- 100

- 102

The correct finance take is downmarseyd. I guess Redditors would rather this guy not be able to get money when he needed it.

And who's fault is it that they have horrible credit again? Not the pay day loan people.

In America? So many reason: medical debt, being in the foster system, minor crimes like shoplifting as a teen, being gay (ie your parents make you homeless), disability, a fire, your landlord ups the rent by 50% or more, your employer decides to fire you, ohh so many reasons.

Instead of being judgmental, you may want to show some empathy and compassion for those less fortunate. SPECIALLY if you call yourself a Christian.

The seethe is amazing.

It’s horrid. Places like that, payday loans/advances and rent to own businesses are nothing short of predatory. You only ever see them near poverty stricken areas of town. They just want to make your life worse

But like do you think rich people need loans to buy basic items like furniture?

The shady stores don't stand a chance there because they would laugh and then buy something that costs more than 3 of the shitty rent to buy furniture sets that have probably been repossessed twice before you got it.

So close to getting the point. So close. Just because someone is poor doesn’t mean that it’s ok to target them with your predatory shit, and it certainly doesn’t mean that these businesses even vaguely belong in working class communities.

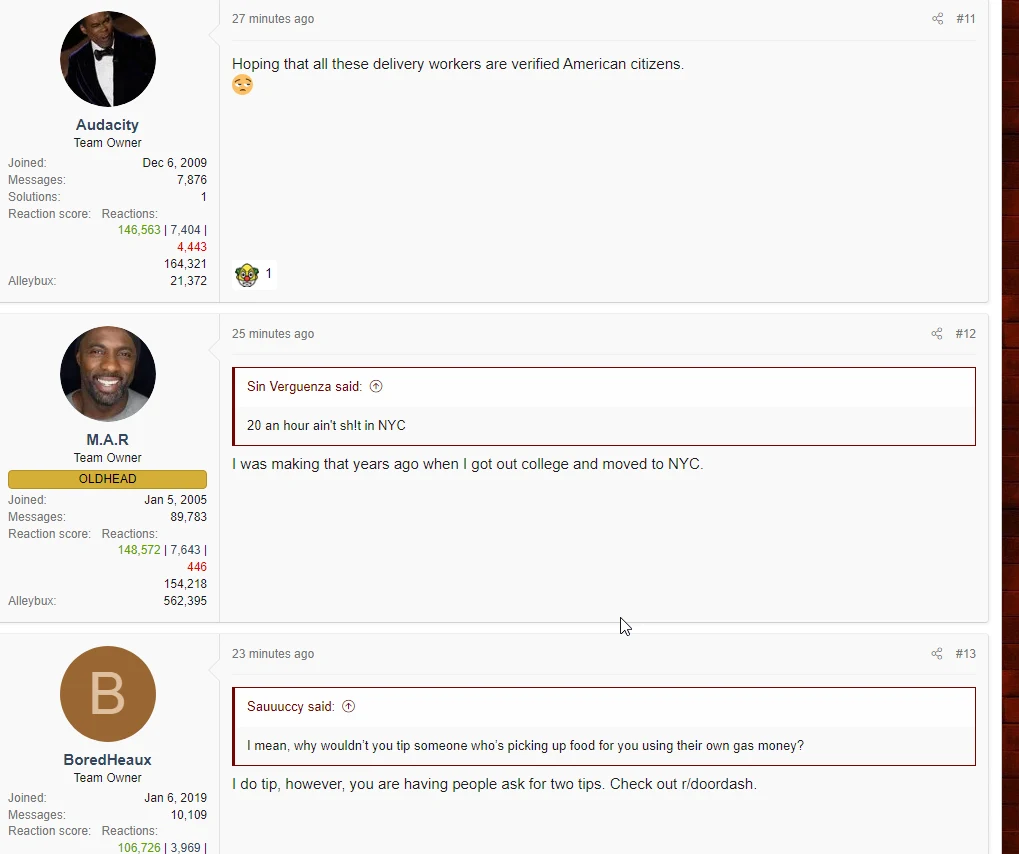

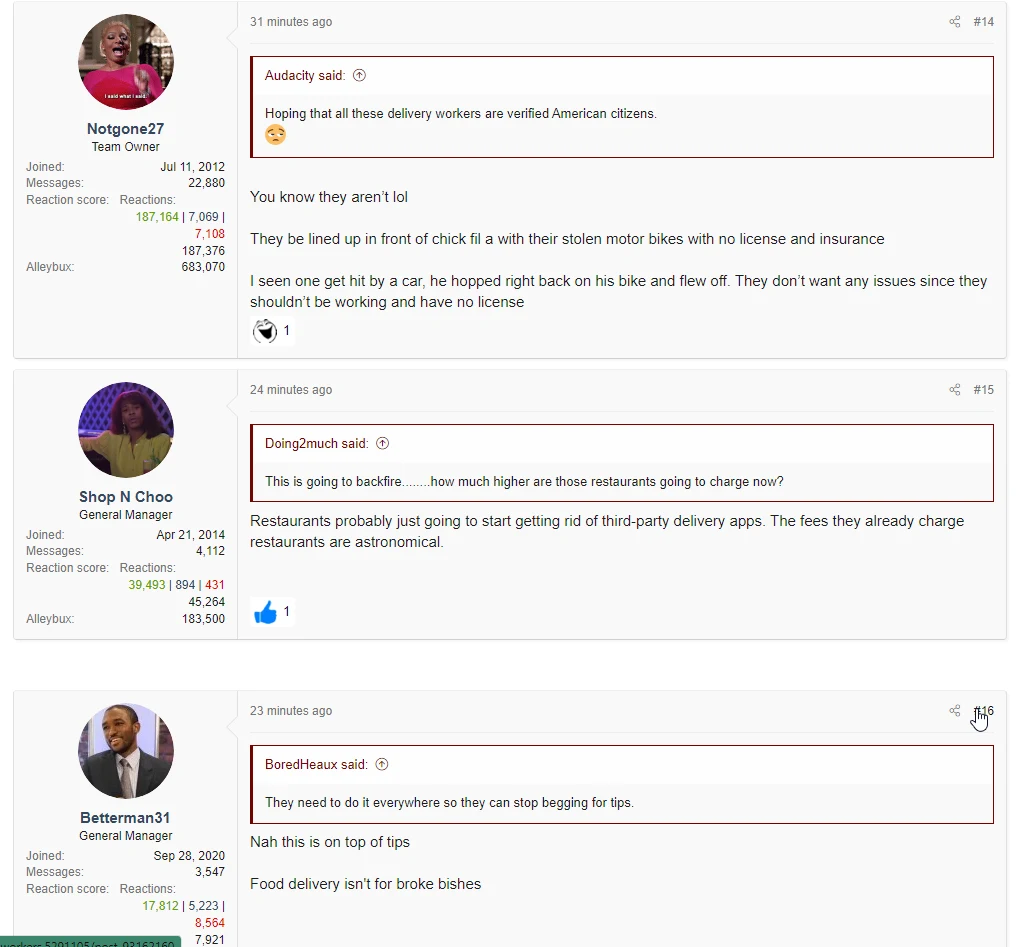

Completely misread the point and smugposts about it.

That's all the effort you are getting out of me. So many people there with poor financial decisions.

- lofi_girl : cool thumbnail. Otherwise, tl;dr

- 50

- 112

- 59

- 43

Massive improvement over the alcoholic harpy link

Lisa, 22, Austin TX

Personal Life:

Lived in a small town in midwest but moved to Austin

My mom didn't graduate high school and my dad barely graduated high school"

Career:

Twitch streamer

Has tried to branch out but "hasn't felt the motivation" to actively put content out elsewhere

"What do you make on a monthly basis?" "I don't really look all that much because it gives me a lot of anxiety"

Sub Revenue:

Bad months - $1000

Good months - $3000

Donations:

Bad month - 2000-3000

Good month - 3000-4000

Last year - a little under 50k

Made 15-20k in the last two months from a "subathon" but did similar last year

- Spent 2-3000 expenses on this

Assumption 4'000 a month

Losing money on fees for Paypal?

- Getting charged an 11% fee

Paid about 4000 in taxes last year

- Does her own taxes, does not have an LLC

Debt/Expenses:

Rent - timestamp

Lease for old apartment is ending June 12 (today)

- Currently in a sublease ending July 31st - $1200 for that

"Where are you going in two months?" "I don't know"

Car: timestamp

2018 Jeep Renegade, about 20'000 miles

- No major issues, crack in the windshield from a rock

Started 2020 8.1% apr, $292 a month payment

Father is cosigner, want her to refinance because they want to get another car but can't while he's cosigned

She's 44 payments in, not even half way through

- 2025 or 2026 she finishes up?

Had car insurance when she first moved there but stopped because $200 a month was too much for her

- Borrows her friend's car a lot, drove

Credit score is 681

Rationalizing about whether she wants to keep the car or not timestamp

Credit cards -

They scare her so she doesn't have any

- Worried she'd forget payments or get in over her head timestamp

Massive bullet dodged

One of the 3 people in america subbed to Discovery+

$500 on eating out last month (15% of her income)

Had a cat, also found a stray cat 1-2k on medical costs but he has feline leukemia, apparently this is cat AIDS

Keeps the two separate, no interactions

Not on her parents' health insurance

Father is disabled and mother is a waitress, both have state health insurance

since she's no longer in school and not in the same state they didn't keep her on, not certain whether it was because state or personal choice by the parents

Doesn't have Renter's insurance, she forgot about it

Savings/Retirements:

Paypay timestamp

Doesn't separate business and personal paypals?

Three $120 payments to something called Canva, she doesn't recognize it

- Also made a $50 adobe payment

Current balance - $1800

Student Checking -

Dropped out

Didn't borrow money, her father got a million dollar settlement in a mining accident before he was born

- Money went 1/4 for funny money other 3/4 split between 3 kids as trusts

Savings -

$12'121

Had to take out some to cover her rent

Goal is never to touch it unless it's the only option

$600 in Bonds, from $500 she put in after High School graduation

- 15

- 34

I (30F) am just frustrated. I don’t understand how to even begin to move forward and get ahead. Money is the worst!! I am at a big adult job now and make 65k which is the most I have ever made. It’s awesome and I love my job it does keep me busy but overall it’s great with good people. Every month I pay 3k to bills (rent, child care, utilities) this leaves me with $400-$500 every paycheck, which is the 15th and 30th of every month. I know it seems like a lot but it’s not. I have a husband (41M) who is graveyard and doesn’t make much but gets paid weekly maybe $450-$550 a week and a toddler (4M) who takes a lot of time and money obviously. Car payment is auto take out $288 and second one I try n pay $350 so we aren’t paying $680 all at once. I’ve had to take out a payday loan and it’s been eating at me. Credit cards are maxed out for gas and food and it’s hard to pay them and not use them.

I feel like I’m drowning. We barley have $15-$20 in our account after everything. I guess my question is, does it ever get better? What am I doing wrong to have it so near death every month? What in the world can I do to do better?

I was thinking of a second job but then I would never be with my kid or even sleep. I feel so torn I think I just need some personal advice on how to make it work.

Thanks 😊

A couple of bad with money tell tale signs were in the OP.

"adult job"

separate finances from spouse and worded in a way that makes it sounds like they pay for nothing and you wonder if they even make money

describes pay in multiple different units. Annual salary for her, weekly pay for him. Expenses are described monthly but left over funds described as per paycheck.

Completely nonsensical sentences like: "Car payment is auto take out $288 and second one I try n pay $350 so we aren’t paying $680 all at once."

So what the heck does that sentence even mean?

$1,260 a month is pretty beefy for someone making $65k/yr with a husband making $450-550 a week. /r/personalfinance turns on them here and lots of "I make $900k and I would never have car payments over $300" posts follow.

The husband is disabled in some way but he can't receive any benefits.

Not really. He’s partially disabled and can’t receive benefits since it’s not “fully disabled” he’s limited in what he can do

Finally, they had to file for bankruptcy two years ago which is why the first car has such a high payment (compared to the second?)

We had to do a BK almost 2yrs ago and that affected the first car. We owe way more then it’s worth unfortunately. The second is a Corolla we got it for the gas since the other car is a Buick enclave and eats gas like crazy. I have tried to turn it in we just don’t have that option.

Once you figure out the puzzle of their financial life (that they tell us about at least), they have about ~$2,000/month after rent, cars, utilities, and child care so they're probably spending $3,000-$4,000/m on food and worthless crap.

- 2

- 17

- 37

- 51

Ron, 33, Nashville TN

Self-rated 3/10 situation

Personal Life:

Falling out with his parents

Says father was emotionally abusive/manipulative

Has since mended bridges with them somewhat?

Asked if he could move back in after getting a remote job, they said no

Good relationship with his mother, bad with his father, they are still married?

- Mother makes 200'000?

Debt from early 20s moving out of his parents house

Story time about being a boozer - timestamp

Was van living for a little while so more money to party

- Stopped in late 2019 early 2020

- Stopped in late 2019 early 2020

Addicted to Mountain Dew timestamp

Goes through 2 a day, doesn't buy from stores, just from gas stations or dunkin donuts?

"If it's a bad day I will go and get more"

"Do you have diabetes?" timestamp

"Not that I know of, I haven't been to a doctor in 5 years"

Blood sugar test timestamp

"I don't have diabetes by the way I just have all medical equipment possible because I'm afraid of something going.. bad"

New Caleb lore - he is terrified of needles and blood plus is some sort of paranoid

Apparently he does not have diabetes?

Brother had addiction stuff as well? (marijuana and alchy)

Career:

Tried to apply for real jobs out of school, never got callbacks

Call center 40 hour week

- $18 an hour

Starting a second job in a couple weeks

Variable, $18.50 after 5, $20 weekends

Also 40 hours?

Call center stuff but different from the other call center

Some online stuff

Runs DnD games online

3 hours a piece depending on how much he needs to prep

$600 a month or so

- 1 game ended

Using some site for this that pimps out DMs

Made 10k last year from this

Runs these games through his phone? "Only reason I bought it"

uses Fiverr people to do stuff for it?

Got a cat recently, photo shown to camera timestamp

His mother gave him 1'300 total last month

Expenses:

Mountain Dew:

- Unreal amounts of mountain dew more than $400 a month

Rent $1230

- Low end, not a great neighborhood, pays for laundry not within complex?

Debts:

Discover Card (Card 1) Around $3000: timestamp

Had to put car repairs on it?

4 tires and some maintenance stuff

Minimum monthly maybe $30? He's not certain

25% interest

Had paid off the card with a personal loan years prior to the car repairs

Dunkin Donuts - 2 Dews for $4 "That's how they get you"

USAA (Card 2) $7712:

20% interest, $631 lost on interest this year

Did not spend anything on there

Costco (Card 3) $908:

Paid 218 but made 185 in purchases 14 in interest

Credit limit of 750

Thinks the purchases were all unnecessary

30% interest

Car: 2010 Toyota Camry

130'000 miles

$5438 left on it

4.99% interest rate

Bought right before the pandemic hit

Personal Loan $18'173 timestamp:

2 or 3 cards, and the rest of the loan balance of the van he had, has since sold Van

$584 min payment

originally 25'000

Student Loans:

Majored in Business?

Southern Hampshire University?

$38'900 federal student loans, Probably 470 minimum payment

These are why he decided to get a second job

Savings:

Checking

Gets money from his mother?

26.76 => 5132 - 3918 => 1247

Business Checking account for his DnD thing:

- "Cloak & Dagger LLC"?

Budget Section timestamp:

- -$1231 between minimum budget and basic survival currently without the second job

- 3

- 7

I've given up on life and am wasting away.

I can't do that under someone else's roof since I won't ask them to support me, so I need to leave and never come back.

I have no job (because I got laid off back in February) and no prospects (just several interviews with tests that never lead to a job offer). Applied to 250 jobs and my unemployment is running out. My savings is depleted, I'm 210 pounds, losing my hair, and am a general waste of oxygen.

I need to go somewhere where I don't have to pay a dime: just lay there until I finally die since killing myself is against the law for some stupid reason.

I'm fine with whatever comes with being in either (being drugged, being assaulted, being robbed) because at least it's a free hot and a cot.

Best advice on where to waste away without having to spend a dime: psych ward or homeless shelter?

The sooner I can be an unidentified toe tag, the better.

Any "it's gets better", "find God/Jesus" nonsense will be ignored.

Feel free to give me tough love, though. That's always a reliable reminder that I'm a roach.

- 6

- 28

She also has vaginismus that sugarbabying has cured i guess. Click link for her tik tok explaining lol

vaseline? what in the !peakpoors use carmex like a normie

what does this mean?

please upmarsey i want a podcast hole thanks

- 49

- 67

oh yeah after watching, she shoulda been left. $5000 on summer camp and he sound asleep ?? pic.twitter.com/6yfz2BdsBd

— Rae (@raefromabyss) June 7, 2023

Honestly that's some bad luck lmaoooo

- 32

- 57

Michael, 33, Richmond VA

Self-rated: 1/10

Career:

Door to door solar salesman

Started working for them in February

Claims it's one of the best markets in the country for it

All commission, no base pay

Income so far this year, he brought a spreadsheet timestamp

Jan - $2163

Feb - $630 (Started Door to Door Solar here)

March - $3220

April - $3125

May - About $9000

Believes it will settle between 7'000 and 10'000

Payment model -

Paid 175 they see the presentation

$225 if they buy

8-10 people -

Who in the world first answers their door to salesmen and two actually lets them do a presentation timestamp

"It happens, all the time"

Apparently old people are a tougher sell, usually younger demographic

Talks to about 20-30 people a day, thinks he should be doing more

- Started out doing 4-6 hours a day, started working 10 hour days in May tripling his income

Worked for a different Door to Door solar prior, made about 45'000, his first year doing it

- Did it for 4 hours a day

Personal Life:

Last year was a "little chaotic" timestamp

Started a business for online marketing

- Wanted to fill the rest of the day since he was only putting in 4 hours a day at the prior solar company

Goes more into this "business" later on when explaining Debts

"So basically you get access to a platform, right? And you can uh you can start your business from there" timestamp

△

Also sold roofs in Florida for 3 months?

"I've been in debt since I was probably... eighteen years old"

"About to completely run out of money" last Decemberish

Tries explaining how he got in this situation in broad terms timestamp

Debts/Expenses:

"Special Financing Company LLC" $4'012 timestamp:

Down to about 3'000 now

Minimum payment $320

- 240 to principal, 80 to finance charge?

Personal loan he took out to start the marketing business

Doesn't remember what the initial amount was

Taxes due timestamp:

Has not paid the IRS jannies

filed extension so he has until September

Interpersonal debts

Borrowed from them since he only made 600 in Feb?

Owes roommate about a $1'000

- Paid off

Owes parents about $2'000

- Not paid off

Student Loans timestamp

$49'845

Got a biology degree from "Old Dominion University" (Not sure I heard the name right)

Thinks it's between 4% and 6%

Probably minimum payment of $500

Another shot of The Spreadsheet, debts section this time timestamp

Verizon $1321

- Financed an iPad and iPhone

Credit Card $6'628 timestamp

Cut it up sometime last month when he started making more money

Losing $100 in interest every month (18% in interest)

$164 minimum payment

Made $68 in purchases

Savings:

Nothing set aside for taxes currently

Nothing saved for Retirement

$4000 in his checking

Savings account 2100 ending balance timestamp

3600 in 2000 out this month, might have gone to checking? Some Dave Ramsey thing about maintaining 1000 in savings

He starts going through all the debit transactions

- 19

- 40

Brief summary:

$350k mortage at 2.75%, covered by military pension and disability

One car loan and one lease at $1,000/m (doesn't give balance, remember this part for later)

$50k credit card debt, $2,000/m

Special needs kid, receives unknown amount from state. Wife stays home with him.

Works for Fedex

Thanks that make you go

my wife worked door dash for 6 months in 2021 to finance 1/2 of an overseas trip (see below).

The thing is my job now is the first one I’ve ever had where I LOVE going into work. I’m probably worth more elsewhere but I currently have a lot of perks (company vehicle, unlimited PTO) that would be hard to let go of.

Go with a consolidation company. My wife did this 2 years ago with her debt. But her credit score suffered, we had collectors calling. She even got served by one bank but collection company worked something out with them as they do I guess. She’ll be done paying them next year.

I have a huge video game collection that I’ve amassed over the past 15 years. I could probably sell half of it over the course of the next 3 months and make about $10k. I’ve actually started doing this within the past week.

Our dinning out used to up to $1200 a month. Now we cook at home almost exclusively. In 2019 I spent about $4000 on video games, buying vintage systems and games. This year I bought the latest Zelda game, that’s it. We do like to travel. But we (my wife) has finally excepted that our planned trip (overseas again) this fall, is not going to happen.

As for the car they purchased while being provided a company car(?):

The car is a 2022 and this year they came out with a new model and drop the price by a significant amount which in essence makes my car worth about $15k less than I owe on it currently.

From what I can tell with some really rough math, I think this guy is making like $40k a year as a Fedex driver. He never says so I'm not sure. But the wife says it's time to man up:

Yes I agree. My wife is a very intelligent person but she is also very stubborn…VERY! Her current stance is my main goal should be looking for a higher paying job.

- 70

- 84

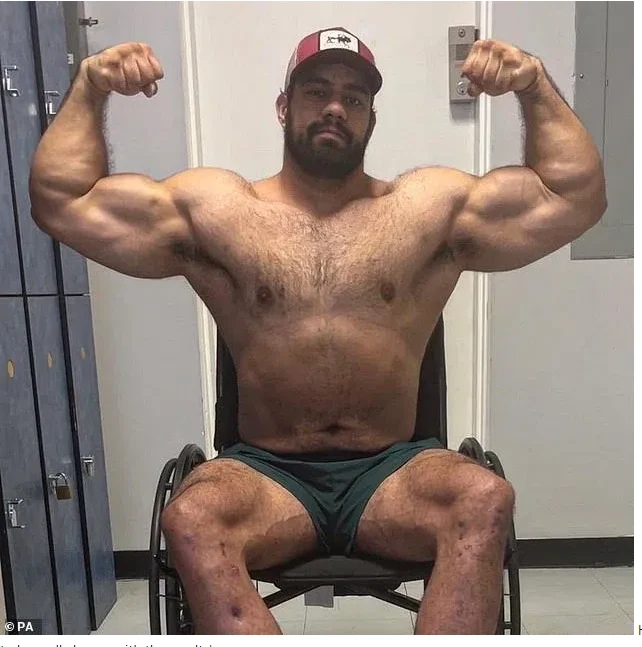

A father-of-two travelled to Turkey and spent $106,000 to get limb-lengthening surgery to increase his height after deciding his legs were 'too short' for his body.

Brian Sanchez, 33, a mortgage broker who lives in Georgia with his wife, Nidia, 30, and their daughters, Kaisley, two, and Kairi, six, said he felt like his body was 'out of proportion' and he looked like 'like a huge thumb

Brian Sanchez, 33, a mortgage broker who lives in Georgia said he felt like his body was 'out of proportion' and he looked like 'like a huge thumb'. Pictured: Brian before (L) and after (R) the surgery

'It's going to be really nice just to be able to hug her and have her all the way down there on my chest instead of being almost eye level.

'One of the things that I'll enjoy the most is being able to work out again and put some weight on my legs and have my body look a little bit more how I want it to.'

Last January, Brian realised his legs didn't match his 'torso proportions'.

He said: 'I realised that my legs were always looking weird, and I didn't know what it was, until one day I was sitting next to my brother-in-law who is almost 6ft 6in, and I was actually a little taller than he was.

'I thought that was weird, because I knew he was taller than I am by a lot, and we stood up, and all of a sudden, I started looking and realised my legs were too short for my body.

I'm broad, have long arms, and I'm wide, but my short legs make me look different – I almost look like a huge thumb, like those thumb men from Spy Kids.'

After the realisation, Brian, who had never previously had cosmetic surgery, started to dislike his aesthetics and decided to research ways to make himself taller.

He said: 'I thought I can either find a new hobby, and give up lifting weights, or I can fix the issue.

Brian had his first operation in last December, which involved breaking his tibia and fibula, putting a rod inside the bones, and fastening it with screws

I'm not posting anymore of the article but it's worth reading if you care

now, some TheColi commentary

please someone make a westbrook marsey for the love of bardfinn

i think the caucs are fine with 6 foot but our brehs see it differently

- aminobastard : this is a transphobic hate site

- VERIFIED-USER : And? We are encouraged by the admins to find rightoid drama. R-slur.

- 54

- 49

- 49

- 126

Forgot to paste this into the link spot

Mel, 22, San Antonio TX

Personal Life:

Lives with her boyfriend, splits rent/utilities

Wants to work govt job for student loan forgiveness? Nothing specific

Boyfriend

Manager at Lackland Air Force Base - timestamp

- Something about videography?

He's planning on going back to school, got a degree in fine arts/photography wants to do cloud computing

Career:

Personal Shopper

HEB

25 hours?

300 a week, depends on hours worked

Grad Student

Got undergrad in Marketing last May

MBA

Taking out debt, took out debt for undergrad as well

12'000 a year tuition

"Why aren't you cashflowing it?" timestamp

Planning to be done next May

Talent Acquisition at Ford "Social Media Coop" (?)

Remote work

20 hours a week?

850 - 900 twice a month

"Why is this Ford position not a full time position for you" timestamp

- Started 4 months ago, thinks it is just a trial? Had it as a part time because she wasn't certain about how demanding grad school would be

Total income $3000 after taxes

Expenses/Debts

Loan ($2069 remaining)

Credit card consolidation

Some part of debt was initially because she wanted a Macbook for school

$90 monthly payments

"26 payments to go"

More than 10% interest

"This past semester I took out $20'000" timestamp

LOTS of eating out timestamp

- "I didn't realize how bad it was"

Explanation of how she budgets

timestamp

timestampImprint HEB Card (Card 1):

"You get 5% cashback"

Pays it off, lots of subway purchases on there

"Favored Subway"

- Some sort of regional doordash that's more expensive?

Synchrony Card American Eagle? (Card 2) (not sure I heard this right):

$300 credit limit

$29 late fee

30% interest on this card, "I got it a long time ago"

Ikea Furniture Plan?

0% financed apartment furniture

546 remaining, her and her boyfriend split it, paid 300 on it last month,

minimum payment 37

2018 F-150 truck

- parents pay for it, it's in their name and they pay insurance for it

Savings:

$102 in her checking ($708 on hold?)

- "I try to leave myself with at least 150 a week, that's my budget" timestamp

Hasn't started a 401k, one of her jobs offers it with matching but she hasn't signed up

SHE THOUGHT HER STUDENT LOANS WERE ZERO PERCENT FOREVER

- 19

- 11

i’ve had the activate windows watermark on my pc for the past 5 years and my moid won’t stop telling me to buy a key but i’m a poorcel and don’t have the money rn (plus frick paying for windows they’re gay) so anyone have a spare key i can have? i’ll give you 1000DC if the key works !dramatards

- 13

- 39

Subreddit link in case of drama

Jose, 29, Dallas TX

Self-rated 4/10 financially and slowly declining

Career/Business stuff:

Personal Trainer

Started a gym

Signed lease a year ago

Opened 6-9 months

"All of it's debt" (did not save up money before starting)

One of his clients loaned him money to help get gym started

Has his business/personal life merged, difficulty separating the two

Bringing in 10k a month

"Now after expenses what does that look like" "Gonna be honest I haven't done the math" timestamp

"I am uhh slightly in the red"

"I would say right now it costs about 2 grand roughly" a month to run the business

Rent is 1600 a month, going to go up in July to 4'600

- Was on a 6 month "baiters" lease? I didn't hear this part clearly

Only employee is his girlfriend, she keeps about 60% commission

brings in 4'500 for the business? Not sure

"A lot of our finances are also intertwined"

0 cost on equipment besides a loan on a body scanner?

- $160 a month

Bought cleaning supplies in bulk and hasn't needed to buy more since then

Electricity - 150, 200 a month

Water currently included with the lease?

Internet about $80

Pandora subscription $10

Insurances

- Doesn't have them

- Doesn't have them

Business credit card debt

"Under a special program that they have" reduced interest, reduced monthly payment

"About 370"

Personal Loan from the client

Lent 50k

Paying him 1360 a month but through an exchange of services? Trains him/wife 3 times a week

Personal Loan

- 170 monthly payment

Has an LLC set up

- Not currently funneling money through this before it gets to him

Setting money aside for taxes? (this wasn't mentioned)

Should be around 3000 dollars of profit but he doesn't know where it goes

Currently struggling to hire a trainer, has two-three leads per month he's able to handle?

No base pay for the new hire, 40% commission only for anyone interested

Had a friend he set up a deal with for training at the gym and the bridge got burned for various reasons

- deets timestamp

Had another guy who put his two weeks in 3 weeks ago they've been looking for someone since then

Plans to start doing youtube content to help promote the gym

Debts:

Blue Cash Preferred Amex (Card 1) $4898:

$86 minimum payment, made $55 in purchases on this card

Doesn't know what those purchases on there, thought he had already canceled everything on this card

$33 interest charged (409 total so far this year)

On this card with his gf

Blue Business Amex (Card 2) 12'691:

Business card

371 minimum payment

$40 new purchases, $81.47 in interest charged, $1112 interest total for this year

691 above credit limit

Thought he had canceled everything on it

Purchases at two record stores and disney+

Inbody scanning machine thing

63 month term

36'260 total financed, has paid maybe 5000?

$100 monthly payment since May of last year

No interest

Upstart Loan

Savings/Expense:

Business checking:

Does not have any savings?

Pays a $30 subscription to another gym

His personal rent is going to decrease he thinks? Will go down to $675 starting June

Does not currently have health insurance

Car insurance $200

Parents currently cover his phone bill?

- 35

- 62

Might have gotten some of this wrong, hopefully mostly right though

Brianna, 41, Seattle WA

Single, owns a few cats, no mention of boyfriend/girlfriend/exes

"I have a lotta debt. It's a lot of stuff I've racked up from a long time ago and I've been slowly making progress over time but just this year is when I started making a really decent income"

- Increased by $6'000 annually

Wants to leave her current apartment because "the neighborhood is going south"

Career:

Job 1: Bookeeper

Small private firm

25.75 full time (53k yearly)

Job 2: Podcast assistant

Working on two podcasts for a woman who has health and wellness podcasts

Show notes, artwork, audio-editing

Flat $385 a week altogether

Around $6'000 monthly pre-tax?

Expenses/Debts:

$176 in subscriptions

- "If you have netflix you have time to work!" timestamp

Rent -

"I'm lucky right now my rent is extremely reasonable"

"I've been living in my apartment for a really long time"

Apple Card (Card 1):

March31 $1'975 -> April30 $2'300

$46 minimum payment

Blames lifestyle creep for the increase in her spending

"Did you follow a budget?" "Then I did not but now I do"

Pays down balance that would accrue interest before interest is charged? I didn't understand this one timestamp

Lots of eating out, 3-4 visits to watch Mariners games

Paypigs hundreds of dollars a month on Angry Birds

2 apple purchases financed -

0% APR on an Apple Watch

0% on some cat thing

Emergency pet services put on the card because she didn't have the cash on hand

Claims she has had it for almost a year now and has not paid a single dime of interest

Card 2:

$6'718

"That card was actually twice as much, I split it to do a 0% apr with a balance transfer"

- "That was like 14'000" "I'm not quite sure what I spent that money on"

Citi (Card 3)

$6689 -> $6'339 (Made $350 in payments on it)

minimum payment $63

Amazon Card (Card 4):

"Because I was buying things on Amazon I opened an Amazon card for the the the points or whatever but this will also be paid off without accruing interest"

$555, $361 on traveling to see Caleb

- He's not comping these people's flights

timestamp

timestamp

- He's not comping these people's flights

Whole Foods

A pair of shoes because she's been walking more often for fitness?

Student Loans timestamp

$18'000s

5% interest

"All Federal?" "I don't know"

- They are federal

In deferment for a very long time when she was younger

Opted not to pause her loans?

- Didn't realize she could pay them off still while they were paused

$304 minimum payment

No vehicles

- does not drive

Savings/Retirement:

$100 -> $300 -> $0

"Every time I try to put money in savings I'm like no wait I should spend that on paying my debt down and like-"

Paid 225 for a psychic reading

timestamp

timestamp$200 in Robinhood

Some health thing, treasury bonds, and a vanguard etf

Cashed it out and spent in on credit card bill

"Stash"

2 accounts both around 1'200

bunch of random stocks

Job just started to offer a 401k and she's made 1 contribution

"I have a contingency plan for retirement" "What?" "It's my best friend, she has a pension and VA disability and she said I could we could get married"

- 57

- 75

Jessilyn, 21

Brandon, 32

Springfield MO

There's a pretty good chance I've gotten some of this wrong, there were a lot of numbers getting thrown around.

Husband self-rates: 2-3/10

Wife self-rates: 3/10

!straggots This is our fate

!incels How are you even real

Career:

Jessilyn: Stay-at-home mom

Doordash and uber as side-hustles (about 400 a week after gas)

- Only done these for 2 months so far, started because slow season for car sales right before taxes were due (end of Feb)

"We're financially illiterate. I'd say I'm financially inexperienced, almost too"

Brandon: Car Salesman

All commission based, 49'918 ytd (did 117k pre-tax last year)

Minimum wage or commission based whichever is greater? 277 hours a month?

About 30% for taxes

Only brought home 4'200 pre-tax in March?

- Best months were Jan/Feb, all downhill from here?

End of 2022 "economy just kinda shit the bed" so sales are down

Personal Life:

"We met selling cars and then I got pregnant then we started dating"

Stopped selling cars in the summer because she didn't want to deal with the heat on car lot both fat and pregnant?

"Kind of a dumb decision looking back because they had 6 weeks of maternity leave and they offered to move me to a different position that was hourly based inside"

"From my understanding they will not hire her back because we're married"

started dating last Spring

moved into apartment last May

"over the last month and a half we've moved out of our apartment so we're kinda like in a position too where there's not a whole lot of space to be able to keep stuff"

Jessilyn is still on the mother's insurance

Building a new house that was supposed to be ready middle of May?

- It sounds like they're renting it?

Saving/Debt/Expenses:

"I got denied for Paypal crediting like where they finance your things"

Got most of these cards in June? Not sure I heard that right

"Yeah, the ones I sent you were all the really bad ones"

- not sure what she means by that?

Got a car in April "probably spent way too much money"

"60'000 dollar car"

Still owe 57'891

Might be worth upper 40s, low 50s?

2022 Grand Cherokee

Got some percentage off since he's an employee

4.24%, was offered 3.29% but took that to go out an extra year in term to get the payment below $1000 a month

920 minimum payment

He tries to convince them to sell this one timestamp

Husband's car:

2018 Kia Stinger

$26'850 owed, 11.51% interest

525 minimum payment

$330 for car insurance that covers both

Loan to pay off delivery

30k bill on the delivery, still owe 1668? Another 1800 sitting off loan because insurance may/may not cover it?

- Projected 150 minimum payment, less if it's only the 1668

Card 1:

2917.43

29 minimum payment (they made $43 in purchases on this card this month

)

)Interest free until December

Lots of recurring subscriptions through apple, they've since canceled them?

Chase (Card 2):

"The baby one:

455/500 balance -> made 0 payments -> 523.60

$80 minimum payment

Citi (Card 3):

4752 -> no payment and $258 purchases -> $5039

Had paid 300 off of it to get it down to 4752 prior "And that's so sad" timestamp

She put multiple Afterpays on here

- One was lunch. She afterpaid her lunch

- One was lunch. She afterpaid her lunch

$29 late fee

- "The way I see it is it's not all the way 30 days past due because my breaking point is if it hits my credit you kn-" timestamp

Bluecash Everyday Amex (Card 4):

826 -> -$60 payment, +$192 new transactions -> $961.36/$1000

Minimum $40, interest free

"We actually had that paid off the beginning of February" -

At 857 because she made just a payment on it

"I actually got one [credit card] sent to me in the mail the other day and I was like I don't need another one" timestamp

"My thought process, hear me out, was that my utilization right now is probably like 94, 96 percent and that's godawful don't get me wrong but if I open another credit card technically it would exp-"

- "I don't give a shit"

Discover (Card 5):

$3453 -> -$94 payment, +$155 new transactions, +$83 interest, +$30 fees -> $3627

$134 minimum payment

[indecipherable] Bank (Card 6):

"Furniture loan"

$2534, 0% interest for another year or two?

Minimum payment $150

Apple (Card 7):

$7'988/$8000

255 minimum payment, 29.4% interest ($171 interest)

"I have 3 Affirm loans"

"Big one that we've had since September of last year"

$400 minimum payment, almost paid off, $671 remaining

Financed their wedding rings

"Only reason we did it was it was 0%"

"Two amazon purchases"

"Both like a hundred dollars so they're each like-"

$53 left on one

$120 on the other

Phones are financed

iPad is financed (they bought an iPad for the baby?)

Her apple watch is financed

Child support

- "That comes out of his paychecks out of the gross percentage"

Brandon 17000 in retirement

Jessilyn "I don't have a retirement"

- "I also have like a cash value life insurance policy my mom's been paying in since I was a baby. It's cash value is only 1700 dollars though"

$50 in their savings 2000 -> 50?

- Getting ready to move into a new place, most of that went to deposit

$300 in checking?

Lots of paypals/venmo for eating out timestamp for her being told she cant eat out any more

Lots of Klarnas that are all paid off now

She is one of the only people on earth still subscribed to SiriusXM

- 110 yearly

- 21

- 62

- 14

- 24

Stephani, 35, Austin TX

Self-rated: 2/10

Personal Life:

"Been in debt since before she hit 18"

"So I also have uhh CPTSD? So I also decided that I wasn't going to have emotions until this year too" timestamp !biofoids please translate this aside into scrotespeak

- "Found out" February of last year? She doesn't say the word diagnosed

- "Found out" February of last year? She doesn't say the word diagnosed

"Somebody got me sent to the hospital for saying I was doing something I wasn't exactly doing"

timestamp

timestamp"They said I was trying to commit suicide? Yeah, I kinda got like attacked, by the cops, and drugged by the EMS"

"Who said this?"

- "This girl I've been trying to avoid for like a year or so...used to be a friend but you know sometimes people have to leave your life because they remind you of other people that make things wild"

Career:

Nurse

"Lower paid nurse" - $32.54 hourly

Works a desk job now so averages 40 hours with a little overtime instead of the 60-80 she'd get otherwise

mostly remote

Tries to do sidehustles

used to bartend for events

Writing jobs, currently freelancing writing curriculum for some company or school in Oregon?

Savings/Expenses:

Checking $4'631 -> $5'639, currently $7400

Savings $725?

Retirement

Rollover IRA 2'189, currently just sitting not invested?

United Health Group 401k $9'515

Had thought she would get married and just have someone else deal with these issues for her

A few $40 coffee trips?

got scammed

55% of regular goes to rent (includes utilities), used to be on a COVID unit grift so her income was way higher when she got it

Phone is $99 but she's supposed to get some credits for being a nurse from them?

Debt:

I didn't catch the monthlies for a lot of these

Lots in collections

Mother had put some bills in her name before high school graduation

A ton of stuff in collections

"I've restarted my life a few times and some of the stuff that's in collections I'm like writing letters to them because I've either never been to some of the places that are charging me or they were like my ex or other things"

Some of the companies are trying for debts that should have already expired or w/e

"Portfolio recovery"

$100 a month, bought a laptop for a sales job?

"An Ashely's account" to buy furniture when she moved 5 years ago?

- $645 left, was just a couch?

IC Systems

- Anesthesiology bill, currently owned by a debt buyer who's willing to give her at least half off

Elevator Recovery $2039

- broke her leg in 2020 and let the medical bills from that go to collections

Credit Card:

- Had to replace a battery around $160 but it's totally paid off now

$30'556 in student loans

Around a $400 minimum payment, thinks she might be on an income based repayment? She's not certain

Some of these loans were for nursing school, some were from an abusive ex-boyfriend who used them to buy "race cars"

Car debt: 9'000, 6 years and 25%?! not sure I heard that interest rate right

"So you what people do when girls go to car lot and try to get cars, they said like- they didn't even show me the original car that I went there for but they just told me the bank wouldn't loan me any money because the bank can recoup its losses easier on a new car than a used car if I were to not pay my car loans but I've never not paid my car loans so-"

$350 insurance payment

Large number of hospital bills coming up

$4-5'000 "of the current ones"

Might get helped out by insurance but she's not counting on it

was thinking of payment planning it

- 8

- 29

You gotta be poor af to frick in a b-word in a tree

Jk I would

Someone tell our coders to add thecoli emojis for the love of god.

- 14

- 22

It often is in North America. The fact is public transport is often terrible, so people don’t use it if they don’t have.

Now that should be a sign towards “hey, let’s improve transit”, not “let’s never consider transit”

Even progressive liberals still view transit as a last-resort public service that only the poor and desperate use.

that’s cause it is

Every American movie out there shows people at their lowest point riding the bus. It’s so normal everywhere else.

I even hear people say it while riding transit. There was a fight on the Portland MAX while I was riding home the other day and one guy said "If you had [money] then you wouldn't be on the MAX"

Bro some of us just hate driving and parking

Public transit being cheaper is a pro not a con

actually sharing your space with poors is a good thing

He invested in crypto, got lucky, realized that he didn't deserve all that money, so he decided to reinvest in his community public services to help those less fortunate than him and help to make his city more efficient and safer for everyone, then he realized that public transit was the superior option? What a Chad!

plot twist: he got out before the bubble burst, moved somewhere with good public transport, and can take the bus to things he wants to do without needing to work anymore

sounds like heck on earth

- 6

- 23

A person allegedly stealing gasoline at a BART parking lot in Antioch started a fire that burned six cars, according to fire officials. https://t.co/mFQ3zcb1dc pic.twitter.com/phSW975DDJ

— KTVU (@KTVU) May 11, 2023

.webp?h=8)

with a business degree and a mountain dew addiction working at a call center moonlighting as a DnD dungeon master for hire

with a business degree and a mountain dew addiction working at a call center moonlighting as a DnD dungeon master for hire