Duncan 26, San Antonio TX

$57'303 total debt

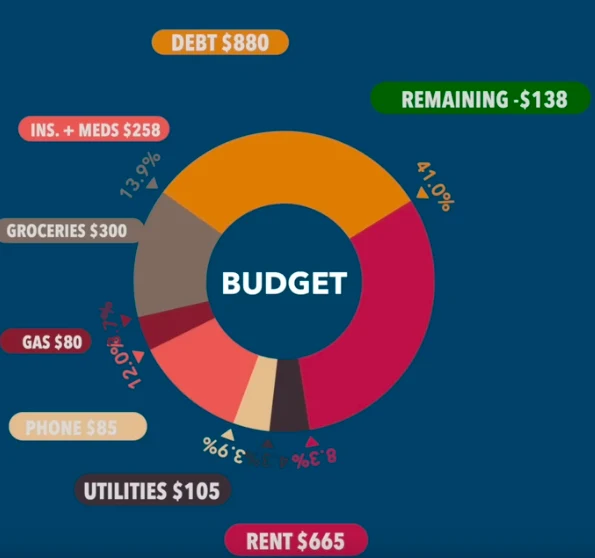

$880 minimum monthly payments, 41% of his current income

At least $400 interest accruing each month ignoring student loans and stuff in collections

First truly mentally ill person on the show, he weirds me out a little but I might be just paranoid. I don't trust people who cry on camera. I've timestamped some of the oddness, not in chronological order

Self-rated 3/10 financially

Has been watching Caleb for "a couple months" hasn't started budgeting

- cries from stress of his situation? Tries to explain his failures in past attempts to budget timestamp

Diagnosed with "Bipolar II Disorder" plus some backstory, only recently got meds

Career:

Delivery for Tiff's Treats and somtimes on-duty manager on weekends, does Grubhub/Doordash on the side

"I got deactivated from Grubhub for some reason" timestamp

Drives company car so his gas payments aren't bad

Currently making $23 an hour and $18 as the stand-in manager

hours cut, losing insurance in July (sales down year after year)

nervous laughter here timestamp

financially struggling

only 6 stores in his district

Personal Life:

Lost his last credt for film grad because Covid and classes/grades fell apart afterwards near beginning of covid?

Was taking classes last semester? timestamp

Not this semester though so Student Loans are active now

Sudden jump from verge of tears to recitation of the canned youtube comment line about finance needing to be taught in high school timestamp

"I think that's a big detriment to the American education system, nobody gets taught finances, ever"

Wants to go back to school for a business degree but can't because of his current situation

Savings/Expenses:

Nothing in retirement

USAA checking

Monthly balance $225 -> 281

Spent money on Uber Eats, overly self-deprecating statement to dodge timestamp

Same dodge trips to coffee shop/donuts/general eating out timestamp

Shared checking with him and his girlfriend

Pays to do gig work? Not sure if I understood that right

$766 last month just on fast food/eating out (36% of income)

Swipe savings

$7 -> $161.85

$224 car insurance payment since he got into an accident uninsured

Debt:

Says he has a terrible credit score (551)

Was at 630 3 months ago

Found a credit repair company he's been thinking of reaching out to

Student loans (paying interest only) Variable Interest Rates

$13'316 14% interest

10% interest

10% interest

Car Max Loan

$16'584 remaining, 421 minimum monthly payment (he's got another 400 past due with a 21 late fee)

10.45 interest rate

"All three of the credit cards I emailed you are in collections" timestamp

USAA credit card

Some old Visa

Coles Card

Owes $63.23 on "Afterpay"

Also on Paypal, Affirm and Klarna "I made a series of really really bad decisions"

- Affirm is 1k

"And it's just this stupid stupid anxiety of not knowing what I'm gonna have left" timestamp

Personal Loan

took it out a year ago because he was "freaking out about money" at the time

1'400 balance

Personal Loan

$986 "one of those finance app where you pay a certain amount and you get the rest of the loan back"

Not paying this one?

Owes Grandpa $4'500

"terrible situation"

First car he bought died, grandpa co-signed for a new car

- got t-boned and did not have insurance

Has had 2 cars get totaled while on job?

$10 monthly payments, it's informal

.webp?h=10)

Jump in the discussion.

No email address required.

The r/calebhammer thread is dunking on this scrote for his mental illness (even suggesting it's misdiagnosed) when women get no shelter with their vague mental health issues.

Jump in the discussion.

No email address required.

oh good find, I forgot that sub was a thing

Jump in the discussion.

No email address required.

More options

Context

More options

Context

I dont see why you'd need a finance education to know not to get 57k into debt and spend 900 dollars a month on fast food lol.

Jump in the discussion.

No email address required.

He was actively getting an education in it by having his credit cards closed and sent to debt collectors. He then enrolled in some more pay as you go programs.

Jump in the discussion.

No email address required.

More options

Context

Even then, most high schools have some sort of personal finance class. For some, it's even a requirement to graduate. They just slept through it or didn't sign up for it, lol.

Jump in the discussion.

No email address required.

I lost all sympathy for “never being taught finances and math that I actually need to use” because people say that then immediately pop open their phone aka a portal into near infinite free knowledge. But to your point, like 30 states require a financial literacy class, and even outside of that, most cities/counties have their own requirements for it; nearly everyone has a class available in school.

My favorite is when people mention “I was never taught how to balance a checkbook!” B-word, no one balances a checkbook anymore and even if you did you’d just be more aware of how r-slurred your spending was, also who even uses checks lmao. Quit mentioning a forgotten financial quip that hasn’t been applicable for 15 years. Pretty much every bank’s app has live charts that automatically reports your spending allocation, being financially illiterate in 2023 requires actively hiding the information from yourself

I also live in a neighborhood where the apartment management was really lax with income requirements and most people are spending everything on rent, so I hear this stuff constantly which is fun

Jump in the discussion.

No email address required.

More options

Context

More options

Context

99% of people that go on his show are r-slurs that refuse to cook so they eat out every day, have ten subscriptions to streaming services and max their credits cards by buying stupid bullshit end up having stupidly high interest rates. Its amazing how restarted people are with money.

Jump in the discussion.

No email address required.

This show instantly dispelled any sympathy I had for the reddit socialist types who cry about working shitty dead-end jobs. Being poor doesn’t mean you’re stupid, but sometimes it’s not a coincidence.

Jump in the discussion.

No email address required.

More options

Context

More options

Context

they should just steal old meat from the grocery store dumpsters!

Jump in the discussion.

No email address required.

More options

Context

More options

Context

All I saw was

With how he looks and the state of his finances what does she look like

Jump in the discussion.

No email address required.

You should see her student loan debts

Jump in the discussion.

No email address required.

More options

Context

!incels take yet another massive L

Jump in the discussion.

No email address required.

More options

Context

There's nothing a woman can't romanticize

Jump in the discussion.

No email address required.

More options

Context

More options

Context

So thankful I'm crazy paranoid about finances and always underspend

Jump in the discussion.

No email address required.

Lmao sounds like my foid. Both my foid and I make good money, but she is still so frugal that her work shoes are falling apart and she refuses to buy a replacement because she can still wear the old ones. She is worried about how expensive homes are and is convinced we’ll never own one, but I frequently have to remind her that we probably could afford a home in just a couple years.

Jump in the discussion.

No email address required.

My wife () recently got bumped up to $29/hr and said she wants me to teach her how to budget.

You don't need a budget. You owe $600/month on your car. $80/month on cable. That's it. If you aren't ending every month with more money than you started, it should be pretty obvious where your money is going.

I paid off my car and my house on a lower wage without budgeting. She doesn't need a budget.

Jump in the discussion.

No email address required.

More options

Context

More options

Context

Same. I think it was because growing up, it seemed like the family not having enough money was the source of all of our problems. Looking back I now understand it wasn't all that simple, but it still left me a very stingy person.

Jump in the discussion.

No email address required.

I would underspend what my parents gave me so I could buy things they didn't approve of. This has helped me in my career as an embezzler at Credit Suisse.

Jump in the discussion.

No email address required.

More options

Context

Coming to the realization that I'm just that much better with money than my parents was rough

Jump in the discussion.

No email address required.

More options

Context

More options

Context

More options

Context

Jump in the discussion.

No email address required.

More options

Context

yeah, but this is just inherent to the system

capitalism forces the poor to live in food deserts with no grocery stores

smdh it's literally a choice between paying a fortune to get goyslop delivered or starving to death

Jump in the discussion.

No email address required.

Arguing with some idiots in the comments of a Destiny video who were claiming its much cheaper to eat fast food than cook at home. One commenter pointed out it costs 10 dollars to get a big mac fries and coke, and then he estimated it woild cost three times that cooking that at home. A lot of these people havent even tried unplugging from goyslop

Jump in the discussion.

No email address required.

Thrice as much as a banana? Starting to sound expensive

But seriously tho you can even buy the Mc burger sauce ready made at the supermarkets these days

Jump in the discussion.

No email address required.

More options

Context

More options

Context

More options

Context

Pretty sure ridiculous spending sprees is a thing with bipolarcels

Jump in the discussion.

No email address required.

More options

Context

Snapshots:

archive.org

ghostarchive.org

archive.ph (click to archive)

timestamp:

archive.org

ghostarchive.org

archive.ph (click to archive)

timestamp:

archive.org

ghostarchive.org

archive.ph (click to archive)

timestamp:

archive.org

ghostarchive.org

archive.ph (click to archive)

timestamp:

archive.org

ghostarchive.org

archive.ph (click to archive)

timestamp:

archive.org

ghostarchive.org

archive.ph (click to archive)

timestamp:

archive.org

ghostarchive.org

archive.ph (click to archive)

timestamp:

archive.org

ghostarchive.org

archive.ph (click to archive)

timestamp:

archive.org

ghostarchive.org

archive.ph (click to archive)

timestamp:

archive.org

ghostarchive.org

archive.ph (click to archive)

timestamp:

archive.org

ghostarchive.org

archive.ph (click to archive)

timestamp:

archive.org

ghostarchive.org

archive.ph (click to archive)

Jump in the discussion.

No email address required.

More options

Context

Jump in the discussion.

No email address required.

More options

Context