.

In essence, a leveraged ETF is essentially marked to market every night. It starts with a clean slate the next day, almost as if the previous day had not existed. This process produces daily leverage results. However, over time, the compounding of this reset can potentially vary the performance of the fund versus its underlying benchmark. This can result in either greater or lesser degrees of final leverage over individual holding periods.

- 37

- 40

I'll make this an effort post since I know you zoomies know nothing about the Internet or gaming before 2015.

Dyack in the middle

Silicon Knights

Silicon Knights was a Canadian developer who made a few decent games, like Legacy of Kain and the Gamecube remake of Metal Gear Solid. They're mainly remembered for the classic Gamecube horror game Eternal Darkness: Sanity's Requiem, which is quite good for its time and is notable for being the only rated-M game ever published directly by Nintendo. They were lead by a guy named Dennis Dyack, a whiny manchild who doomed his company to fail.

Zoomers: This was considered scary in 2002

To give you an idea of their management, here's an image of games in production, games that were cancelled or abandoned before release are marked in yellow. Note the staggering ratio of unreleased/released games:

Anyways, Dyack's passion project for decades had always been a game called Too Human, but every effort to make it had been abortive. After the successes of Eternal Darkness and MGS, Dyack decides the Wii doesn't have shiny enough graphics and makes the bold choice to unshackle his company from a lucrative position as a Nintendo third party so he can truly fulfill his vision on the superior XBawx Please Fix Me. Silicon Knights shacks up with Microsoft and Epic Games and produce an E3 demo (zoomers: people used to go to an annual convention for video game trailers) which is received overwhelmingly negatively.

Dyack is NOT HAPPY and goes on the IGN forums to whine about how the critics will regret their words and deeds:

Unedited clip from Too Human

NeoGAF

Once upon a time there was a gayming website called Gaming Age, with their forum called the Gaming Age Forum (or GAF). Eventually Gaming Age imploded, but the top two jannies (Evillore and Bishoptl) were able to move their community to a new forum, appropriately called NeoGAF. You wouldn't know it these days with GAF being a shambling corpse and its spinoff ResetERA being what it is, but pre-G*merGate GAF was chill and a place where industry figures would show up and sperg out while everyone laughed at them.

Dennis Dyack makes a bet

Right now the man just appears confident in his project. But his next post is a bit more... unhinged, and seems to be setting the bar rather low by making alreay-forgotten games Lair and Haze the standard to beat:

Dyack then does another interview where he declares that not only is NeoGAF the worst forum in the world, but forums in general are evil and this is why the US military no longer uses writing:

Too Human comes out and scores lower than Haze. In classic GAF fashion the top janny punishes Dyack for losing the bet by writing lots of words and then perma-banning him. Dyack copes by saying g*mers are too stupid to understand his genius.

By this point the capital-G G*mers are pissed at Dyack in a way that prefigures G*merGate in a way. Seething articles are written speculating that angering the G*mers has resulted in him not just being banned from NeoGAF, but divorced from his wife, kicked out of the house, abandoned by his employees, his car towed, banned from every website ever, banned from the city of Niagara and tossed over the waterfall.

He messed with g*mers. G*mers.

The Saga Ends

Denis Dyack has brought Silicon Knights from one of the more respected devs in the industry to basically a joke. Following the failure of Too Human Dyack blamed the Unreal Engine and Epic Games and made the genius decision to sue them. This didn't go their way and by 2012 they owed Epic millions of dollars, had less than five employees, and were legally obligated to destroy all of their unsold games and source code.

In the meantime they had six more projects (including two sequels for Too Human) which were cancelled before they finally released another game, the absolutely awful X-Men Destiny, which turns out to be their last. In desperation, Dyack crawls back to Nintendo and pitches a sequel to their last hit, Eternal Darkness. NeoGAF insider reveals that Nintendo is agreeable until SK loses the lawsuit against Epic, and they decide they'd rather not fork over $10 million in legal fees so SK can survive, which Dyack denied. Former SK staff reveal that this was the case and part of the reason the X-Men game sucked was because Dyack was taking money given by Activision for that game and instead putting it toward Eternal Darkness II.

Years later Dyack attempts to kickstart his own Eternal Darkness successor and makes $300,000 out of the $700,000 target. He has yet to make another game. The end!

Dyack, left

tl;dr

- 26

- 44

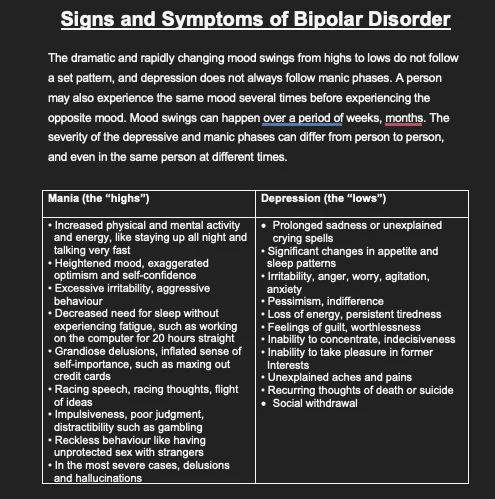

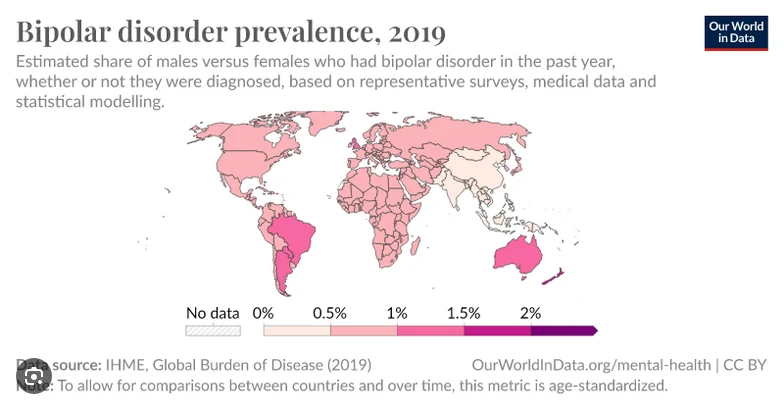

As you probably know by now, I'm a sick, sick man. I am diagnosed with Bipolar II disorder along with OCD. This has affected my life negatively, but I'm still alive which more than many can say. Today, I'm going to explain the ins and outs of Bipolar Disorder. I hope you enjoy the short read.

What is Bipolar Disorder

Bipolar disorder is a mental disorder characterised by mood swings. In other words, the sufferer may have periods of great euphoria followed by an irrational manic-depressive episode. During the upswing, a Bipolar patient will experience the following:

euphoria

high motivation

irritability

risky behaviour

heightened sexual activity

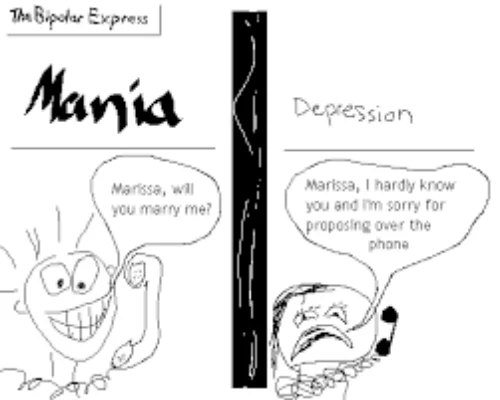

I am currently in an upswing and I have very little need for sleep. Five hours or less is enough for now, which is partially why I have time for this shit. I also feel highly productive and cannot stop myself from producing something. I wish I was a genius so I could channel this energy into something other than rdrama posts that 12 people will upvote and cause 3 people to block me. After the upswing comes the downswing which consists of depression, suicidal thoughts, a lack of motivation, and self-harm. How much self-harm? It is estimated that 30-40% of folks with Bipolar Disorder will engage in self-harming behaviour. Upswings and downswings are usually not congruent with what is going on in the person's life. For example, someone with a good life may find themselves in a downswing while others may experience a euphoric downswing as they ruin their life.

Quick notes from Holly!

Holly says to take benzos, avoid sleep, play The Last of Us Part 2, and listen to Cocaine 80s. In between these activities, make shitposts on rdrama.

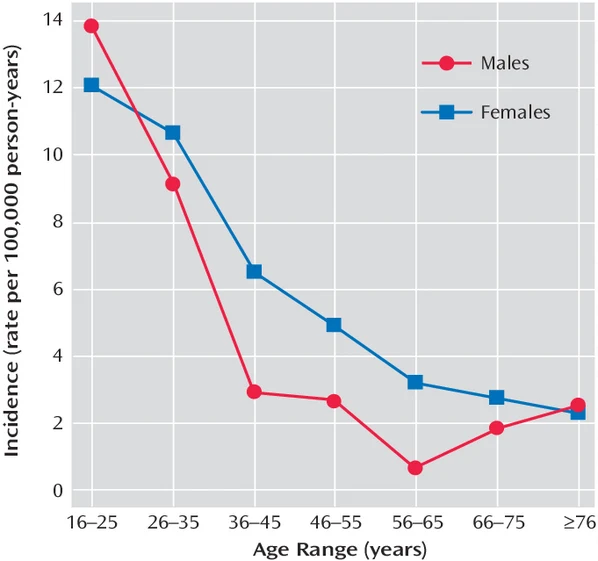

How quickly do these mood swings occur? Well, it depends on what kind of Bipolar disorder one suffers from. With Bipolar I and II, each upswing and downswing can last weeks to months. However, there exists rapid cyclic bipolar which is typically characterised as a series of 4 or more upswings or downswings occurring within a 12-month period. Symptoms typically begin to manifest in one's early twenties, though signs may appear during teen years or it could onset in one's late twenties.

Difference between Bipolar I and Bipolar II

Though Bipolar I and II share many similarities, there are some key differences. Most notably, one can only be diagnosed with Bipolar I if they experience a manic episode. A manic episode is characterized by psychotic symptoms such as visual and audio hallucinations. Other symptoms include:

racing thoughts

disinhibited social behaviour

hypersexuality

feelings of grandiosity

pressured speech

For example, someone may feel that they are receiving messages from God, hear divine voices calling their name, believe they can change the world, or are on a special mission. With the propensity for risky behaviour comes increased drug use and risky sexual behaviour. Such individuals typically end up requiring involuntary institutionalization, and they demonstrate decreased activity in the lingual gyrus region of the brain and decreased activity in the inferior frontal cortex. In contrast, Bipolar II patients suffer from hypomania which is more subdued and less likely to ruin someone's life, but is nonetheless still highly disruptive. They do not experience the psychotic aspects of mania and do not usually require hospitalization during a hypomanic episode.

What goes up must come down. When the mania or hypomania is up, we get to the depressive stage. This is usually a period filled with great regret, melancholy, and a downswing in one's mood. This period is usually longer than the hypomanic or manic phase and this is when the self-harm and suicidal ideation slips in. Activities that were once enjoyed now feel dull, and constant sleep is common. During one of my downswings this year, I had to be hospitalized after severe self-harming.

But wait! There's a third option! Some people suffer from mixed affective state. This is when a person experiences an upswing and downswing simultaneously. This is common in patients with rapid cyclic bipolar where the mood swings occur so quickly, they don't have time to resolve.

What causes Bipolar Disorder

It is currently not known precisely what causes Bipolar Disorder though it is estimated that it is 70-90% genetic with a minimal environment factor. For example, an abusive childhood can aggravate the condition or a significant life event such as the loss of a loved one.

Scientists have zoned in on variants within the genes CACNA1C, ODZ4, and NCAN, and polymorphisms in BDNF, DRD4, DAO, and TPH1. The end-result is dysregulation in the dorsolateral prefrontal cortex portion of the brain.

Treatment of Bipolar Disorder

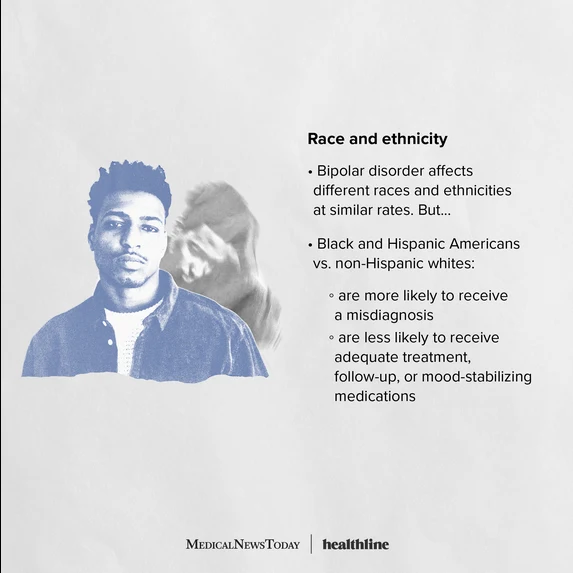

Bipolar disorder is treated through a combination of therapy and medication. Currently, I am on lithium (a controversial mood stabilizer) and Abilify (an antipsychotic). Previously I have also been on sodium valproate and serdep. And of course, I have been given a plethora of benzodiazepines. Typical therapy methods include CBT (cognitive behavioural therapy) and DBT (dialectical behavioral therapy).

It is difficult to treat Bipolar disorder because those with the illness are often in denial about it and resistant to treatment. This is especially true during manic episodes. Hence, more than 75% of individuals with BD inconsistently take their medications for various reasons.

Bipolar Disorder memes and infographics

Conclusion

I hate being bipolar. It's awesome.

Tune in next time when I discuss the function of the foreskin or the Beat Generation or some shit.