So I was at the Trans Pacific Maritime Conference 2024, held in LA (don't worry about it, it's not open to plebs like you) and the keynote speaker, Robert Gates, Secretary of Defense (2006-2011) was giving his talk.

Two things caught my ears:

1st the triple problem of Red Sea crisis initiated by the Houthis, the Black Sea Crisis initiated by the Russians and the Panama Canal crisis. Now you may know about the first two, but what about the third? If I told you the Panama Canal crisis was caused due to a severe drought brought on by an episodic yet rare climate phenomenon called El-Nino, you would be more confused. But Bill, doesn't the canal just link two oceans? How can oceans experience droughts?

Well, you have to dig a little deeper. (Haha)

Panama is currently suffering a prolonged drought that began in early 2023 and has not let up. In October, rainfall was 43% lower than average levels, making it the driest October since the 1950s. For the area around the canal, 2023 was one of the driest two years since record keeping began in the country. Panama's severe drought is being exacerbated by the double-whammy of a strong El Niño and record-breaking global warming—2023 exceeded the pre-industrial temperature average by 1.35 C. El Niño is a natural climate fluctuation that brings warmer-than-average air and ocean waters to the West coast of the Americas. That influx of warmth can vary in strength and last between nine and twelve months, and the National Oceanic and Atmospheric Administration (NOAA) predicts it will continue into at least April of 2024.

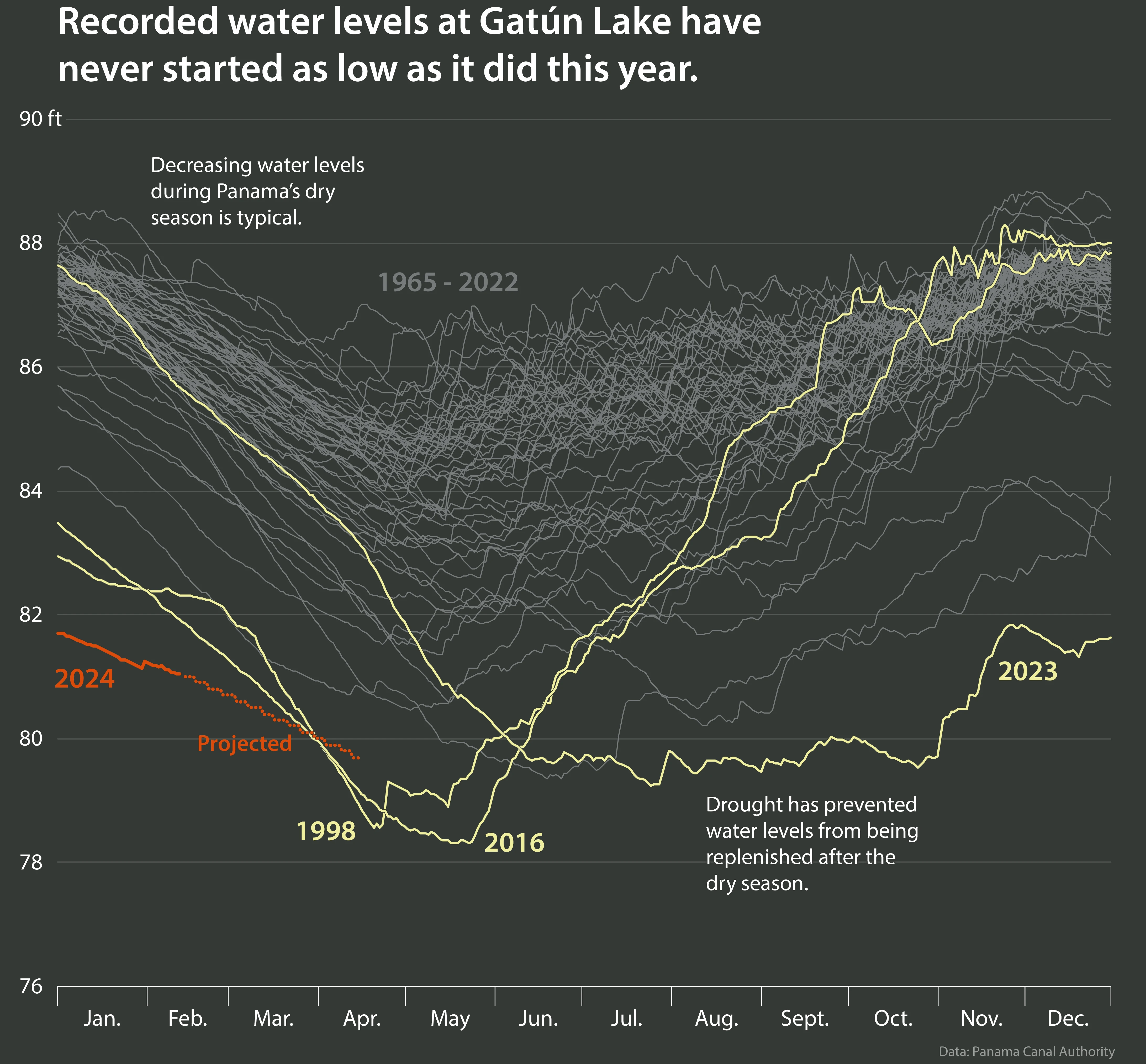

The drought has had a particularly profound effect on the man-made Gatún Lake, which holds the water supply that operates the Panama Canal. On January 1, 2024 water levels in Gatún Lake were lower than in any other January on record, almost 6 ft lower than January 1, 2023. Millions of gallons of water from Gatún, along with other regional lakes, are used to fill the locks that raise ships above sea level for the passage over Panama's terrain. Insufficient water supply jeopardizes ship passage. Not only does Gatún Lake feed the locks that power the Canal, it also supplies drinking water to millions of residents in the central region of the country, including two major cities: Panama City and Colón. As both Panama's population and the scale of global shipping has grown, there has been greater demand on the lake for freshwater.

Linked Image - Water levels in Gatun Lake

For more information on this, consult this article

Anyway, so that's the first point. What about the 2nd?

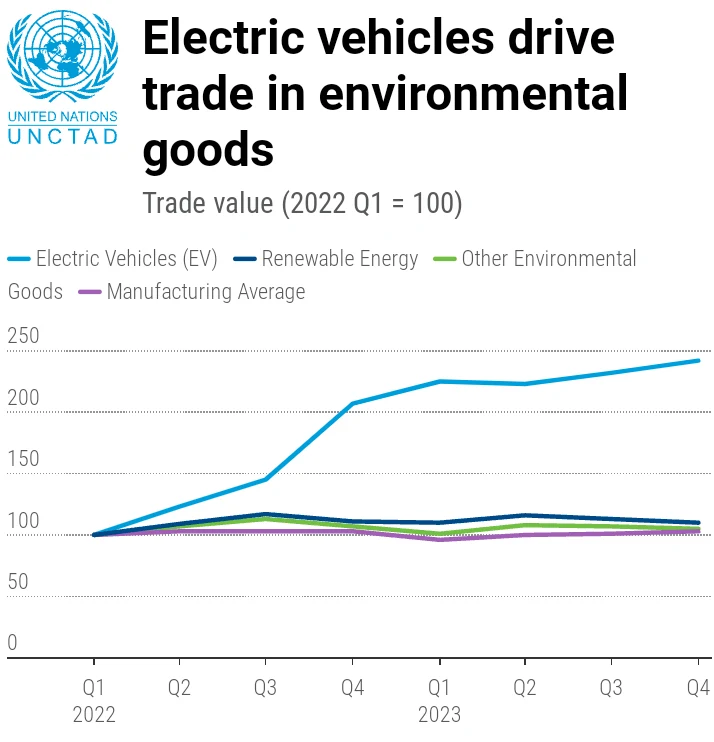

The 2nd is Geopolitical in nature. See the US with its Chips Act and race to counter Chinese Manufacturing Hegemony has started building up massive Semiconductor and Foundry firms inside the US, and in the case of EVs selected either mainland US or one of its allies to produce them.

Both of these acts require huge CapEx and Supply Chain complications. As China has a near monopoly on rare earth materials, the US has to source them from LatAm countries (and occasionally Australia) while regarding the CHIPS Act, it has to bring in huge investment products from abroad, mainly Europe, Taiwan and Japan. Zeiss is a good example of this since it is perhaps the only company in the world which produces some optical thing which is essential to making cutting edge semicon.

But, now that I have given you the basics of why shipping demand is so high and supply so low due to the constraints shouldn't it boost the stock of all the shipping corporations?

Not so fast.

While B2B shipping corporations like DHL which classify themselves as Freight Forwarding Companies are holding steady based on the margins from different sections of their operations including LCL (Less than Container Load), Customs Clearing, Trans Loading, Over the Road Trucking etc, companies like Diana Shipping Corporation (DSX) and Navios Maritime Partners (NMM) have gone down badly in the last 6 months.

Meanwhile corporations like Golden Ocean Group Ltd (GOGL) have soared 67% in the last 6 months. (The old fart Jim Simmons boasts about having GOGL in his portfolio at RenTech but anyone with two brain cells can understand why.) Star Bulk Carriers Corp(SBLK) has grown 32% in the 6 months.

So what differs among these losers and winners?

[Of Note] I'm only talking about Dry Bulk Carriers here. Not O&G carriers.

The answer is simple. Go to https://marinetraffic.com and look up the shipping routes of each of these corporations. You will notice a pattern. The winners avoid all three constraints while the losers try to mitigate the problems as best as they can, often getting tangled up in complicated problems like being captured by Houthis and tying up different Navies of different countries thereby making those countries demand concessions from these countries as a post condition for freeing them from their Houthi guests. That's a vicious loop you never want to see yourself get sucked into.

Some of them try to go around cape of Good hope which would have been a good plan during Vasco Da Gama's time but not anymore.

The two stockpicking tips

1. Whichever Shipping company is actively avoiding both the Red Sea and Cape of Good hope, thereby operating local pools of shipping routes.

2. Whichever is big enough to maintain separate fleets for Atlantic and Pacific thereby avoiding the Panama Canal conundrum completely. For example GOGL has a fleet of 81 ships and is planning to buy 7 more.

Also look out for Mexico bound ships going out for China. I won't explain the reason here. But keep an eye out.

!jannies please pin this as an effortpost

Everything is advise. Markets have an inherent risk and the burden of any loss belongs entirely to the reader.

Jump in the discussion.

No email address required.

Not reading any of this. Also you are a cute twink

Jump in the discussion.

No email address required.

More options

Context