- 3

- 18

NYC rich is just different pic.twitter.com/QgPoDwqNGZ

— Tune, MBA, CISSP (@CartuneNetwerk) December 3, 2023

- 3

- 21

- 2

- 16

- 41

- 65

- 12

- 32

The typical American household must spend an additional $11,434 annually just to maintain the same standard of living they enjoyed in January of 2021, right before inflation soared to 40-year highs, according to a recent analysis of government data.

Such figures underscore the financial squeeze many families continue to face even as the the rate of U.S. inflation recedes and the economy by many measures remains strong, with the jobless rate at a two-decade low.

Even so, many Americans say they aren't feeling those gains, and this fall more people reported struggling financially than they did prior to the pandemic, according to CBS News polling. Inflation is the main reason Americans express pessimism about economy despite its bright points, which also include stronger wage gains in recent years.

"On the edge"

Average hourly pay for workers has increased robust 13.6% since January 2021, although that lags the 17% increase in inflation during the same period, according to government data. The main categories requiring heavier spending for consumers simply to tread water: food, transportation, housing and energy, which together account for almost 80 cents of every $1 in additional spending, according to the analysis from Republican members of the U.S. Senate Joint Economic Committee.

"Middle- and low-income Americans aren't doing well enough — they are living fragilely on the edge," said Gene Ludwig, chairman of the Ludwig Institute for Shared Economic Prosperity (LISEP), a think thank whose own analysis found that the income needed to cover the basics fell short by almost $14,000, on average, in 2022.

Where inflation bites hardest

Around the U.S., the state with the highest additional expenditures to afford the same standard of living compared with 2021 is Colorado, where a household must spend an extra $15,000 per year, the JEC analysis found. Residents in Arkansas, meanwhile, have to spend the least to maintain their standard of living, at about $8,500 on an annual basis.

The differences in costs are tied to local economic differences. For instance, typical housing in Colorado requires an additional $267 per month compared with January 2021, while other states saw much smaller increases, the analysis found.

Still, a higher cost of living doesn't necessarily doom people to financial distress. Ludwig's group recently found that some expensive cities offer the best quality of life for working-class Americans, largely because of the higher incomes that workers can earn in these cities.

Inflation takes a bigger bite out of lower-income households because by necessity they spend a bigger share of their income on basics than higher-income Americans. And until recently, lower- and middle-income workers' wages weren't keeping pace with the gains enjoyed by the nation's top earners.

"Food costs and basic costs are up more than other costs," Ludwig noted. "Putting on a Thanksgiving dinner costs the same if you're a lower- or upper-income American, but for a lower-income American it's a bigger portion of your spending."

To be sure, inflation is cooling rapidly, with October's prices rising 3.2% on an annual basis --- far lower than the 9.1% pace recorded in June 2022. But pockets of inflation are still hitting consumers, such as at fast-food restaurants like McDonald's, where Big Macs now cost 10% more than in December 2020.

Although inflation is cooling, many consumers may not be feeling much relief because most prices aren't declining (One major exception: gas prices, which are notoriously volatile and which have declined about 5% in the past year.) Consumers are still paying more, albeit at a slower pace, on top of the higher prices that were locked in when price hikes surged in 2022 and earlier this year.

- 22

- 60

How much are Europeans left with at the end of the month?

In 2022, European households saved 1/8 of their income, according to latest data. However, in which country do people save the most? Euronews Business takes a look.

To save or not to save, that is the question. Last year, Europeans chose to save 1/8 of their income, according to the latest data released by Eurostat, the EU's statistical office.

In 2022, households in the EU saved on average 12.7% of their disposable income, while the rate for the euro area was higher, at 13.7%.

Household disposable income is what households have available for spending and saving after taxes and transfers, as defined by Eurostat.

"If households earn €100, they spend €78.30 and are left with €12.70 to spend," chief economist at Astères, Sylvain Bersinger, explained. "It's a normal figure. Most countries in the EU have a household saving rate between 10% and 15%," he added.

A much higher figure than in the United States, where residents only saved 3.4% of their income in September 2023, according to Statista.

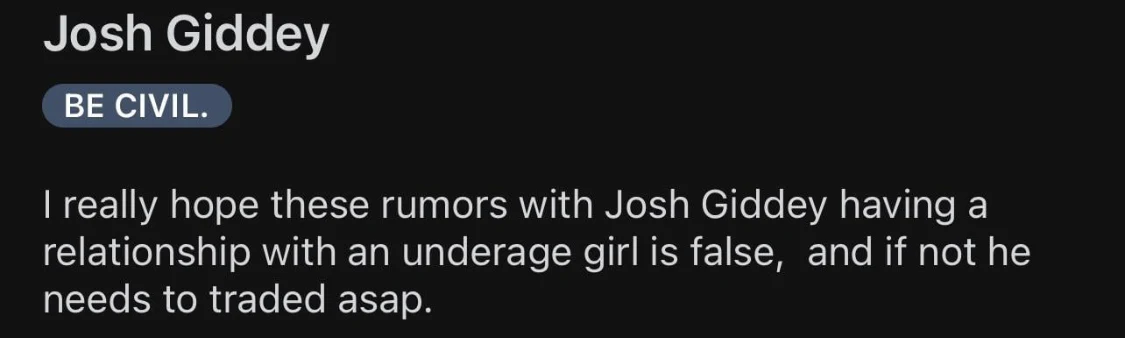

Germany is the European champion

In the EU, Germany reached the top podium spot with the highest gross saving rate (19.91), the Netherlands earned the silver medal (19.44) and Luxembourg the bronze (18.14).

Two countries are in the red, with negative saving rates: they spend more than they earn. What they are earning is not enough to finance their consumption so they borrow or use savings they have accumulated in the past. These two countries are Poland and Greece.

12 EU members recorded saving rates below 10.0% in 2022, among which Poland and Greece had negative rates, -0.8% and -4.0%, respectively. - Eurostat

However, European households can't be summed up in one profile. Large differences exist in saving behaviours in Europe, "as much as across families," Luigi Guiso, research fellow at the Center for Economic and Policy Research (CEPR) explained. "There are some who spend it all and those who save a large chunk of their income but it's difficult to understand why."

The saving rates across countries differ massively, as much as across families.

Luigi Guiso

Research fellow ath Center for Economic Research

Wealth is certainly one factor to account for systematic disparities in household saving rates. "We see that countries with lower income levels are struggling to meet their needs and therefore able to save very little," the chief economist at Astères, Desringer, observed.

It's also the case in Greece which has experienced great economic difficulties and imposed a series of austerity measures, decreasing households' disposable income.

"The negative saving rate shows that the Greeks are not out of the crisis yet. On the other hand, countries with the most savings tend to be richer," Desringer noted.

Some experts point out cultural differences in saving habits. Germans consistently saved more than 8% of their disposable income over the last two decades, according to OECD data.

However, Luigi Guiso finds limits to this explanation. "Differences between Germany and Greece don't exist because Greeks like to spend everything and Germans do not. German saving rates used to be low 20 years ago."

The saving rate of a country is affected by many economic variables, such as the demographic structure of the country. "Young people tend to save more than retired people who have a lower income flow," Guiso explained.

A return to pre-pandemic levels

Europeans saved less in 2022 than in 2021 (16.4%), Eurostat also revealed, allowing household consumption to expand further with the household rate returning to its pre-pandemic levels.

"It reflects a desire of returning to normal, pre-COVID life," Helene Baudchon, economist at BNP Paribas, commented.

The household saving rate in the EU is going back to pre-pandemic levels, expert says.- Eurostat

"During the pandemic, Europeans' household consumption was suspended while their income was broadly preserved. This caused an abnormal jump in the saving rate across the EU," Baudchon analysed.

Meanwhile, 2022 marked an economic rebound phase, which explains the lower saving rate compared to the previous year.

However, successive shocks post-pandemic, including Russia's invasion of Ukraine and the associated rising living costs, have also disrupted household saving behaviour. "The economic uncertainty is likely weighing on household consumption and supports precautionary saving," she observed.

Another factor motivating Europeans to save rather than spend is the rising interest rates. "Today, credit is more expensive and savings are more remunerated: there's a real financial incentive to keep your money in the bank."

Will the savings rate improve?

Experts forecast little change in next year's household saving rates.

"We're predicting a slightly more positive story next year. As inflation is falling and if the effects of economic shocks dissipate, households are likely to be less worried about the future and save less," Baudchon said.

The household saving rate would either remain the same or drop. "But forecasting means there is a possibility for error so let's talk in a year's time to see whether we were right," she added.

- 16

- 38

- 5

- 44

Gram had been paying $800 a week and was notified her rent would jump to $1100. She counter-offered $975, but the agent came back asking for $1200 a week

. Gram then agreed to $1100, and considered taking extra shifts or getting a second job.

The 45-year-old firefighter, and single mother of four, said she would have welcomed an explanation at the very least.

- 107

- 85

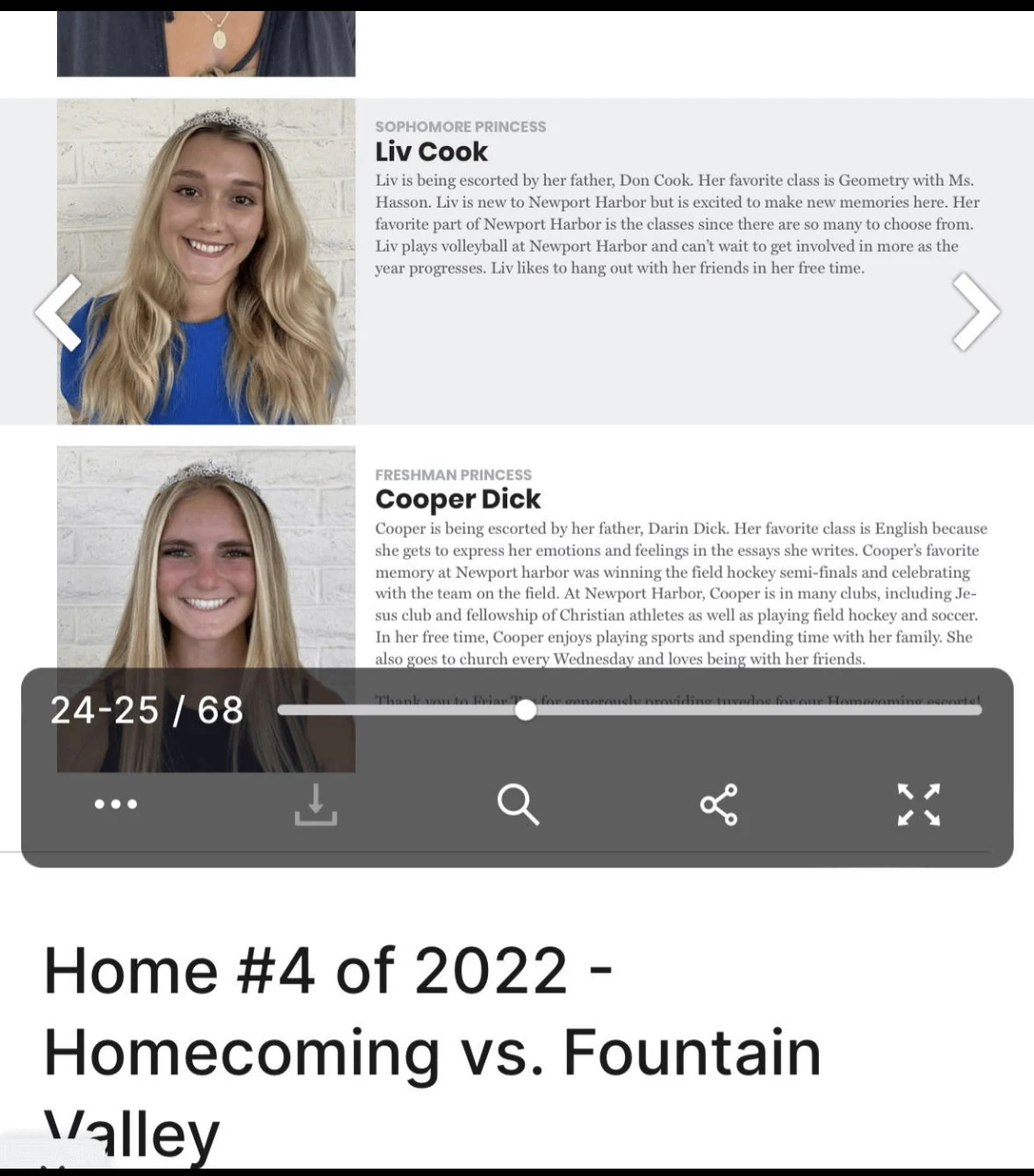

Thunder sophomore bangs high school sophomore.

Let's her post it all over the net.

It's legal in Oklahoma so it's mostly just morally wrong.

He looks so young lmao

https://old.reddit.com/r/nbacirclejerk/comments/1822gt1/if_hes_fricking_kids_just_trade_him_duh

Yeah to Utah with warren Jeff's

Her Tik tok

Don't click it you pedos

https://old.reddit.com/r/nbacirclejerk/comments/181wkst/josh_giddeys_girl_has_a_tiktok

The “proof”

- 7

- 21

- 43

- 107

OP

Dealing with the depression that comes with being priced out the city.

I have been here for years and have wonderful friends. To make it I have had to live with multiple roommates and live in shit holes . It got to the point where I can't take moving every year and can't pay off my debts when in the city .

I can't even afford rent or go through the heck of competing with 30 people for an adorable room .

Is anyone else in the same boat . Did you have to move out of the city due to the cost of living ? How did you deal with the feelings of defeat? Did it hurt you that you had to leave your home and change your lifestyle completely?

More from this r-slur https://old.reddit.com/u/Pristine-Confection3/submitted?sort=top

Why is it okay to hate addicts ?

Anyone else annoyed by people calling autism “ tism” or “ spergs”?

Now, just imagine if you grew up here and could no longer afford it.

Horrifying.

Me right now. This is my home but it's not worth it anymore. It hurts. It hurts a lot

It really fricking sucks

Software engineer?

UX design

Too poor to afford New York, just learn to code

Ah yes, nobody who has done drugs has ever afforded rent

If funds are limited, rent should be prioritized over drugs

Easier said than done, brother

ETA darn no solidarity for people struggling with substance abuse?

A wild no-fapper appears. Comment too long  to copy-paste.

to copy-paste.

No drama, just laughing at poors.

- BimothyX2 : Unfunny, uninteresting and unrelated to drama

- 84

- 104

Alex, 22, San Antonio

Personal Life:

Had 4 vehicles at one point, since sold a car and a motorcycle

At 18 got a $3700 GTI timestamp

Spent more than that on parts to modify it

Engine blew

Other car mentioned

- Engine blew

"Cycle of buying cars"

Has 2 dogs

Career:

Facility Technician

"I work in critical environments"

105'000/yr

"HVAC mechanical/electrical"

Got a job because he fixed some guy's AC while he was buying his motorcycle off Facebook marketplace

Got the job August of last year

Financials:

"I have a budget, I just don't stick to it"

Navy Federal #1 (16'000): timestamp

18%

Bought it at 17'500

Minimum payment $431

2008 Corvette

Beautiful car

Allegedly worth 17'000 or more now (about 8kish at the moment, needs repairs)

Blew up this one's engine too "I like to add power to cars"

"Where are you driving these" timestamp

"Mexico"

"There's no speed limits on the highways in Mexico"

Caleb is a speedcuck

This gigachad is driving around at 3-4am so he can go as fast as he wants

"How often are you doing this?" timestamp

- "Well not any more because the engine blew up"

Car explanation timestamp

"A lot of nitrous and a lot of boost from turbos"

"300 shot of nitrous, it was doing a 200 okay didn't like the three at much"

"Starting to blow up a little less as time goes on"

Navy Federal #2 (1'577): timestamp

17.75%

First car, Volkswagen GTI, bought in 2020

"Not running and not worth fixing"

220'000 miles

Planning to pay this off next paycheck

457 minimum monthly

Navy Federal #3: (4'309): timestamp

12%

141 minimum payment

Suburu WRX

"Person who sold it to me said they rebuilt the engine and within 3 months of owning it it blew a head gasket"

Audi (24'088) timestamp

$505, 67 payments remain

13% interest

"Low miles, for what it is the price isn't bad"

- 37'000 miles

Bought it for 25'500

Was spending 600 a month on gas driving the 2008 corvette

Thinks it's worth 23'000

This one is operable

Plug-in hybrid so he will get a 4'000 tax credit

Jared Card ($5'185) timestamp:

$185 minimum payment

30% interest

"Ummmm.... I bought previous girlfriend a lot of jewelry"

- Together for 2 years, broke up last Sunday?

- Together for 2 years, broke up last Sunday?

"They do 12 months no interest, I was like I'll pay it off... I didn't pay it off"

Personal Loan ($5'000): timestamp

When he moved, didn't have cash on hand for security deposit and first month's rent

thinks they charged the interest up front and it's not accruing?

Originally for 3'000?

Thinks it's in the 20s in interest

$120 minimum payment

Navy Federal Card (4967 => 5003. timestamp

$122 minimum payment

Purchased $85 and accrued $73 interest

- It was 3 UberEats purchases

- It was 3 UberEats purchases

5'000 credit limit

"Whenever I see that card go over the limit I pay it down"

Checking Account Transactions: timestamp

Mostly food market, vending machine

Road tolls timestamp

- "I sold a car and left the license plates on.... the car never got re-registered"

401k Loan timestamp

Needed a trailer hitch because he thinks he is getting hired in and moving to Virginia

$2'000 and 9% interest

Paid off a few other cards already in the last few months

The fat man rambles for a bit then Alex blows him out of the water - timestamp

- 58

- 85

Some of this probably inaccurate. I had a hard time following what she was saying through the tears, not actually sure if she's a tumblrina, just guessing from behavior patterns and age

Cia, Oklahoma, 29

Personal Life:

Found Caleb through TikTok

Was in a dual income situation but spouse is currently leaving her? They were both going to be on the show?

- Brushed over at the beginning of the show

Since 2017, in 2019 grandma passed, she goes to North Carolina where her tribe is "Eastern Band Cherokee Indians"

- Met cousins also in "table games" at the funeral

Mother is Comanche

Moved into grandma's old house when covid hit?

Timeline is a little weird here

Was also paying father $500 a month

Other grandma gets sick, also died, she found out at beginning of 2021 died early 2023

- She came back to Oklahoma for her?

"So basically I've been just surviving since then, I started table games jobs when I wasn't in the right mindset" timestamp

"So basically what you're seeing right now I'm getting out of the depression"

Not sure what this even means

"Everyone views me as the parent"

Gets tribal benefits if she's in North Carolina?

Household income

She works from Jan - early Aug at other table games job

Husband has been getting around 1800 on his checks

"You guys were going to come on, what happened between your application and no-[ad break]" post-ad timestamp

Major waterworks here, avoid if you don't like seeing people crying

Not going to take notes on segment but it's beat for beat a Boogie diatribe -

everyone's using her

she's the nicest person around

her soon-to-be ex-husband is immature and didn't reciprocate emotional support

muh therapy

Close-up interjection from cell phone-cam Caleb timestamp

"blah blah blah, only one side of the story try not to be judgemental"

"A couple days after the episode she sent them an email saying we are in the wrong, me and my team, that we are against her, that we are the evil ones and we hope for her to not succeed essentially"

She and her ex will be co-tackling debt before separating with dual income

Diabetic, lost weight on ozambiec?

Career:

"Table Games" (Casino)

Blackjack dealer

13/hr base, just started, 7 and a half hours a day

Worked at this position before asa supervisor, made 13.30 + tips (rare)?

1950/month? maybe?

Also gets tribal gibs, 20k last year but varies depending on casino preformance

Financials:

Has a house, that's paid off

$33'000, bought ten years ago, in Oklahoma

Gets tribe gibs twice a year, varies depending on how casino is doing.

20'000 last year, lower this year

June and December

Car Loan $17,657 timestamp

18% interest

$414 minimum payment

"That's uh... That was like I need to get out of the house"

"It's my car"

Chevy Spark

"So basically when my grandma passed away I was going to take over payments on the car which was like six hundred something"

"This car?"

- "Not this car, it was like a Honda er uh Honda Accord hybrid but then my mom she wouldn't let it go so then I wanted to at least pay that six hundred try to maybe refinance it but then she let it go and that got repossessed and in the midst I'm like I need to start getting out of the house I need to start getting ready to get a job"

Mentioned later that both of their names are on both car loans

Car Loan 2 $32'776 timestamp

Chevy Colarado 2021

813 minimum payment

11% interest

Newegg $1'600 (I'm not sure) timestamp

"Cozy games"

"Like Stardew Valley, you know"

"Well I also like Borderlands too"

Bought a pre-built for 1'307.99 timestamp for thing showing

35.98% interest rate

Currently owes 1'600

Has paid $154.44 so far?

- $120 payment later mentioned through Affirm? I don't understand this

787.22 minimum monthly payment?

Husband was the one that ordered it but it's hers?

Caleb mutters the specs under his breath timestamp

"Six core CPU"

16 gigs RAM 3600 DDR4

1 TB SSD

Nvidia 3060

Home security (in collections)

was not in a good area, now in a better area

Didn't pay this because [storytime] timestamp

Credit card 1 timestamp

Pays this off

- "That was just for one month, I was working really hard"

"My grandma when she passed away I got money, I got some insurance money so I've been that's how I've been surviving is her money"

- $30'000, has 10'000 left

Balance is back with a vengance, now

waterworks are back "every day I was like taking like edibiles and like high edibles and I was gaming" blah blah blah more boogie bullshit

"It's like almost maxed out"

- It's not, it's $990 out of $1'800

$20 monthly payment, 28.24%

Buys streamer merch, some woman pronounced "Payton" who streams on Youtube?

- I couldn't find her, just got football videos

"Super Secret Debt" timestamp

About $3'000

Not on a payment plan, a couple years old

Something about someone needing documents but she never gave them the information

iPad $500

0% interest?

$55 a month?

additional $30 a month for phone bill

Student loans $5'000

- Federal

Chime checking account balance -$84 => 0

Retirement Account - $436

Canceled subscriptions - Manta, AMC, Crunchyroll

Has not cancelled - Hulu

No savings

Allegedly $800 a year in property taxes

Doesn't have home insurance

Caleb claims to be on a diet

- 27

- 70

Dunkin Donuts in my area does the same thing. They throw out probably 15-20 dozen donuts a night and bleaches them all.

Report them.

___

It doesn't seem like they are intending to do harm. Their intent is to keep people from getting their wasted food.

Correct. Putting up this sign shows that they don't actually want people to eat the contaminated food.

It's using lethal (chemicals) means to protect their property (discarded food). You can't do that. Even though it is Arkansas.

___

WORDS WORDS WORDS, but correct

-10 points

___

Discuss

- 33

- 53

As one of the heavily shorted stocks, Bed Bath & Beyond ($BBBYQ) attracted attention from the meme stock buyers. This Snallypost is an excellent summary of what happened. TLDR went bankrupt and apes lost all their money they invested.

Some apes are accepting of their fate, and /r/bbby allows some dissenting opinions amongst all the cheerleaders. But not /r/ThePPShow , which is a YouTube channel which feeds the most loyal apes some r-slurred made-up nonsense that some investor will give money for their shares in a company with no assets and a ton of creditors. The channel guest stars Bill Pulte, a grandchild of a billionaire who is idiotic enough that the family's charity has a pop-up disowning him. The channel knows a bunch of marks when they see one, and is charging $500 for a meet and greet.

Anyways, how is the financial state of these poors with a get-rich-quick mentality? Not good! We got the following tales of woe:

Laid off 7 months ago after an 18 year career. 880 job applications as of today. Completed 76 interviews as of last Friday, with 2 more scheduled this week. On top of that, completed 12-15 take-home tests, projects, and presentations for various interview processes, ranging in effort from 3 hours to 2 days. Endless lies and ghosting by employers. Aiming for 1/2 of my previous compensation; far, far below what I've been making for the last 10+ years. Burned out beyond belief. Four month old kid. Savings nearly drained. "Nobody wants to work."

I'm more than ready for these times to wrap the heck up.

same, but over a year unemployed. 6 month old, credit card up to my eyes and wife probably going to walk out.

If I turn into a rich snob, I hope my journal entries during my time of poverty will bring me down to earth.

I've got a week before I need to tell my wife that I'm 120k down on meme stocks, with a hefty chunk from my pension and far too much from unsecured credit and we need to borrow against the house otherwise we drown paying debt.

Car broke today as rat chewed through main wire consoles, dishwasher broke, mortgage increase 50% and the overdraft I had planned to cover the next few months has just been cancelled without notice all this week.

First world problems I know and all of my own creation but if this doesn't go well for shareholders it not only cost a lot of money but likely the trust my wife had for me.

Any plays in the future please don't do what I've done, don't use borrowed money for investing it will cause a lot of pain, even if and when butterfly comes and hopefully moons it's been 3 years or stress.

I'm broke as shit, and not even first world (Brazil) lol..

Managed to grab 512 shares of BBBY before it went OTC.. Now I'm just waiting for the rocket

Dose of semi-reality (0 points)

I hope that for most people, the real work begins once we get paid. Nothing will change unless we change it. It is 1000% on us to architect the future we want for our children.

I'm ready to do some meaningful work that's for sure..

As the grift does not have an end point with vague promises of 'someday MOASS' stringing them along, expect more tales of poor gobbling up tales of hopium from the grifters in the belief their ship will come in.

Crystals Can Heal

Crystals Can Heal  . Namaste

. Namaste

.webp?h=8)

at their lack of savings

at their lack of savings

finance

finance

Official North Pole Government Account ☑️

Official North Pole Government Account ☑️

scores basically new iPhone 6s

scores basically new iPhone 6s  . Even r/DumpsterDiving

. Even r/DumpsterDiving  .

.

Oh, he's also an neurodivergent drug addict.

Oh, he's also an neurodivergent drug addict.

The eternal foid, incarnation of Tumblr, arrives on the show

The eternal foid, incarnation of Tumblr, arrives on the show

non stop over a company

non stop over a company  absolving themselves of liability

absolving themselves of liability  .

.