- 2

- 13

I own the house (30F), and I am also moving out at the end of the month to join my partner in a different state (military). I have new tenants renting the entire house starting January 1. This has been the plan since I started dating my partner in January, and regularly communicated to my roommate (35F) who has been renting a room in the house at significantly below market rate for the past 2.5 years.

Long story short roommate is upset that she has to move out, and has refused to say a single word to me for over a month. Even when I attempt to speak to her when present in the same room.

In mid-November I gave her notice by email, text, and in her renter portal to move out by 12p on 12/31. She does not respond to any text messages. I let her borrow a bookcase and I asked her when she planned to clear it off so that I could sell it. No response. I reiterated and gave 24 hours or else I would consider it stolen and would file a police report. Nothing. I then sent a certified letter with notice to inspect. That letter is still sitting on my counter unopened, but I did go into the room at the day and time designated, filmed myself emptying the bookcase, and removing it. I also took a photo of a half-eaten plate of Chinese food that was probably 5 hours old and ended up remaining in the room overnight.

There is no sign of her packing her things. She told our neighbor that she has not found a place yet and is “considering all her options.” She turned down a FREE room in my neighbor’s house because she thinks it would be best to move away and move on from the “resentment” she is harboring over this situation.

I told her that the internet will be shut off on the 28th as that’s the day I’m moving out and I’m taking my equipment (I pay for the internet, she never has). Today I offered $500 cash to move out by/on the 28th as well. No response. At this point I’m thinking she may have blocked my number.

I’m beyond upset, frustrated, and stressed at this grown woman’s behavior. She will be in the same room as me, I’ll try to say something, and she literally will not respond. She continues to move around the house without a word. She will go out the front door and walk around to the back to get to her car to avoid crossing paths with me. Her behavior is completely irrational and makes me incredibly nervous that she won’t leave. The new tenants can sue me if they aren’t able to move in. It’s insane to me that I can’t remove someone from a house that I own and live in and just have to wait. It’s all I can think about.

On Wednesday I packed up my entire house, everything in the kitchen including plates, pans, utensils since everything in this house is mine. I put all the boxes in my bedroom and now have a camera in my room to make sure she doesn’t enter, as I’m about to travel for the holiday.

It didn’t have to be this way, and I greatly regret letting her stay here. I wanted to provide someone with affordable housing and now I’m spending a ridiculous amount of money in attorney fees and security measures.

Long story short, roommate removed all of her possessions and left the keys on the counter by 12pm today. House is now ready for the next tenants to move in tomorrow.

Things that happened between my post and today:

- While I was away for the holidays, she dragged the outdoor patio table into the house. I spoke sternly through the backyard camera to stop and put it back, but she didn't comply. Now there are a bunch of water ring stains on the table.

- I had packed up the silverware--rubber bands around the forks, knives, etc. and had them nicely placed into a paper shopping bag for donation. In my rush, I forgot to put it in my room. So she unpacked all of it and threw out the shopping bag.

- She invited her family from Alaska to stay at the house for a week.

- She entered my room and showed her dad my bathroom, which he proceeded to use. Extremely unnecessary—theres a common bathroom (her bathroom) in the hallway. I know this happened because I had a camera set up in my room, watching over all my moving boxes that I had stacked in there.

- They ate my food and used my condiments. I had all of my stuff in a box in the pantry (not much, just some bread, crackers, cookies, etc.) Someone unpacked it all and set the contents on the shelves for no good reason. I had purchased a new container of butter a few days before I left, there was 1/5 of it remaining when I got home. Using my condiments happened pretty much every time I was traveling, but this time it was the most blatantly obvious.

- She took most the boxes I had saved from deliveries and used them to pack her own stuff.

- She failed to clean the freezer space where she had all of her stuff (tons of crumbs and such in the bin) and I had put all of her refrigerator items in boxes yesterday so the cleaners could easily pull her food out while they did their work and put it back in after.

- She took my nice OXO shower caddy organizer ($50)

I have zero interest in renting a room to anyone ever again. It's either the entire house or nothing. I understand the importance of tenant rights but someone renting a room in an owner-occupied property should not have equal rights as someone renting a whole property. Not being able to remove this child-behaving 35 year old from my own home caused me way more emotional distress than it was worth.

- 11

- 19

- 7

- 38

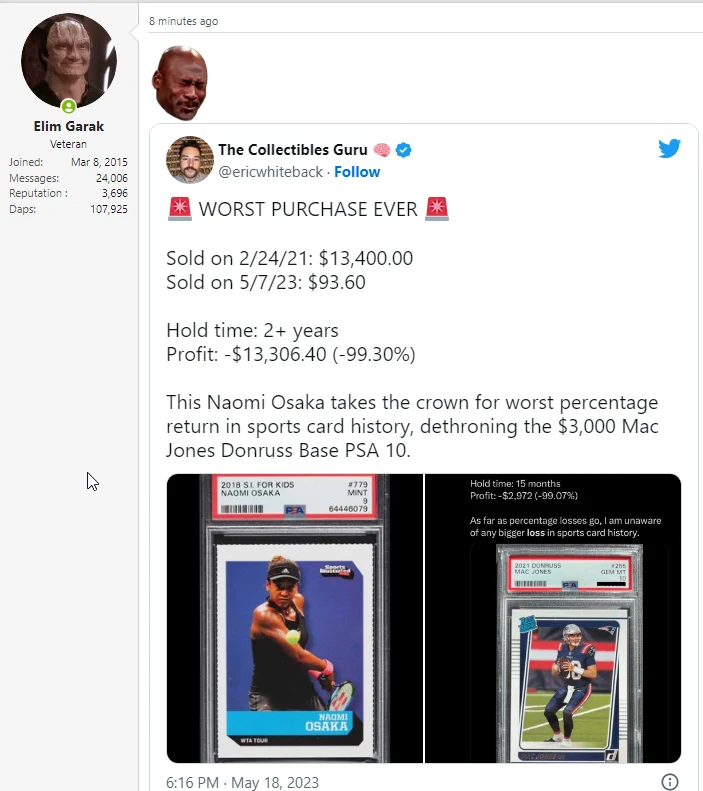

Black Lives Matter risks going bankrupt after running an $8.5 million deficit last year, financial disclosures indicate.

The Black Lives Matter Global Network Foundation (BLMGNF) saw the value of investment accounts fall by almost $10 million in the most recent tax year, according to a copy of its tax return, first reported by The Washington Free Beacon, a conservative website.

The nonprofit's latest Form 990 shows that a loss of just over $961,000 was logged on a securities sale of $172,000. The disclosures suggest a year of missteps for the foundation, as well as a dramatic drop in donations.

The foundation was started by organizers of the Black Lives Matter movement, which first emerged in 2013 following the acquittal of George Zimmerman in the killing of 17-year-old Trayvon Martin. It is not the sole organization within the broader movement but is the largest and most well-funded.

Donations amounted to about $9.3 million for the period between July 1, 2021, and June 30, 2022, while net assets stood at about $30 million. By comparison, for the period between July 1, 2020, and June 30, 2021, the organization reported donations of nearly $77 million, while net assets amounted to $42 million, suggesting a sizeable drop in both categories.

Brian Mittendorf, a professor of accounting at Ohio State University, told Newsweek that the "financials indicate spending down some of the windfall the organization received in the previous fiscal year.

"This does not necessarily mean the organization is headed toward insolvency. However, if their revenues continue as they are after the windfall from 2020-2021, they cannot maintain the spending level from 2022 indefinitely, so the organization would need to shrink its spending footprint to be sustainable."

Mittendorf said while the overall investment losses "are consistent with losses in the market as a whole during this time period, the huge loss on disposed assets is concerning."

BLMGNF shared with the Associated Press in May 2022 that it had invested in stocks about a third ($32 million) of the $90 million it received as donations amid racial justice protests in 2020 following the killing of George Floyd.

Black Lives Matter co-founder Patrisse Cullors acknowledged in an interview last year that BLM was not prepared to handle the wave of contributions that came in following the murder of George Floyd at the hands of Minneapolis police.

She stepped down as executive director in 2021, on the heels of controversy over the foundation's finances and her personal wealth. Cullors told the AP last year that neither she nor anyone else in leadership misused donations.

The nonprofit's latest tax form shows that although Cullors has departed, contracts to her family have continued.

Her brother, Paul Cullors, and his two companies were paid $1.6 million for "professional security services" for the tax period ending June 2022. He is listed as one of only two paid employees during the year, receiving a $124,702 salary for his role as "head of security."

Shalomyah Bowers, the foundation's board secretary, told the AP last year that protection could not be entrusted to the former police officers that typically run security firms, given the movement is known for its stance against law enforcement.

According to the organization's Form 990, Bowers' company, Bowers Consulting, was paid almost $1.7 million for management and consulting services.

Mittendorf said the biggest issue raised by the financial disclosures is the "continued and substantial transactions with insiders."

"While this is not improper per se, it does raise concerns about potential conflicts of interest in governing the organization. So I would hope the organization would take strides to ensure any such transactions benefited the organization and not individuals affiliated with it," he said.

Black Lives Matter Grassroots, which represents local BLM chapters, has accused Bowers in a lawsuit of treating the foundation as his "personal piggy bank" and stealing more than $10 million in donations for personal use, the Los Angeles Times reported.

The lawsuit, filed last year, alleges Bowers' actions have led the foundation into "multiple investigations by the Internal Revenue Service and various state attorney generals, blazing a path of irreparable harm to BLM in less than eighteen months."

Bowers and the foundation denied claims of financial misconduct.

Newsweek has contacted the Black Lives Matter Global Network Foundation for comment via email.

- 22

- 61

Colton Rock Springs Texas, 26

Self-rated: 5/10

Employment: Christian Adventure Camp

Was a summer job, decided to to do full time to avoid living with parents after academic suspension

Govt wouldn't give veteran living stipend if not doing education

Plans to go back to school within next few years

Might stick with this because a director position (30'000) might open up in a few years

Retreat coordinator or host "ministry work"

- "Talk with mens' groups or with churches and things we have them come out, specifically I'm in charge of mens' groups and [indecipherable] groups"

$18'900 takehome

Laterally transferring to another job at same camp will be paid 19'000 flat

Doesn't need to pay rent, food, or utilities

80 hours a week

about $3000 total monthly counting disability

Most of income from disability pay

got 42k when he left the military, half to help move half for savings

was paratrooper in 82nd airborne

"Double parachute malfunction ended up falling from around 1800 feet and I shattered my left femur, 26 different bone fragments"

$1'663 a month

Talking with VA about getting disability upped, would be pulling around 90k from that

Retirement plan from the military gets a plan from the camp when he hits a year, plans to roll it in, camp offers 4% match?

Education:

was free, still has GI Bill and Texas Hazelwood Act (latter will pay for another 150 credit hours)

Academically suspended because grades

Something about maritime? Looking at a 6 figure salary with it? I didn't fully catch this part

He thinks he can get his Bachelors within a year

Savings/Expenses:

$15'000 in an investment account

- Wells Fargo Hedge Fund?

$5000 emergency fund

$10'000 in an IRA

Looks like about a 2x coffee a day habit ($2 each) timestamp

Basically all expenses are subscriptions or mobile games

Low-level whale paypig to one of the supercell games

- lot of transactions for it, probably close to a thousand dollars

http://tcgplayer.com/ - trading card game marketplace (physical), doesn't specify which

- Pretty big purchases on here, one of them was $77

http://cardkingdom.com - Magic the Gathering site

- Paid 570 in one purchase on there

Rents movies on Youtube

Paypigs Blizzard, maybe Diablo Immortal or Hearthstone? Not sure what blizzard does these days

$77.78 on Dr Squatch organic soap timestamp

- Looks like a monthly cost?

$148 at "Bass Pro Shop" timestamp

Learning piano, pays for "Flow Key" (?) ($120 a year)

Debt:

Tried debt consolidation but canceled that when they told him not to talk to creditors and realize it was hitting his credit score. He's on a payment plan with Capital one instead

In therapy

Credit Card 1: $3965 -> $6'817 -> $6633

Put a vacation on it (around 1000), going scuba with some old friends from the military

$116 interest accrued, then $169

Credit Card 2: $4571 -> $3885 -> $3385

$113 interest

152 minimum payment

Opened it when he got out of the military, went NEET mode for a year (2021)

Car is a 2004 F-150 (paid off), had it a decade, 130'000 miles on it, thinks it will last another 6 or more

- $90 a month

Losing $283 interest a month total

- 36

- 59

- 26

- 59

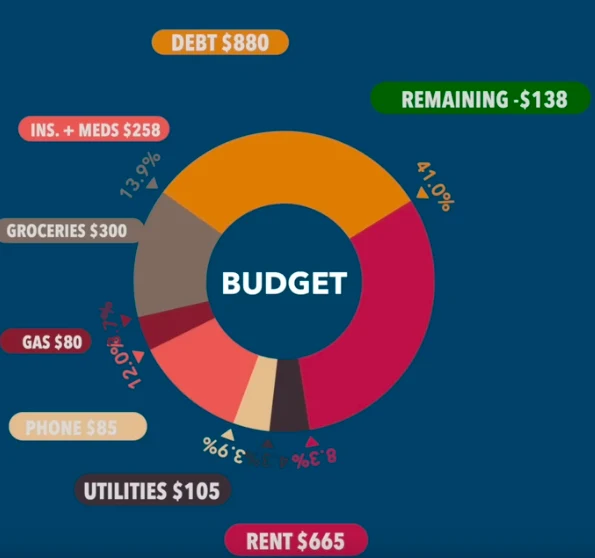

Duncan 26, San Antonio TX

$57'303 total debt

$880 minimum monthly payments, 41% of his current income

At least $400 interest accruing each month ignoring student loans and stuff in collections

First truly mentally ill person on the show, he weirds me out a little but I might be just paranoid. I don't trust people who cry on camera. I've timestamped some of the oddness, not in chronological order

Self-rated 3/10 financially

Has been watching Caleb for "a couple months" hasn't started budgeting

- cries from stress of his situation? Tries to explain his failures in past attempts to budget timestamp

Diagnosed with "Bipolar II Disorder" plus some backstory, only recently got meds

Career:

Delivery for Tiff's Treats and somtimes on-duty manager on weekends, does Grubhub/Doordash on the side

"I got deactivated from Grubhub for some reason" timestamp

Drives company car so his gas payments aren't bad

Currently making $23 an hour and $18 as the stand-in manager

hours cut, losing insurance in July (sales down year after year)

nervous laughter here timestamp

financially struggling

only 6 stores in his district

Personal Life:

Lost his last credt for film grad because Covid and classes/grades fell apart afterwards near beginning of covid?

Was taking classes last semester? timestamp

Not this semester though so Student Loans are active now

Sudden jump from verge of tears to recitation of the canned youtube comment line about finance needing to be taught in high school timestamp

"I think that's a big detriment to the American education system, nobody gets taught finances, ever"

Wants to go back to school for a business degree but can't because of his current situation

Savings/Expenses:

Nothing in retirement

USAA checking

Monthly balance $225 -> 281

Spent money on Uber Eats, overly self-deprecating statement to dodge timestamp

Same dodge trips to coffee shop/donuts/general eating out timestamp

Shared checking with him and his girlfriend

Pays to do gig work? Not sure if I understood that right

$766 last month just on fast food/eating out (36% of income)

Swipe savings

$7 -> $161.85

$224 car insurance payment since he got into an accident uninsured

Debt:

Says he has a terrible credit score (551)

Was at 630 3 months ago

Found a credit repair company he's been thinking of reaching out to

Student loans (paying interest only) Variable Interest Rates

$13'316 14% interest

10% interest

10% interest

Car Max Loan

$16'584 remaining, 421 minimum monthly payment (he's got another 400 past due with a 21 late fee)

10.45 interest rate

"All three of the credit cards I emailed you are in collections" timestamp

USAA credit card

Some old Visa

Coles Card

Owes $63.23 on "Afterpay"

Also on Paypal, Affirm and Klarna "I made a series of really really bad decisions"

- Affirm is 1k

"And it's just this stupid stupid anxiety of not knowing what I'm gonna have left" timestamp

Personal Loan

took it out a year ago because he was "freaking out about money" at the time

1'400 balance

Personal Loan

$986 "one of those finance app where you pay a certain amount and you get the rest of the loan back"

Not paying this one?

Owes Grandpa $4'500

"terrible situation"

First car he bought died, grandpa co-signed for a new car

- got t-boned and did not have insurance

Has had 2 cars get totaled while on job?

$10 monthly payments, it's informal

- 2

- 13

It's old but it only just popped up in my recommendations feed.

Description of the video -

Link to original video: •

Links: https://linktr.ee/eszekecles

Check out my podcast! - https://open.spotify.com/show/0pWGNq7...

Come check out the stream! - https://www.twitch.tv/eszekecles

I'm live practically all day everyday. - https://www.twitch.tv/eszekecles

This video has been edited to showcase and highlight the main topics I really wanted to talk about and hit on in each of Caleb's videos. The comments in each comment section greatly disappoint and sadden me as yall were watching but never listening to what I truly had to say. You continue to consume and feed your ego with these videos in order to feel better about yourselves when in reality you are no better than each individual in each episode. I hope you can break the cycle and instead of consuming you consciously create and make the world a better place as I am attempting to do. Please carefully listen and consider what I have to say in this video and ask yourself, is what I have to say wrong?

If you find yourself asking more questions or thinking about the same concepts I talk about in the video please consider subscribing and joining my community so that we can talk about solutions to making the world and each individual's experience that much better. Namaste friends.

Join the Groomercord! - https://groomercord.gg/jQySrBPj8g

- 66

- 57

Some or all of this might be wrong, was listening to this while eating :marseynerd:

Adriannah, 22, Austin TX

Could you fix her !straggots ? I think this one's beyond me

Self-rated: very bad, worst of her life maybe

Is our student loan debt being forgiven or no?

No

For real?

Yeah for real

Okay yeah, because I have 9'000 of that and I don't know how to pay it

Personal Life:

Cut off while she was 17, :marseythinkorino: had to work two jobs in highschool

Went to college full time (lived there)

- 3 jobs in college, part time wedding videographer, streamed on twitch and took a lot of addies (perscribed)

Had addictions at some point, claims to be over them

Trying to save to move (thinking about doing a payment plan with the IRS)

A family friend told offered to be her financial advisor and put her in life insurance ($100 a month)

In therapy "One time I had a really bad incident where I thought the world was ending and I spent $500 at HEB"

- :marseywomanmoment:

"A lot of my financial things are from travelling since my parents are far away"

Career:

"Content Creator"

Tiktok, Twitch, Instagram

- 109k Tiktok, 112k Insta, 15k Youtube, 100 paid subs Twitch

Trying to expand presence on youtube

Income:

$6 a month from Youtube

$4-6k average income across all platforms

Expenses/Debt:

Total minimum monthly payments $983, a quarter of her income

Wanted to consolidate credit card debt but hadn't done her taxes for two years?

- Just got a CPA, doing all her taxes now

Someone else is using her credit card?

- I missed a chunk, not sure what's going on here

Restore "Monthly Payment"

Her IVs? !biofoids please explain, what is an IV?

"I get IVs because I had problem with my hair falling out and when I drink I can't throw up so umm usually I'll get an IV so it restores me"

Tons of eating out, fast food places

$418 on a Salon :marseyfoid:

- "I wanted to look good because there was a chance I would get signed and get a literal salary to this thing that I was literally led on since August to get signed to and they were like 'Come to LA you`ll have a better chance if you come to LA' so I'm like I need to look my best I need to be my best self before I come to LA. So I got my hair I got extensions but they weren't mine they're my mom's so I didn't have to pay for them I just had her put them in and then, those extensions ruined my life. So this is me getting my extensions out and my hair redone because I could show you my bald spot right now but I'm not going to, my extensions literally ripped my hair out and it was like a mess."

$213 on an outfit

Stopped doordashing since she started watching Caleb's channel

Car

"Before you say anything I will not be selling it... but I am going to be refinancing it. But listen-"

Couldn't refinance because she let her out of state license expire and now has to retake the entire test

- Apparently this is an insurmountable process for this egirl as by the time she got her license to refinance she was deep in debt

Land Rover LR4 2011

400 minimum monthly, 9% interest rate, 72 months, got it at 19

Student loans

$900 Federal

$150 minimum maybe?

Didn't graduate, year and a half going to school for film

- "It was a waste of my time because I talked to the lady, I said what, how can I reasonably get a job with this degree after and she said 'you can do wedding videography for a company' and I said 'I already do that' so I dropped out"

Credit Cards

All basically maxxed out

Apple store $6996.24

"When I signed up for an apple card I thought it was just for the Apple Store and I wanted a macbook beacuse I was like I'm buckling in and I'm editing"

Minimum payment- 280.74 (will be paying 20k over 21 years if only doing minimums

)

)3 things financed on this card

- Macbook, iPad, Apple Pen

Wanted a macbook

Still spending on it, bunch of apple bills for buying app subscriptions? "I don't know what they are" "I don't really look at my things"

American Express $10'831 - 27% interest

She loves this one because it sometimes gives her 'free' first class upgrades

"It wasn't my choice to have that limit"

- Customer service told her they love her so she went with it

"I started a show, it's called 'Drinking with Dree' where I invite 3 creators on, and I would like to invite you on' and we [words words words basically a podcast]"

- Was going to use it to prove herself to that company she thought was going to sign her

I think this succubus is trying to get her claws into

's $$$$ and clout

's $$$$ and cloutInteresting contrast between how they approached the eceleb game Timestamp

$50 minimum payment but pays more than that (and spends even more than that purchasing with it)

Mastercard $3356.44/$3500

First card

minimum monthly payment around $40?

24% interest maybe?

Paying it off but spending way more than she's putting on it

Target

"because my other cards were maxed out and I didn't have money for a while I had to use my Target card even though I just paid it off because I needed to buy groceries... And I could this right now if I wanted to"

$153 previous balance now $374 "well because I bought groceries"

Paypal Credit Card?

Used only for stream stuff and editors

646.94/650

normal minimum is 40?

not sure interest rate

Savings:

2000 in a savings

1450 in a checking but 900 of that came out to pay the CPA to deal with the taxes

3000 in a Robin Hood

Never pulled anything out of Robin Hood besides Doge

"I like that it's in Robin Hood because I am impulsive and crazy"

Gets stock advice from some guy on Twitch

Over a year 2900 => 2230 => 3100

- 34

- 43

Ran into one of my former clients today. Unfortunately they’re back on the street after losing access to housing we had secured for them. I got them into something temporary for the next few days. I am telling you this because I want you to understand how hard it is out there.

— Lolo (@LolOverruled) May 19, 2023

replies are all coddling the houseless folx !nooticers !chuds thoughts?

- 16

- 24

- 37

- 55

OP in case he deletes it

Thought I'd share my experiences with this (embarrassing as it is) in case anyone is interested.

For those who haven't experienced hunger it can be difficult to imagine.

I don't remember the last time I ate 3 meals a day. I'm lucky to even eat 1. But regularly go days without eating.

Then usually have to eat something I hate like tinned spaghetti (I've eaten so much of it I struggle to stomach it these days). But have to because it's all that's available.

Or I eat plain pasta without any sauce, or plain rice.

Ive had to eat really odd things too just to not pass out - like just eating Vegemite straight out of jar. Or when I spent a week eating just a packet of sprinkles (2 yrs past expired).

Recently I bought a packet of mints ($1.50) and ate only that for days straight. Thought I could fool the hunger pains for a bit. Backfired badly though in form of diarrhoea for days, so I learnt my lesson and won't do that again lol.

People say 'call salvos' or 'go to Foodbank'. Like they just give out baskets of free food to all in need. The reality is that's not the case (at least in my area).

Where I am:

- St Vinnie's don't give supermarket vouchers anymore

- Salvos never answer the phones and just have a pre-recorded message saying they 'have no vouchers available in my area' no matter how often or when I call.

- my local food pantry closed down

- Nearest foodbank is like 3 busses, 3 hour round trip at least away. With physical disability this is tough.

- Foodbank - most people don't realise you have to pay for food here in most cases (unless lucky enough to get a once off 'agency pay' voucher). It is not hugely cheap either - tinned fruit is $3.50 per can, tinned soup meal $3/can, margarine $3.50. Not a big saving and no good if you have no money to pay anyway. Extremely limited range, just a few shelves, 1 type fruit if lucky (none last visit, and just rotting plums times before that), most of the food is past used by or lines that didn't sell. But you still pay those prices to buy it. And only have limited amount can get ($30 in my case which was 10 items). Certainly not enough for 3 meals/day.

And all these places have limits like 3 visits per year.

Because in Australia hunger and poverty is seen as something very rare. A once-off caused by an extreme event like flood or bushfire. Not something routine which people deal with on a daily basis.

So there's no real help available.

And we suffer in silence - embarrassed and ashamed.

Because it's treated like it's something wrong with the individual, rather than the system.

The rest of the comments are equally baffling. Isn't Australia like bongland lite with their ridiculous taxes and welfare state?

- 37

- 32

Does this dealership realize this makes them all look really bad???? pic.twitter.com/RGhOoMznXt

— Jessica Ray (@jessicaray0) August 27, 2022

- 58

- 86

Honestly I don't know what the frick this site is but it makes me feel uncomfortable.

Here we have Brooke (presumably a child??) discussing her sisters threat of spanking. An adult chimes in.

Here justin and brooke continue their creepy butt role play

lets move on

Here we learn about the forums delight in spanking on christmas.

Here we have charlotte posing a question? Should i beat my kids harder?

Our heroine Brooke (the presumed child) has a take (Age traitor)

And finally, girl decides to introduce her new reoomate to the circle of trust (spanking circle lmaooo)

Ok i'm bored of the spanking VoyReddit

if anyone wants to search more https://www.voy.com/250404/

- 3

- 10

- 6

- 15

Lael, 23, Berlin NJ

Rates himself a 2/10 financially

591 credit score?

He cuts up his credit cards on camera  timestamp

timestamp

Real Estate (for the last year?), Realtor?

- Got license 2 years ago, did nothing with it for a year but pay dues

Personal Life:

Went to school for Nursing

- Didn't handle the transition to online only well so he dropped out

Mother booted him out for reasons, allegedly not personal

lived with aunt for $500 a month (very cheap)

- Moved out and now pays $600 a month

Paid to sign up for Dave (didn't go through with it)

- he dodged a bullet here lmao

Income/Savings:

- 15'000 so far this year, in contract to make another 15'000 within the next two months

DoorDash

Fluctuates

Between 600-1000 a month

918 last month

Sperm Donor

"A good month, $900"

- "Sometimes they have bonuses I made 3000 one month"

"Donated at least 250 times"

"Can't go more than 3 times a week"

Started month with $16 in his account

- No savings, no emergency fund. Claims he has prioritized his debts

Expenses/Debts:

$28'478 total CC/Student Loan debt?

$250 a month in gas

Not setting money aside for taxes

- Only now making enough to be taxed lol

Purchased an old Tesla

Car was $550 a month, insurance was another $330 a month

Got into an accident, not his fault, got insurance payout, bought a much cheaper car

Current Car

2015 Hyundai Sonata

8'500 balance

16% interest rate

$212 monthly payment

Lot of spending, a few credit cards

Losing significant money on interest

Lots of late fees

Opened a card as a balance transfer, didn't bother paying it off and now it's horrifying

$7'000 in student loans (5k subsidized, 2k unsubsidized?)

- all federal

- 15

- 36

$350 shoes, multiple video games, out to eat a few times, Lego sets, $100 at the candy store, clothes.

This is what the OPs husband spent it on

I live in Texas (no state tax), have 2 kids, and make about 40k a year. I don't claim any exceptions for payroll taxes so my tax returns are usually 10-12k after the earned income credit.

Why wouldn’t you adjust your withholding rate ?

Because I prefer to get a lump sum of money once per year than extra income each month. I take that money and I put half into an emergency fund and the other half goes into an account for my kids that I use to pay for summer camp, field trips, extra curriculars, Christmas & bday presents, etc.

Why yes waiting a year to get 25% of my income makes sense.

By not planning properly. They are making mistakes all over the financial board most likely

-2

One MacBook pro. My wife and I bought two of them this year... Quick way to blow $6k

You see a lot of weird comments like this in a sub talking about poverty. Bunch of responses justifying Apple product after.

- 31

- 54

UNHOUSED FOLX ARE NOT CRIMINALS

— Ashley, LPN 🏳️🌈✊🏻✊🏼✊🏽✊🏾✊🏿🏳️⚧️ (@AshZification) March 21, 2023

HOUSE THE HOUSELESS https://t.co/DJx2hF9eDC

HOUSELESS FOLX ARE NOT CRIMINALS!!!! !chuds !nonchuds !peakpoors

- 4

- 19

Jason, 40 years old, Baton Rouge, LA

This guy seems sane and relatively intelligent unlike a lot of the other people on the show.

Interesting talk about the private security market

4 kids, 16, 15, 10, 7

Total debt: $134'794, 5'384 minimum monthly

Personal debt: $65'903, 3'419 minimum monthly

Last month's interest and fees: $3000

Career/Business:

He's W2'd himself so no tax issues

Owns eight security (physical) franchises, 6 active, 2 not launched

At least one business partner (is legal, not informal)

Military Police Marines, Air Force 6 years of each

Started in 2013, employs 150 people

Revenue $4.2 million last year

- Expects $7.5 million this year?

Takes a 60'000 salary, before taxes, $4'000 child support

around 1k left in salary post minimum payments

Total needs category is 1000 more than his monthly take home

Some personal expenses run through business

"Constant Growth period"

Charged based on the population of the territory purchased

Was $0.35 per capita now $1 per capita, minimum 100k chunk of people

$24-$40ish per hour depending on the service

- $500 a month (spot checks occasionally at night) - $25'000 a month (dedicated patrols)

Vehicle insurance gas all business expenses

Stronger franchises currently funding his newer ones but hasn't slowed down? Thought the opportunities were too good to pass up

20 vehicles in fleet

- Thinks more than $200'000 car debt at the moment? Not sure I heard that right.

Personal Life

Moving to Dallas in around a month

Divorced wife partially because of her spending, turned out he had the same issue, moidmoment

Debt

Started the business on credit cards

One of those companies that opens a bunch of credit cards in your name

120k cash from that (4500 a month minimum payments), he had no fallback

Took 6-7 years to get real progress on the debt

Personal Cards

USAA Credit Card

10'952 balance on an 11'000 limit

Paid 287 on it but made 210 in purchases on it

$171 in interest on this one, woah

"That's the good card... unfortunately"

Banana Republic Card

$4'764

$164 minimum payment

$117 interest charged

City Double Cash Card

Was paid off

$1600 balance now as a deposit for the movers

Delta Amex (?)

13000 credit limit

13331

Minimum payment $447

$297 interest

Chase

$24'290

$676 minimum

$433 interest

Business Cards

Card 1 (BoA?)

$8'990 balance down from $10'567

197 finance charges

"Some of the purchases are unavoidable and some are not. I sometimes have a hard time distinguishing between the two"

Chase

$23'746 down from 24'045

$615 interest

Savings/Expenses

Asked ex if he could borrow against the child support, currently pays 1900 twice a month to afford his move to Dallas

- wanted to pay once a month for a couple months then three times a month for the next couple

USAA checking money comes in, goes out to other accounts?

Bills on autopay for one of his

Fair bit of eating out? He's on the road pretty frequently

- Gives himself a $200 budget for that stuff a month

Borrowing against receivables for payroll? I don't know what that means but it sounds cool

- 4

- 15

- 7

- 15

- 7

- 21

Please subscribe to the hole. Only a few away from surpassing those vile fat haters.

.webp?h=8)