- 3

- 16

My credit card has a $2000 limit, right now it has about $200 on it. Can't afford to pay it down until the baby bonus comes in. My husband's credit card has a $10k limit and there's about $8k on it that we are trying to pay down.

What I appreciate about this answer is that it is honest. Everyone else in this thread is rushing to congratulate themselves for having enormous credit limits with $0 balance. I have an upvote and award for you!

Yea because you're supposed to run up your credit card each month up to its limit

- 26

- 59

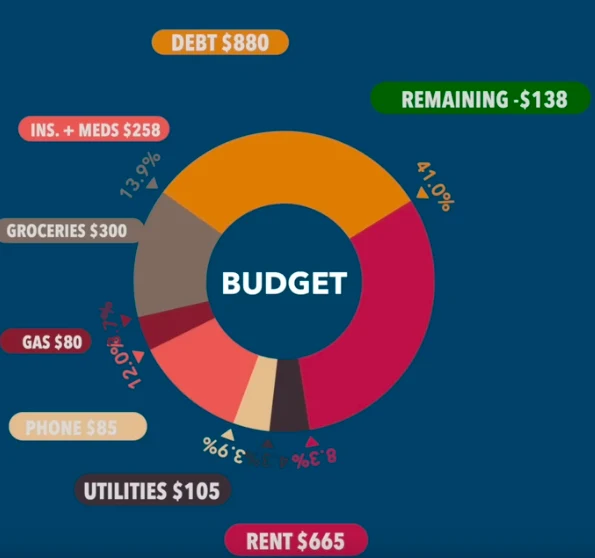

Duncan 26, San Antonio TX

$57'303 total debt

$880 minimum monthly payments, 41% of his current income

At least $400 interest accruing each month ignoring student loans and stuff in collections

First truly mentally ill person on the show, he weirds me out a little but I might be just paranoid. I don't trust people who cry on camera. I've timestamped some of the oddness, not in chronological order

Self-rated 3/10 financially

Has been watching Caleb for "a couple months" hasn't started budgeting

- cries from stress of his situation? Tries to explain his failures in past attempts to budget timestamp

Diagnosed with "Bipolar II Disorder" plus some backstory, only recently got meds

Career:

Delivery for Tiff's Treats and somtimes on-duty manager on weekends, does Grubhub/Doordash on the side

"I got deactivated from Grubhub for some reason" timestamp

Drives company car so his gas payments aren't bad

Currently making $23 an hour and $18 as the stand-in manager

hours cut, losing insurance in July (sales down year after year)

nervous laughter here timestamp

financially struggling

only 6 stores in his district

Personal Life:

Lost his last credt for film grad because Covid and classes/grades fell apart afterwards near beginning of covid?

Was taking classes last semester? timestamp

Not this semester though so Student Loans are active now

Sudden jump from verge of tears to recitation of the canned youtube comment line about finance needing to be taught in high school timestamp

"I think that's a big detriment to the American education system, nobody gets taught finances, ever"

Wants to go back to school for a business degree but can't because of his current situation

Savings/Expenses:

Nothing in retirement

USAA checking

Monthly balance $225 -> 281

Spent money on Uber Eats, overly self-deprecating statement to dodge timestamp

Same dodge trips to coffee shop/donuts/general eating out timestamp

Shared checking with him and his girlfriend

Pays to do gig work? Not sure if I understood that right

$766 last month just on fast food/eating out (36% of income)

Swipe savings

$7 -> $161.85

$224 car insurance payment since he got into an accident uninsured

Debt:

Says he has a terrible credit score (551)

Was at 630 3 months ago

Found a credit repair company he's been thinking of reaching out to

Student loans (paying interest only) Variable Interest Rates

$13'316 14% interest

10% interest

10% interest

Car Max Loan

$16'584 remaining, 421 minimum monthly payment (he's got another 400 past due with a 21 late fee)

10.45 interest rate

"All three of the credit cards I emailed you are in collections" timestamp

USAA credit card

Some old Visa

Coles Card

Owes $63.23 on "Afterpay"

Also on Paypal, Affirm and Klarna "I made a series of really really bad decisions"

- Affirm is 1k

"And it's just this stupid stupid anxiety of not knowing what I'm gonna have left" timestamp

Personal Loan

took it out a year ago because he was "freaking out about money" at the time

1'400 balance

Personal Loan

$986 "one of those finance app where you pay a certain amount and you get the rest of the loan back"

Not paying this one?

Owes Grandpa $4'500

"terrible situation"

First car he bought died, grandpa co-signed for a new car

- got t-boned and did not have insurance

Has had 2 cars get totaled while on job?

$10 monthly payments, it's informal

- 56

- 38

A couple of other details:

$320 a month for cigs and booze

$200 for "fitness"

$150 phone

$100 eating out

$80 App purchases

No car so he ubers sometimes.

2 Big dogs

How was he even approved for this rental lol that's crazy.

- 3

- 14

For real, I can't stand tradies who brag about not using PPE or being clean and then have more skin conditions than a Vietnam vet turned New Orleans hooker.

- 4

- 8

- 5

- 26

Employee approached me crying, asking if he could park his car in our parking lot overnight and work late “to stay warm”. I asked him what he meant and he told me that he hasn't been paying child support so 100% of his next three paychecks would be garnished and now he couldn't afford rent and was planning on living in his car.

I told him that I wouldn't allow any of my employees to be homeless so I gave him a $6000k interest free loan to pay all of his child support at once, so his paychecks wouldn't be garnished and he wouldn't be homeless.

Then we sat down and I helped him form a budget so he wouldn't have this issue ever again (he makes nearly six figures, just financially illiterate)

Four week later, he requesting PTO because he's flying out of state for a little vacation.

How do you go from on the verge of homelessness over unpaid child support to buying a plane ticket and taking a vacation four weeks later? Wtf man? Why can't people just be normal?

Edit: $6k my bad yall!

I also personally know the guy, he's a good dude just a little deep on the goofy spectrum.

Supposedly the money is being pulled from his paycheck so OP might eventually get paid back. There's some back and forth about whether or not child support can take your whole paycheck. Other manager stories dealing with poors.

One time I had an employee come to me sobbing that he was unable to buy groceries for his family. I spoke with my superiors and we agreed to help him out. I went and bought $500 worth of groceries and we filled his fridge and cupboards. Lots of shelf stable stuff that would last a long time. Beans and rice and stuff.

About a month later he was super excited telling me about the new vr headset he bought. A couple weeks after that it was the airsoft gun he bought to go play with his friends. Couple more weeks on he's showing me the puppy they're going to buy. He didn't understand why I didn't seem excited about the puppy, so I laid it out for him.

Haven't been willing to help an employee in that capacity since, unfortunately. I will show them compassion and even leniency for things like attendance when they're having a hard go at things, but I've learned that that has to be the extent of it.

I had a staff member give me a sob story on how they have to have surgery but do not have enough PTO to cover their surgery. She was very upset since the surgery is not optional and she didn't want to lose her job. I felt bad and donated 40 hours of my PTO to her so she could take the time worry free. Two weeks later she went on a weeklong vacation...

My dad used to give our payroll advances for situations like this semi-regularly. At best, the person just ends up coming back for another one as soon as they paid off that one. At worst, then end up quitting or needing to be fired for cause before it's paid off and we have to garnish it in its entirety in their final paycheck, which usually pisses them off more and some have gotten violent. Even worse, sometimes their final check isn't enough to cover it and we either kiss it goodbye or have to pursue them for it with threat of legal action. I've made him add the stipulation that it has to be taken out of the next check for whatever pay period we're in and cannot be greater than where their takehome pay is at the moment they're asking. Doing that, we've been able to help people that just had a very rare shortfall for rent or something like that so they don't have to go to a payday loan place while also keeping away the people that abuse it.

As everyone mentioned you got played, sorry.

It took me knowing someone who was "always broke " over 10 + years...at first it made sense, they were supporting a lot of kids, no degree and few jobs to accommodate the schedules for various kids and pick up drop off being sick etc...but then she attached herself to a guy who paid big bucks.. and I had hope for her, they got bills paid off, a nice house, help with the kids...except now with the change in support and schedule she continued not to work by choice (no medical issues). Annnnd then came the (in my mind unexpected) money choices...new cars, lots of new tech and junk for her and the kids...then we learn the mortgage is behind and they used COVID as an excuse to blow it off...despite making the same amount of money throughout...dude made 2.5 times more than me and she started asking for help with bills...they scammed medicaid/snap/wic etc and got found out and had to pay it back and got banned for life from receiving benefits.

Long story short she had already fricked her credit and fricked his...got him to quit 3 years before he could retire and cash out.. when the money ran out she ditched his butt.

So I say this: she could get a million dollars and still be broke within a month. It's pointless to give her money because she won't learn. I remember one time hanging out and Bill collectors were calling and they both acted irritated with the people for bothering...she doesn't see this as an obligation to pay back just another free paycheck. Sorry OP.

I own a travel agency, and I've seen the other end of this. His vacation is very likely being covered by a relative or it was purchased before the garnishment was announced and was non-refundable. It's a bad look, and people assume that someone like this is playing them, but it isn't necessarily that they have played you. Just keep this in mind as you move forward.

Travel agent's still exist  Also

Also

- 5

- 12

I work for a major airline as a new hire. I am making $40,000/year in a major city. In the last year, my food cost has doubled. So what does that mean? Well think of it like this. Let's say I take home after tax, $2500/month and I have to pay out $1500/month in rent+utilities. My car payment and insurance is $500, leaving me $500 remaining. So $125/week normally is enough to feed me basics as I eat a lot of ramen because I have to. I eat a lot of pasta because it's cheap. Sometimes I make eggs in the morning, and sometimes I get a pizza delivered once every two weeks if I am managing my food.

This means that just to break even and have the same pasta-eating lifestyle I had before, I need a 25% raise. My boss would never give me this. Never. My rent will undoubtedly go up $200 in June when my lease rolls over and I literally CAN'T keep going to work. I have to make $60,000/year to continue what I had one year ago. The only way that's going to happen is if I quit and go find two jobs at $30k each that are full time, but no business wants to hire you with a fixed schedule. They want to hire you 9-5 but demand that you are 'flexible' to work late or come in on weekends making a second job impossible.

Awards? Give me a dozen eggs. Give me gas cards. Pay my rent one month. Thing is, I am resentful that you on the top make $100,000 a year and can 'handle these increases' but the guy like me on the bottom? We are starving here and hate you for it.

Awards? Give me a dozen eggs. Give me gas cards. Pay my rent one month. Thing is, I am resentful that you on the top make $100,000 a year and can 'handle these increases' but the guy like me on the bottom? We are starving here and hate you for it.

This poorcel is making 40k and he's 30+ and this r-slur is acting like this wagie business owner is the same as a major airline

"Hot-take"..

If you don't pay enough to own a home in the surrounding areas, you aren't providing anything of worth to your employees - just different levels of treading water.

i can't wait until our corporate overlords take over the world

i can't wait until our corporate overlords take over the world

- 34

- 43

Ran into one of my former clients today. Unfortunately they’re back on the street after losing access to housing we had secured for them. I got them into something temporary for the next few days. I am telling you this because I want you to understand how hard it is out there.

— Lolo (@LolOverruled) May 19, 2023

replies are all coddling the houseless folx !nooticers !chuds thoughts?

- 36

- 100

.webp?x=8)

.webp?x=8)

Landchad uses rent money to pay the loan off AND keep a little extra

Landchad uses rent money to pay the loan off AND keep a little extra

poors are a different breed

poors are a different breed

](/images/1661103065029099.webp)