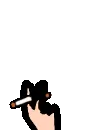

Hi. My company has been doing system wide layoffs for about 6 months now. In hindsight I should have started applying from then but I didn't think it would continue. Low and behold I was finally on the chopping block today. They sent a meeting invitation around 6pm last night from someone I've never heard of with no company branding. I ignored it because I thought it was spam. Then I lose access to all systems this morning. I text my supervisor who tells me to email some other company alias. Their email states my position was eliminated effective immediately and i would receive a fedex package with a separation agreement and additional information. I just bought a car which took some of my savings, and tanked more savings into a big vacation I've been planning for years. I actually just paid for the flight yesterday afternoon. I'm absolutely, royally fricked. My mom has also been unemployed for the same reason since about June or so. I won't have any help from her and I'm absolutely terrified of losing everything.

Can anyone help with next steps? I live in Maryland. I'm a bit too shocked to think straight but I don't want to waste time. I'm really just trying not to cry at this point.

TLDR: Laid off from job, low savings, and panicking. Advice?

The layoff notice she got after skipping the meeting

A post from her 5 years ago:

110000k in student loans and a 70mile/day commute to work with no car - budget help wanted

Finally, her bird she posts a lot about.

.webp?h=10)

Jump in the discussion.

No email address required.

Travel insurance will usually refund your expenses if you get fired (some stipulations apply)

Always get it, it's like an extra couple hundred and can save your butt if you're a poorstrag trying to see the world

Jump in the discussion.

No email address required.

Just get a credit card that provides it if you travel a bunch tbh. I probably pay $200/yr in fees but the included insurance easily makes up for it. And yes, I've used it before, it takes a bit for the reimbursement check to come (maybe a month tops) but you do get the money.

For example I had a flight delayed due to weather and they paid for meals and a hotel. They also provide primary car insurance for rentals which is nice.

Jump in the discussion.

No email address required.

Why do poor people never know this shit? It's literally the reason people have credit cards

Jump in the discussion.

No email address required.

Bc much like how you wouldn't trust your alcoholic uncle around a case of budweiser at christmas, neither should poors be trusted with a line of credit and endless things to spend it on

Jump in the discussion.

No email address required.

Um sweaty that's why we have governments to protect poors from their poor decisions.

Jump in the discussion.

No email address required.

Governments exist to facilitate poors making poor decisions

Think about it logically

Jump in the discussion.

No email address required.

More options

Context

More options

Context

More options

Context

Poor people don't trust mainstream financial institutions since "making money off other people's money is evil" so they never save cash or use good financial products

Jump in the discussion.

No email address required.

More options

Context

More options

Context

Drop card names and specs you cute twink

Jump in the discussion.

No email address required.

Try this: https://www.nerdwallet.com

Jump in the discussion.

No email address required.

I do use it but why expend the effort if @tempest can just spoon-feed me?

@tempest can just spoon-feed me?

Jump in the discussion.

No email address required.

Mood

Jump in the discussion.

No email address required.

More options

Context

More options

Context

More options

Context

More options

Context

I got a credit card through American Airlines and they refund every cancelled flight, give me free flights all the time, fully cover room and board for any delay on their side and can use my miles on most flights. It's like $100 a year and the only big downside is the credit limit is extremely low but I never use it outside of travel.

Jump in the discussion.

No email address required.

They won't bump it up on request if you meet the income requirements?

I've never had a credit card company refuse to raise my credit limit, but I also haven't asked in a while bc my combined limit is currently like $150k and I have literally no reason to ever spend that much on a card.

Jump in the discussion.

No email address required.

You could buy me a present :))))

Jump in the discussion.

No email address required.

You should be buying your constituents presents if you want that !dramatards of the year election in the bag

Jump in the discussion.

No email address required.

More options

Context

I could!

so uh, frozen... what's ur credit limit...?

Jump in the discussion.

No email address required.

More options

Context

More options

Context

I wonder if anyone's ever financed a down purchase on a house with a credit card.

Jump in the discussion.

No email address required.

No they require cash unfortunately. You can pay your taxes with credit card though, good way to get a lot of rewards.

Jump in the discussion.

No email address required.

More options

Context

More options

Context

They bumped it up quite a few time but never exceeded like 20k. My main credit line is around 1.5m so it's just a card I use for travel.

Jump in the discussion.

No email address required.

More options

Context

More options

Context

More options

Context

I've been considering getting an amex platinum or venture x card

Jump in the discussion.

No email address required.

Between those two, Venture X and its not even close

Jump in the discussion.

No email address required.

Yeah, $395 annual fee but comes with a $300 travel credit + $100 of points a year + loads of other travel benefits.

Jump in the discussion.

No email address required.

If you use all credits annually (not just travel credit) they actually pay you $5 annually + the 10k miles every year. The downside is least partners and shitty portal, but its very good otherwise. I went the chase route because of the travel partners and low cost cards.

Jump in the discussion.

No email address required.

What other credits are you talking about? You only get a GE credit every 4 years.

And for partners, the only chase ones capital one doesnt have are mid or low tier like united, southwest, and jetblue. Meanwhile capital one gives you turkish, avianca, and qantas which are pretty solid.

Though chase probably has more transfer bonuses and the ink train is unbeatable.

Jump in the discussion.

No email address required.

More options

Context

More options

Context

More options

Context

More options

Context

More options

Context

Currently building my credit with a baby card so I can get a cash back card (i just treat credit cards like debit cards and pay off daily so it goes into my round up checking)

Jump in the discussion.

No email address required.

More options

Context

More options

Context

Insurance is always a negative expected reward. If you can afford the cost of covering whatever event you'd need insurance in, you'll save money never getting insurance and sometimes being unlucky vs always getting insurance and sometimes getting lucky.

Jump in the discussion.

No email address required.

Most people take maybe 1 big trip a year. Im not saying buy insurance for your 3 days trip to Sioux Falls, ND. But if you have a trip to tour like all of Western Europe or Southeast Asia, it is pennies compared to potential losses.

Jump in the discussion.

No email address required.

More options

Context

Some nerd claimed at me that insurance pays out more than they take in and makes money on holding/gambling the money between fee payment and the payout, which disabused me of that opinion

Jump in the discussion.

No email address required.

More options

Context

More options

Context

More options

Context