- 52

- 94

Christa, 33, Las Vegas NV

Career:

Stripper

"I work at a nice one"

Average between 10'000 and 12'000 a month

- Thinks she's at 120k yearly

Gets VA disability, was in Navy for 6 years

- 2'000 + Free healthcare

1099 contractor timestamp

Paid in 2021, hasn't paid 2022, hasn't saved for 2023

Thinks she owes about $60'000

- Might be closer to $40'000

Has an accountant, has been "avoiding them"

Filed for an extension on this years?

Summer didn't go so well, $4-$5k, November $13k

While stationed in California went to school, worked restaurant jobs, started doing 'bottle service' at a club in San Diego, then into modeling, got into a school in Orange county? Was living in a van in Orange County, wanted to do a grad program with the GI program instead of using it for undergrad (age 29). Met some Vegas strippers/prostitutes who suggested stripping, started working for first club?

Was studying sociology

"The only way to make money with a sociology degree is to become a stripper"

6 months stripping, then Covid, then clubs opened up again, she quits school and goes back to stripping

Says club has a couple 40 year olds and a 50 year old who are still making good money but acknowleges that her career's got a time limit

Planning to do this for 5 years max

Hates it but likes the money timestamp

Got a boob job, had them done previously, "one of them fell out of the pocket and was rolling around on my chest like an egg yolk so I had to get that fixed"

Purchased a property in Arizona an hour outside of Vegas that she plans on turning into an AirBnB or "event space"

Getting serious Big Short vibes, timestamp.

Doing renovations, paid "a lot" in cash, 9000 on a credit card though

Trivia about laws detailing many inches a thong can be timestamp

Can she write off her boobs? (No) timestamp

Financials:

Card 1 $9032 => $9094:

$600 in payments

$505 in transactions

$150 in interest

$10000 credit limit

Thinks she pays another 500 to a thousand

$1200 total in interest this year and $10 in fees

Canceled 2 cards that she had used for online shopping, just paying them off

Loan 1 20'130: timestamp

7% loan

$564 minimum payment

Past due, she already paid it though, she says

Truck loan, had a minivan, got into an accident "wasn't my fault"

Buys furniture and flips it?

- Has also been doing a lot of the house renovations herself?

"Perhaps I should have gotten something a little more modest"

- "I love this truck to death, it's a great truck"

Boob loan 7'400 timestamp

0% if she pays it off in a year

Needs to be paid off by end of next September

Original total not mentioned

Card 2 $26'453 => $27'016 => timestamp

649 in payments

838 in transactions, $399 in interest

$27'000 credit limit (she's over it now)

Says she paid $3'000 to this after the statement, it's at 24'000 now

wtf is on here:

$3'000 of plumbing

Home Depot purchases

$3'000 in interest this year

Loan 5'859 timestamp

15% interest

Took it out because she thought she was gonna buy a mobile home but the deal "fell through" took this out to consolidate debt

726 minimum payment

Property Loan $67'000 => $60'000 timestamp

Doesn't own other property

She thinks it's 5% interest, actually it's 10%

"Default interest Rate" of 5% and an "Interest Rate" of 5%

- Total 10%

- Total 10%

$90'000 house, she put some cash down

1 acre, good area

half-hour from Grand Canyon, good tourist destination

"If the demand's there why was it so cheap?"

"because umm.... the area itself, the local population, is pretty poor and umm... you know so a lot of locals weren't able to buy it"

Property sat for a year before she purchased?

Put in a new HVAC, new roof, fixed structural damage, new kitchen, new counter

$0 ending balance in her checking timestamp

Had to take time off from work while recovering boobjob

Fair bit of eating out

Overdrafted

Schwab

I think this is retirment? Not certain- Later mentioned it's an index

$15'000

Retirment from military

- Was at 27k, down to 21k now

Invested in "stupid stuff" also, individual stonks timestamp

- T-Mobile, and energy company and a few weed companies

Rent timestamp

Bought a mobile home with one of the personal loans

$20'000

$380 a month to park mobile home in the lot

Thinks a one bedroom is $1500 monthly, so she's saving even with the loan's interest?

- KongmothyX2 : Unfunny, uninteresting and unrelated to drama

- 84

- 104

Alex, 22, San Antonio

Personal Life:

Had 4 vehicles at one point, since sold a car and a motorcycle

At 18 got a $3700 GTI timestamp

Spent more than that on parts to modify it

Engine blew

Other car mentioned

- Engine blew

"Cycle of buying cars"

Has 2 dogs

Career:

Facility Technician

"I work in critical environments"

105'000/yr

"HVAC mechanical/electrical"

Got a job because he fixed some guy's AC while he was buying his motorcycle off Facebook marketplace

Got the job August of last year

Financials:

"I have a budget, I just don't stick to it"

Navy Federal #1 (16'000): timestamp

18%

Bought it at 17'500

Minimum payment $431

2008 Corvette

Beautiful car

Allegedly worth 17'000 or more now (about 8kish at the moment, needs repairs)

Blew up this one's engine too "I like to add power to cars"

"Where are you driving these" timestamp

"Mexico"

"There's no speed limits on the highways in Mexico"

Caleb is a speedcuck

This gigachad is driving around at 3-4am so he can go as fast as he wants

"How often are you doing this?" timestamp

- "Well not any more because the engine blew up"

Car explanation timestamp

"A lot of nitrous and a lot of boost from turbos"

"300 shot of nitrous, it was doing a 200 okay didn't like the three at much"

"Starting to blow up a little less as time goes on"

Navy Federal #2 (1'577): timestamp

17.75%

First car, Volkswagen GTI, bought in 2020

"Not running and not worth fixing"

220'000 miles

Planning to pay this off next paycheck

457 minimum monthly

Navy Federal #3: (4'309): timestamp

12%

141 minimum payment

Suburu WRX

"Person who sold it to me said they rebuilt the engine and within 3 months of owning it it blew a head gasket"

Audi (24'088) timestamp

$505, 67 payments remain

13% interest

"Low miles, for what it is the price isn't bad"

- 37'000 miles

Bought it for 25'500

Was spending 600 a month on gas driving the 2008 corvette

Thinks it's worth 23'000

This one is operable

Plug-in hybrid so he will get a 4'000 tax credit

Jared Card ($5'185) timestamp:

$185 minimum payment

30% interest

"Ummmm.... I bought previous girlfriend a lot of jewelry"

- Together for 2 years, broke up last Sunday?

- Together for 2 years, broke up last Sunday?

"They do 12 months no interest, I was like I'll pay it off... I didn't pay it off"

Personal Loan ($5'000): timestamp

When he moved, didn't have cash on hand for security deposit and first month's rent

thinks they charged the interest up front and it's not accruing?

Originally for 3'000?

Thinks it's in the 20s in interest

$120 minimum payment

Navy Federal Card (4967 => 5003. timestamp

$122 minimum payment

Purchased $85 and accrued $73 interest

- It was 3 UberEats purchases

- It was 3 UberEats purchases

5'000 credit limit

"Whenever I see that card go over the limit I pay it down"

Checking Account Transactions: timestamp

Mostly food market, vending machine

Road tolls timestamp

- "I sold a car and left the license plates on.... the car never got re-registered"

401k Loan timestamp

Needed a trailer hitch because he thinks he is getting hired in and moving to Virginia

$2'000 and 9% interest

Paid off a few other cards already in the last few months

The fat man rambles for a bit then Alex blows him out of the water - timestamp

- 58

- 85

Some of this probably inaccurate. I had a hard time following what she was saying through the tears, not actually sure if she's a tumblrina, just guessing from behavior patterns and age

Cia, Oklahoma, 29

Personal Life:

Found Caleb through TikTok

Was in a dual income situation but spouse is currently leaving her? They were both going to be on the show?

- Brushed over at the beginning of the show

Since 2017, in 2019 grandma passed, she goes to North Carolina where her tribe is "Eastern Band Cherokee Indians"

- Met cousins also in "table games" at the funeral

Mother is Comanche

Moved into grandma's old house when covid hit?

Timeline is a little weird here

Was also paying father $500 a month

Other grandma gets sick, also died, she found out at beginning of 2021 died early 2023

- She came back to Oklahoma for her?

"So basically I've been just surviving since then, I started table games jobs when I wasn't in the right mindset" timestamp

"So basically what you're seeing right now I'm getting out of the depression"

Not sure what this even means

"Everyone views me as the parent"

Gets tribal benefits if she's in North Carolina?

Household income

She works from Jan - early Aug at other table games job

Husband has been getting around 1800 on his checks

"You guys were going to come on, what happened between your application and no-[ad break]" post-ad timestamp

Major waterworks here, avoid if you don't like seeing people crying

Not going to take notes on segment but it's beat for beat a Boogie diatribe -

everyone's using her

she's the nicest person around

her soon-to-be ex-husband is immature and didn't reciprocate emotional support

muh therapy

Close-up interjection from cell phone-cam Caleb timestamp

"blah blah blah, only one side of the story try not to be judgemental"

"A couple days after the episode she sent them an email saying we are in the wrong, me and my team, that we are against her, that we are the evil ones and we hope for her to not succeed essentially"

She and her ex will be co-tackling debt before separating with dual income

Diabetic, lost weight on ozambiec?

Career:

"Table Games" (Casino)

Blackjack dealer

13/hr base, just started, 7 and a half hours a day

Worked at this position before asa supervisor, made 13.30 + tips (rare)?

1950/month? maybe?

Also gets tribal gibs, 20k last year but varies depending on casino preformance

Financials:

Has a house, that's paid off

$33'000, bought ten years ago, in Oklahoma

Gets tribe gibs twice a year, varies depending on how casino is doing.

20'000 last year, lower this year

June and December

Car Loan $17,657 timestamp

18% interest

$414 minimum payment

"That's uh... That was like I need to get out of the house"

"It's my car"

Chevy Spark

"So basically when my grandma passed away I was going to take over payments on the car which was like six hundred something"

"This car?"

- "Not this car, it was like a Honda er uh Honda Accord hybrid but then my mom she wouldn't let it go so then I wanted to at least pay that six hundred try to maybe refinance it but then she let it go and that got repossessed and in the midst I'm like I need to start getting out of the house I need to start getting ready to get a job"

Mentioned later that both of their names are on both car loans

Car Loan 2 $32'776 timestamp

Chevy Colarado 2021

813 minimum payment

11% interest

Newegg $1'600 (I'm not sure) timestamp

"Cozy games"

"Like Stardew Valley, you know"

"Well I also like Borderlands too"

Bought a pre-built for 1'307.99 timestamp for thing showing

35.98% interest rate

Currently owes 1'600

Has paid $154.44 so far?

- $120 payment later mentioned through Affirm? I don't understand this

787.22 minimum monthly payment?

Husband was the one that ordered it but it's hers?

Caleb mutters the specs under his breath timestamp

"Six core CPU"

16 gigs RAM 3600 DDR4

1 TB SSD

Nvidia 3060

Home security (in collections)

was not in a good area, now in a better area

Didn't pay this because [storytime] timestamp

Credit card 1 timestamp

Pays this off

- "That was just for one month, I was working really hard"

"My grandma when she passed away I got money, I got some insurance money so I've been that's how I've been surviving is her money"

- $30'000, has 10'000 left

Balance is back with a vengance, now

waterworks are back "every day I was like taking like edibiles and like high edibles and I was gaming" blah blah blah more boogie bullshit

"It's like almost maxed out"

- It's not, it's $990 out of $1'800

$20 monthly payment, 28.24%

Buys streamer merch, some woman pronounced "Payton" who streams on Youtube?

- I couldn't find her, just got football videos

"Super Secret Debt" timestamp

About $3'000

Not on a payment plan, a couple years old

Something about someone needing documents but she never gave them the information

iPad $500

0% interest?

$55 a month?

additional $30 a month for phone bill

Student loans $5'000

- Federal

Chime checking account balance -$84 => 0

Retirement Account - $436

Canceled subscriptions - Manta, AMC, Crunchyroll

Has not cancelled - Hulu

No savings

Allegedly $800 a year in property taxes

Doesn't have home insurance

Caleb claims to be on a diet

- 64

- 92

Justin, 37, Arizona

I'm not even going to try coming up with a total debts or anything. This guy is insane.

Personal Life/Career

"I'm in logistics and I sell stuff online" timestamp

"What are you sellin online?"

- "Whatever makes profit"

"Logistics" is door dashing/roadie full time

various gig work things

Minimum $1200 a week (sounds like pre-expenses?)

7000-8000 a month for holiday season

127'000 gross income last year

Lives out of his car?

"I've settled into this lifestyle and I don't like it

living a nomad life for the last 3 years "sort of by choice"

Regional Manager for a marketing firm but laid off December 2018

- Since then he has been "focusing on [his] logistics"

"I focus on my kids and myself"

17 and 14

Kids are with their mom full time

Sees them often?

Relationship failing sent him spiralling for 8 years?

Was reselling full time on Amazon and bringing in money?

Live-in girlfriend wanted him to go back to a job

He caved to the pressure, got regional manager job at a marketing firm

300k from Amazon reselling, salary for manager not mentioned

- Later mentions the salary is $83'000

Owned condo, bought 2009, rented it out when he moved in with his girlfriend?

Complicated situation where he rented out the condo to his ex who had the kids

$36'000 remaining on the condo somehow prevented him from renting elsewhere?

Signed over the condo to the ex and her new boyfriend? Basically gave it away, they took over the loan

- "That was one of my first bad decisions"

Got burnout last year, started going to the casino frequently

- "was winning a lot of money" but was sending all back in

- "was winning a lot of money" but was sending all back in

Hasn't paid his taxes in two years

- Filed in 2020 but the agi was all wrong?

Moved to stay with his uncle in California for fresh start

Got in an accident?

"I was out of commission for a week"

Uncle is a gambler and they would go to casinos together?

Accident caused a fallout between them?

Had a Mazda CX-5 but the belt broke and he drove 50 miles without the belt

"Catastrophic engine issues"

Could cover the repairs $3000

Then it broke down again afterwards with some new issue allegedly?

Got a Nissan Sentra after the second issue with the CX-5 in August 2021 timestamp

renting his vehicle at $475 but that price includes any issues with it?

Averages 9000 miles a month in the car

Has been thinking about going back to a regular job but thinks the transition would be difficult

His job hunting timestamp

- Applied to one recently but got rejected post-interview

Financials

Had a car repo'd timestamp

- Was providing a vehicle as a part of child support but couldn't pay that as well as his own when he lost the marketing job?

Lives in Hotels when he has his kids? Usually weekends?

Doesn't miss his monthly payments but does carry balances on some of his cards?

Car rental details timestamp

161 dollars overdue because he incurred a cleaning fee on the last one

28 day cycle, has been doing it for a year

$350 a week on the bottom end

$484 a week on his current one

"On the bright side it's a tax write-off"

- He hasn't paid taxes in years

"I think I was hacked" timestamp

Some stuff on his report that he doesn't know anything about

He reported them?

Lost his wallet last year and never got physical cards becuase he has no physical address?

He did not cancel the cards he lost

2 student loans and an auto loan from Miami Florida

Hasn't locked his credit?

- He says he didn't think of it

- He says he didn't think of it

7 things in collections

- Can account for 4 of them but doesn't know about the other 3 timestamp

Tried to deal with the student loans timestamp

Called University of Phoenix they told him to come in with his photo ID

Arizona has digital ID so he wasn't driving illegally despite not having a drivers license?

Got an iPhone timestamp

- One's business one's personal

Further car explanations timestamp

Once the one car got repo'd he stopped making payments and he'd spray painted the car during a mental episode so it wasn't worth as much

- Got sold 6 months ago?

Goes on for a while? Sounds like he had a melty over customer service chads and made terrible decisions? I didn't follow this

Checking Account? timestamp

- Just goes on forever, amazing.

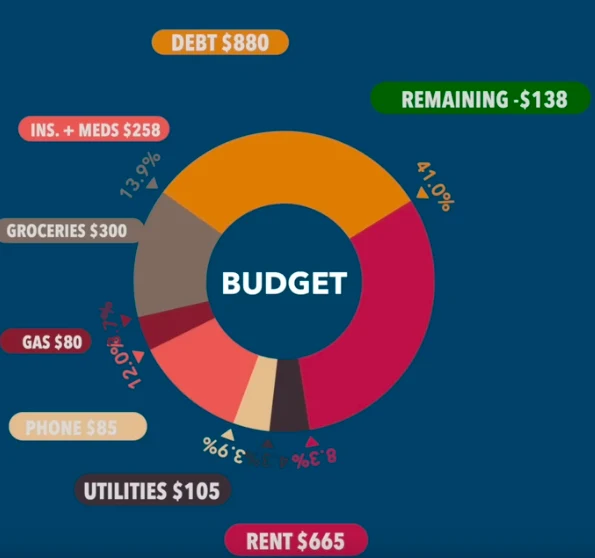

Spending Pie chart timestamp

- 65

- 89

Some of this might be wrong

Summer, 27, Dallas TX

Personal Life:

Flew in from Dallas, was worried about the Check Engine light on her car

From Atalanta, wants to go back

In Dallas because her boyfriend moved there and she's remote work so she went with him

Has a kid with boyfriend

- Kid is 3

Boyfriend is making around 80k

Started Therapy about a month ago

- Says she has an emotional spending problem

Career:

"I'm in Fintech"

"Merchant Success Rep"

Point of contact, helps with onboarding and stuff

After benefits before bonuses 3518 a month hits account

Bonuses between 200-1000 a month before taxes

Financials

Payday Loan 1 ("Possible Finance") timestamp

260.30% interest rate

She didn't know the interest rate

Looks like it was an $80 loan? She paid 20 for this

Boyfriend paid to get there and went to some super tiny apartment at $1850 a month? 749 sq ft

Boyfriend covers majority of the rent

3 bedroom townhouse in Atlanta

"Oh wait, oh no you're talking about that loan" timestamp

- this is the smaller of the payday loans

"Why did you borrow $80 at 260 percent?!"

"I really don't know"

pause while she looks at the loan

"After moving I got really broke"

Says she just paid this off

Payday Loan 2: timestamp

$1693.75 => $1773.75

$80 in fees

- She hadn't made payments towards it

119 minimum payment

Has made a payment now, says she will pay it off by Thanksgiving

Quicksilver (Card 1): timestamp

$493 => $510

$25 minimum payment

$29 transactions, $13 in interest

"I just ran out of money and I was like well I have my credit card"

Lot of eating out on here.

Credit One (Card 2): timestamp

$317 => $366

$30 in payments

$30 in transactions

$41 in fees

$90 minimum payment, I think this means 2 missed payments?

- Says she paid it but the payment didn't go through and got the fee waived?

30% interest rate?

Amazon (Card 3): timestamp

$1019 => $1022

$23 interest

$70 payments

$50 transactions

$141 in fees this year

"I do forget about this card sometimes"

"Why aren't you on autopay?"

- "Oh my account would be overdrafted"

- "Oh my account would be overdrafted"

35 minimum payment

"Vacation spending"

"Wait are there payday loans that I don't have in this stack?" timestamp

- There are

- There are

Student Loans timestamp

Federal

Hasn't started payments, deferred

Payment is about $200 a month

Stuff in collections timestamp

Portfolio Recovery $1332

PDQ Services Inc $880

Caine & Weiner $430

I C System $307

Southwest Credit Systems $268

I C System $258

National Credit Systems $110

Credit Collections Service $78

"Yeah, those are like really bad choices when I was younger, that's for sure"

$1332 is from back in 2015 fresh out of High School, might be dropped might not be

App says open for another 4 years 2 months.

She plans to try getting them all settled by January

"Cash reserve manual payment" timestamp

wtf even is this?

"If you have a good amount of income comin in my bank will give you money on reserve and you can take it out"

"Wait wait wait, what does that mean?"

- "So it's like a payday loan I guess"

- "So it's like a payday loan I guess"

Can borrow up to 750?

- Currently has $750 borrowed

- Currently has $750 borrowed

"Earning" (another payday loan) $260: timestamp

- Says she's paying it off completely tomorrow

- Says she's paying it off completely tomorrow

Lot of Zelle payments

FloatMe Fund (Payday Loan that's already finished)

Drake Concert, also the start of the payments timestamp

More than a thousand dollars

These payments are nuts :lets goooooo:

So much eating out

Some legal fees for an issue with the lease

Bought furniture for this new place

$798 in Retirement

- Started job in January

"I've never seen a statement like that timestamp

Pie Chart of her current spending timestamp

- Absolutely insane, 3.5% of her income is going to her debts

Budgeting Segment

- 30

- 50

Elise, 24, Houston TX

Career:

Cashier HEB

Spending a lot at HEB

- says she spent on water bottles

$1'348 income

been doing this job for 5 years timestamp

HEB only lets her work up to 35 hours

"I've been looking for jobs that are like salary paying jobs but I don't know where to look" timestamp

Personal Life/Education:

Mentions she got pell grants, scholarships and some other stuff for undergrad timestamp

Studying for LSAT

Future Lawyer

"I want to go to a good law school but it's debatable what's good" timestamp

- Mentions UT and Michigan as ones she's looking at?

Father says she has to go to law school or move out

- He got several degrees blah blah blah, has a hundred thousand in student debt?

Father wants her to just take out loans for law school? She wants to wait a few years and pay off debts?

Poli Sci Degree undergrad

Lives with her dad

- Moved back home after graduating college in May 2023

Claims she found his channel last month and has only then changed her spending

Didn't work from January to mid-March

Spending/Debts:

Credit Score - 640

Multiple overdrafts

Missed payments on multiple debts

Carrying balances on cards (still spending on them)

- Justification - timestamp

Lots of eating out

- Reading through it - timestamp

"Why is all going to 'frick you' spending?"

"This was your most recent statement though, so this just happened

- Justification for only just changing spending timestamp

Synchrony (Card 1. $1216.73 => $1280.56 timestamp

Missed payment

$77 minimum payment, next is $117 due, normal is $40?

$23 in interest added

$40 of fees

Totals for 2023 on this card:

$189.00 in fees

$195.27 interest

$284.50 interest paid?

Discovery Card (Card 2. $773 => $697

$38 minimum payment

Made $93 in payments

$17 in interest charged

Totals for 2023:

$30 in fees

$137.76 in interest

TDE Credit Union (Card 3. 2'608 => $2'558:

$58 over the credit limit

$25 fees

$29 interest

2023 total:

$125 fees (5 missed payments)

$264 interest

Car 2020 Toyota Corolla $23'812 remaining 17.17% interest rate

$563 payment

$28.18 late fee

Probably worth about $17'000

Got car May of 2022

Went full r-slur at the dealership out of laziness holy shit she's a born mark

Storytime - timestamp

So I just let the dealer run my credit and told him I wanted whatever I was approved for

Why didn't you like go with someone?

- I was trying to hide it from my parents

Why have you not sold it?

Attempted justification timestamp

Underwater 8 or 9 thousand dollars

AT&T (1150?) timestamp

Past due $506, says she's caught up now though

Normal payment is $230 (includes cell service)

Phone, iPad, Apple Watch

"You're not even wearing it!"

- "I left it in my car"

Nothing owed on the phone ("trade-in value")

$286 on the watch

$900 on the iPad

Tried to return the watch (failed)

- Caleb tells her to sell it

Freedom(?) (Card 4. 1365 => 1233

165 payment made

$33 in interest

$45 minimum payment

Student Loans: 27'000 timestamp

in grace period right now, extended from November to next May

- "You get another one if you request it"

Planning on deferring them again when she goes to law school

TDECU Checking Account timestamp

$5 balance

Spent $12 on a car wash

Affirms ($300) timestamp

- around $40 minimum

Checking Account -$11.69 timestamp

- she got another car wash from this one

- she got another car wash from this one

Budget Segment timestamp

- $1070 total minimum payments

- 8

- 29

Virgin Galactic sponsorship mentioned in the description, Caleb is really moving up in the world

A couple new Caleb deets for this episodes

Has been to a lot of therapists

On Solexa

- "Can't be a millennial if you don't have an anti-depressant"

Chris, 39, Austin Texas

Personal Life/Education:

Big Wrestling fan

"I've been on stage in front of 30'000 people before introducing Taylor Swift"

- Very early on apparently?

- Very early on apparently?

Had gone to college "for Radio" because he wanted to do that

Moved from NYC to Austin

Career:

Unemployed

used to work for Facebook

Let go with the first round of layoffs Nov 2022

Program Manager managing relationships for the payments team

Meandering Storytime:

Was on medical leave when he was let go

Mentions mental health (Depression and Anxiety)

Based therapist at 1.50

"She told me that in order to continue seeing her I'd need to be dairy-free, gluten-free, sugar-free, drink half my weight in ounces of water every day, walk a mile or two every day, it was preposterous but it made me feel like I wasn't even good enough for therapy"

In september (2018? I can't figure out the timeline), started working out, lost 100 pounds over 10 months

- "30 Workout"

Has a different therapist now who's agreed to see him for free until he finds a job to pay

"Took some time to get back on top of my mental health and then when I started applying for jobs I just had... it's probably been 3 or 4 months of regular applying and I've had zero luck"

Tried to get a youtube Channel going? Eventually got tired of that

Took all his savings, stock money, retirement money and and planned on living his best life for 6 months before roping "I don't want anyone to feel sorry for me, I had a blast"

"6 months came up, I no longer wanted to not be here and had to figure out a way to survive, I no longer had any money or job"

That was in 2018-2019ish?

12 hours a day UberEats living in a Truck stop parking lot

Facebook found his linkedin and dm'd him for an interview during the Truckstop living saga

- "Went from homeless to making 108'000 almost overnight"

Started a podcast with a high school friend a year ago

"Troyalty Podcast" (sounds like it's a weekly thing)

I HATE JOE ROGAN

I HATE JOE ROGAN  I HATE JOE ROGAN

I HATE JOE ROGAN  I HATE JOE ROGAN

I HATE JOE ROGAN

Assets/Debt/Expenses:

Savings - 200-300 bucks left

Paid his rent ahead at least a month so he's fine for the moment there

$1000 eating out in the last month

- Throws a lot of groceries out because he eats out so much

Money left from Facebook

paid all the way through mid-Jan

Severance package - $20'000

Retirement fund 30k (took them out again

)

)

Credit One (Card 1) $500:

Paid off => $500

Lots of subscriptions

fees and interest not mentioned for this card

Credit One (Card 2) $300:

270 in interest so far this year

73 of fees on this card

Capital One (Card 3) $893:

2345 in payments to it, 2'581 in transactions

$698 => $893

Credit limit $740

"Cash Advance 150?" No idea what this means

Lots of eating out and weed on this card

Financing a phone

- $175 monthly T Mobile payment on his plan

Went to see the new indiana jones movie so he could review it on his show

PAID FOR A TICKET TO JIM NORTON'S SHOW

$40

didn't end up going because he was nervous about being in public?

Spending not gone through:

Gambling, UberEats, some other stuff

- Gambling apparently only a couple times on some lotto site

This is a man who PAID MONEY for a ticket to a Jim Norton comedy show in 2023

- 66

- 109

Ariel 30 and David 35, Louisville TX

Personal Lives:

No kids

Married for a year

Education: timestamp

Husband

No college

Current career plan is becoming a dominoes guy? I'm so confused timestamp

- Sounds like he's being sold down the river tbh but I'm paranoid

Wife

BS in Rehabilitation and Concentration of Orientational Ability (not sure I heard this right)

Had to pass a test to work in the field but failed it and they wanted her to take it again so she tried to get a job in the process while studying for the test so she went for another area of work and never took the test a second time?

- Salary for this is between 55k (average) and a 104k (top)

Started college for nursing but she couldn't handle vomit

Careers:

Both have 80 hour work weeks

Ariel -

Both jobs remote

Payment processing for an auto company

Second job at a comtech company helping build websites?

40k salary from each job

David -

Amazon Warehouse forklift driver

- 39 hours 17.20 a week. Flex hours

Dominoes Pizza Delivery Driver

40 hours

Around 260 biweekly and 600 a week in tips?

Donates plasma twice a week

- around 120 a week

Debt:

Why are you guys working so much timestamp

- Claim they've already started trying to get rid of debt, almost gotten rid of husband's then dealing with the wife's after

Didn't save money for their wedding, some of their debt is from that

"Are you guys completely on the same page when it comes to personal finances?" timestamp

- Wife wants to do things, husband wants to get rid of debt

Wedding expenses discussions timestamp

2019 Toyota Highlander 44'332 => 32'806

$725 minimum monthly payment

5.4%, 5 year

Thinking about selling it. Believes it's not upside down

At the time he'd purchased this, a year or two ago, he'd paid off ALL their debt except her student loans

"I got all those credit cards because I was taught that.. you know... umm.. I guess... if you have higher I mean cards with higher limits on it you have I don't remember the technical term for it but I heard it's supposed to be better for your credit if you have a higher spending limit or something like that"

(Card 1) FNBA Visa $3475: timestamp

Paid for Best Man of the wedding's travel expenses

0% but not sure how long it will be

$70 minimum payment

"It's so low, we can definitely get that paid off"

(Card 2) Navy Federal $11'714: timestamp

Wife tried to get into e-commerce "I took a course"

Two $5'000 courses, she got taken for a ride

(Card 3) Navy Federal $3'378: timestamp

For wife's everyday purchasing

Made 116 payment, Bought $544 in new purchases

(Card 4) Discover Card ($6'000)

Husband's

Two sections, 1 accruing interest, 1 not. Already paid off one that was

0% interest ends on September 4th

Part of the wedding debt

(Card 5) Amazon $1400 timestamp

$7.86 interest, $39 late fees, she thought she had auto pay on

400 payments, 360 in new purchases

Other credit cards all paid off now?

- They said this after card 1 but there were so many more

- They said this after card 1 but there were so many more

---Intermission while she pulls up student loans---

Caleb (to the husband): "can you say something upsetting so I can verbally so I can get some equal treatment over here"

Husband: "I just wanted to stay out of it, I've talked to her enough I need somebody else to say something..." [he goes on but it's just filler]

---

Student Loans (51'000)

Around 600 a month minimum payments when it starts up again

She thinks payments start back up in June 2024 timestamp

Car 2 Around 16'097(?)

$366

4.39%

72 month term

Savings:

Retirement Fund $1'000

A collection of small checking/savings, none higher than 500 I think

Living Situation:

- $1600 a month 1 bedroom, thinking about a new lease or acquiring house? Wife burned down the kitchen? timestamp

- 66

- 89

Daniel, 22, Lubbock TX

His other half overrode the financially savvy asian half

Self-rated - 6/10

Personal Life:

"Barely 22"

Why'd you go in to the debt?timestamp

- "Well it's a long process"

Went to a trade school, Universal technical institute

- Automotive, certified in Volvos

Friend encouraged him to come on the show, doesn't watch the show himself

"Last year I got myself into a predicament"

- "I moved out by myself and I was paying so much in rent I didn't really think it through so last year was a year where I really struggled and this year is a year where I really tried to step it up"

Career:

A Volvo technician

52'000 a year pre-taxes

Lives in Lubbock for his job

Expenses/Debts:

Credit Card - $1'628

Not spending on it while paying it off, made $200 payment (way more than minimum)

35% interest, talked them down to 18%

"I honestly don't remember how I got so high up in debt, I think I did pay off some student I think I paid off a class and it really set me behind and then I used my credit card to get a car"

- Put the downpayment on the card

- Put the downpayment on the card

Collections (1) - $972

Medical Debt

When he was living in Arizona, not working at the time, wasn't feeling well

Two years ago, not something that will repeat

Wants to pay credit card off before this

"They can't report medical debt on your credit if it's less than $500?"

Tried to negotiate but failed, only tried once

Been in collections since last year?

Student Loans (4) - $12'000

Federal but he thought they were private

Around a $150 minimum payment

Maco debt toolbox? timestamp

18% interest rate

Toolbox itself was 6'500

Owes 9'500

Minimum monthly is $180

There's something weird later on where he thinks it shows up differently on his credit report timestamp

Missed a payment at some point?

Car Loans (2) - $30'638

"I have two cards, I'm thinking about getting a third, a Tesla"

"Well you save on gas, yuh know, it's always nice to have three cars"

"I have one car, the other ones from my mom, it wouldn't hurt to get another one... it's always an investment"

"My mom needed a car so I bought her a car under my credit"

- "She's in a financial situation as well"

Sion IM 2016

19'000

"I'm pretty sure it's overpriced... it's just my mom really needed a car"

Put down $2'000

13% interest

"That's the cheapest they had on the lot" "I was in a tight schedule with work"

72 months

"Well at the end of it I'm not really paying for it, Mr.. pushes up glasses Hammer, my mom is" timestamp

- The plan is once she buys a house she will buy the car off him with her credit?

Ford Focus 2019

11'703 remaining

103k miles

2 for one deal with the other car

He's not sure about the term or the interest rate

9'000 downpayment?

$312 minimum payment

24.39% interest

Trashes In n out and Red Robin timestamp

Trashes In n out and Red Robin timestamp

Savings/Retirement:

High Yield Savings with Amex:

$866 => $1'066

4% interest

Investment Account

All part of the Acorns

$200 in one

$300 in another

No match

Budgeting Conversation:

Under contract at job, can't leave until it's over, Feb of next year, plans to move back home after timestamp

Putting money into a "Christmas Fund" at work

Doesn't pay renter's insurance timestamp

Apartment is under his roommate's insurance?

Not on the lease, "they didn't approve me" (because of the collections)

- 16

- 33

Sienna Wereham, 25, Austin Texas

Self-rated - 1.5/10

Personal Life:

From Montana

Lives with Boyfriend (Korean)

He pays rent, she "takes care of everything else"

Owes him money

29, law student

He gets money from his family

Just finished his first year (2 more years then Bar)

Was doing pretty good this time last year but "then like I had a series of like um events come up and that kind of resulted in me using my credit card a lot more than what I normally would have been using"

- Trying to focus on paying off her credit card but it's going slowly

No car, uses his car to drive to work

- Lives close enough to law school he bikes there

Career:

Bond underwriting assistant

23/hr, 37.5 hours per week (doesn't know yearly pay)

Was 40 hours they decreased this during covid?

Thinks about 42'000

recently hired as a full time employee (only 2 pay periods?)

- 1'200 a paycheck?

401k contribution is 3% (company match )

Contract to hire type thing, she is hired as of March?

- Paid weekly as contract, biweekly as full timer?

Debt/Expenses:

Personal trainer twice a week

Trying to lose weight

Virtual appointments since trainer moved from Austin to Chicago

Might be $55 an appointment, neither person says the price but that's what's on the venmo

Credit Card 1 timestamp

"Trying to pay off"

"I was paid weekly when I was a contract worker and I switched to biweekly as a full time employee so there was like a bit there where I umm uh I need to go to like the grocery store and stuff but I didn't have enough money to go to the grocery store"

- DSP soundbite

- DSP soundbite

$3212 => Paid 271, Spent $1688, $91 interest => $4720

Student Loans

University of Hawaii at Hilo

No idea what this is and I probably heard it wrong timestamp

Wanted to go to Portland State but that was too expensive for her (50-60k)

32'000

About a 400 minimum payment (5-6% interest)

Always been on deferment, graduated in 2021

Owes Boyfriend $1'800 timestamp

Had borrowed money to pay off her credit card that she'd used to make purchases when they first moved to Austin

Where'd he get this money from

- "I can't share that"

- "I can't share that"

Gave her the money in August (they moved there in July) ($4'000)

After this money her credit card was $2'000

- Boyfriend said not to pay him back initially because he wanted her to pay off the card, the card is now 4'720

- Boyfriend said not to pay him back initially because he wanted her to pay off the card, the card is now 4'720

Currently paying him $400 a month

Retirement/Savings:

Story time timestamp

"Yeah, so, about this time last year um I had about a thousand dollars in my savings account or twelve-hundred actually but then like I said earlier um there's like a series of like events that happened um"

Grandmother in Idaho had a health scare while Sienna was in Korea (boyfriend is from Korea) so flight costs, then spending money while she was visiting?

She and her boyfriend had nothing saved when moving into the Austin apartment after that?

Took on debt on spending to furnish apartment and groceries? A little uncertain, she backtracks on whether it's furnishings or just essentials

Boyfriend had just paid tuition so his account was pretty empty

Initial job when she moved to Austin was very stressful

- Remote job, no friends in Austin, shopping was her only reason to go outside

Checking

- $98 started => 1691 in, 1232 out => $557

Savings

$69.26 stated => 10 out for being below min, => 59.26

- Two charges a half month apart each $5

Bank had increased minimum balance from 50 to 100 and she hadn't seen that notice?

- Bank is up in North Dakota

Retirement account

- $86

Robin Hood

- $77 total in here

- 37

- 51

Ron, 33, Nashville TN

Self-rated 3/10 situation

Personal Life:

Falling out with his parents

Says father was emotionally abusive/manipulative

Has since mended bridges with them somewhat?

Asked if he could move back in after getting a remote job, they said no

Good relationship with his mother, bad with his father, they are still married?

- Mother makes 200'000?

Debt from early 20s moving out of his parents house

Story time about being a boozer - timestamp

Was van living for a little while so more money to party

- Stopped in late 2019 early 2020

- Stopped in late 2019 early 2020

Addicted to Mountain Dew timestamp

Goes through 2 a day, doesn't buy from stores, just from gas stations or dunkin donuts?

"If it's a bad day I will go and get more"

"Do you have diabetes?" timestamp

"Not that I know of, I haven't been to a doctor in 5 years"

Blood sugar test timestamp

"I don't have diabetes by the way I just have all medical equipment possible because I'm afraid of something going.. bad"

New Caleb lore - he is terrified of needles and blood plus is some sort of paranoid

Apparently he does not have diabetes?

Brother had addiction stuff as well? (marijuana and alchy)

Career:

Tried to apply for real jobs out of school, never got callbacks

Call center 40 hour week

- $18 an hour

Starting a second job in a couple weeks

Variable, $18.50 after 5, $20 weekends

Also 40 hours?

Call center stuff but different from the other call center

Some online stuff

Runs DnD games online

3 hours a piece depending on how much he needs to prep

$600 a month or so

- 1 game ended

Using some site for this that pimps out DMs

Made 10k last year from this

Runs these games through his phone? "Only reason I bought it"

uses Fiverr people to do stuff for it?

Got a cat recently, photo shown to camera timestamp

His mother gave him 1'300 total last month

Expenses:

Mountain Dew:

- Unreal amounts of mountain dew more than $400 a month

Rent $1230

- Low end, not a great neighborhood, pays for laundry not within complex?

Debts:

Discover Card (Card 1) Around $3000: timestamp

Had to put car repairs on it?

4 tires and some maintenance stuff

Minimum monthly maybe $30? He's not certain

25% interest

Had paid off the card with a personal loan years prior to the car repairs

Dunkin Donuts - 2 Dews for $4 "That's how they get you"

USAA (Card 2) $7712:

20% interest, $631 lost on interest this year

Did not spend anything on there

Costco (Card 3) $908:

Paid 218 but made 185 in purchases 14 in interest

Credit limit of 750

Thinks the purchases were all unnecessary

30% interest

Car: 2010 Toyota Camry

130'000 miles

$5438 left on it

4.99% interest rate

Bought right before the pandemic hit

Personal Loan $18'173 timestamp:

2 or 3 cards, and the rest of the loan balance of the van he had, has since sold Van

$584 min payment

originally 25'000

Student Loans:

Majored in Business?

Southern Hampshire University?

$38'900 federal student loans, Probably 470 minimum payment

These are why he decided to get a second job

Savings:

Checking

Gets money from his mother?

26.76 => 5132 - 3918 => 1247

Business Checking account for his DnD thing:

- "Cloak & Dagger LLC"?

Budget Section timestamp:

- -$1231 between minimum budget and basic survival currently without the second job

- 32

- 57

Michael, 33, Richmond VA

Self-rated: 1/10

Career:

Door to door solar salesman

Started working for them in February

Claims it's one of the best markets in the country for it

All commission, no base pay

Income so far this year, he brought a spreadsheet timestamp

Jan - $2163

Feb - $630 (Started Door to Door Solar here)

March - $3220

April - $3125

May - About $9000

Believes it will settle between 7'000 and 10'000

Payment model -

Paid 175 they see the presentation

$225 if they buy

8-10 people -

Who in the world first answers their door to salesmen and two actually lets them do a presentation timestamp

"It happens, all the time"

Apparently old people are a tougher sell, usually younger demographic

Talks to about 20-30 people a day, thinks he should be doing more

- Started out doing 4-6 hours a day, started working 10 hour days in May tripling his income

Worked for a different Door to Door solar prior, made about 45'000, his first year doing it

- Did it for 4 hours a day

Personal Life:

Last year was a "little chaotic" timestamp

Started a business for online marketing

- Wanted to fill the rest of the day since he was only putting in 4 hours a day at the prior solar company

Goes more into this "business" later on when explaining Debts

"So basically you get access to a platform, right? And you can uh you can start your business from there" timestamp

△

Also sold roofs in Florida for 3 months?

"I've been in debt since I was probably... eighteen years old"

"About to completely run out of money" last Decemberish

Tries explaining how he got in this situation in broad terms timestamp

Debts/Expenses:

"Special Financing Company LLC" $4'012 timestamp:

Down to about 3'000 now

Minimum payment $320

- 240 to principal, 80 to finance charge?

Personal loan he took out to start the marketing business

Doesn't remember what the initial amount was

Taxes due timestamp:

Has not paid the IRS jannies

filed extension so he has until September

Interpersonal debts

Borrowed from them since he only made 600 in Feb?

Owes roommate about a $1'000

- Paid off

Owes parents about $2'000

- Not paid off

Student Loans timestamp

$49'845

Got a biology degree from "Old Dominion University" (Not sure I heard the name right)

Thinks it's between 4% and 6%

Probably minimum payment of $500

Another shot of The Spreadsheet, debts section this time timestamp

Verizon $1321

- Financed an iPad and iPhone

Credit Card $6'628 timestamp

Cut it up sometime last month when he started making more money

Losing $100 in interest every month (18% in interest)

$164 minimum payment

Made $68 in purchases

Savings:

Nothing set aside for taxes currently

Nothing saved for Retirement

$4000 in his checking

Savings account 2100 ending balance timestamp

3600 in 2000 out this month, might have gone to checking? Some Dave Ramsey thing about maintaining 1000 in savings

He starts going through all the debit transactions

- 13

- 39

Subreddit link in case of drama

Jose, 29, Dallas TX

Self-rated 4/10 financially and slowly declining

Career/Business stuff:

Personal Trainer

Started a gym

Signed lease a year ago

Opened 6-9 months

"All of it's debt" (did not save up money before starting)

One of his clients loaned him money to help get gym started

Has his business/personal life merged, difficulty separating the two

Bringing in 10k a month

"Now after expenses what does that look like" "Gonna be honest I haven't done the math" timestamp

"I am uhh slightly in the red"

"I would say right now it costs about 2 grand roughly" a month to run the business

Rent is 1600 a month, going to go up in July to 4'600

- Was on a 6 month "baiters" lease? I didn't hear this part clearly

Only employee is his girlfriend, she keeps about 60% commission

brings in 4'500 for the business? Not sure

"A lot of our finances are also intertwined"

0 cost on equipment besides a loan on a body scanner?

- $160 a month

Bought cleaning supplies in bulk and hasn't needed to buy more since then

Electricity - 150, 200 a month

Water currently included with the lease?

Internet about $80

Pandora subscription $10

Insurances

- Doesn't have them

- Doesn't have them

Business credit card debt

"Under a special program that they have" reduced interest, reduced monthly payment

"About 370"

Personal Loan from the client

Lent 50k

Paying him 1360 a month but through an exchange of services? Trains him/wife 3 times a week

Personal Loan

- 170 monthly payment

Has an LLC set up

- Not currently funneling money through this before it gets to him

Setting money aside for taxes? (this wasn't mentioned)

Should be around 3000 dollars of profit but he doesn't know where it goes

Currently struggling to hire a trainer, has two-three leads per month he's able to handle?

No base pay for the new hire, 40% commission only for anyone interested

Had a friend he set up a deal with for training at the gym and the bridge got burned for various reasons

- deets timestamp

Had another guy who put his two weeks in 3 weeks ago they've been looking for someone since then

Plans to start doing youtube content to help promote the gym

Debts:

Blue Cash Preferred Amex (Card 1) $4898:

$86 minimum payment, made $55 in purchases on this card

Doesn't know what those purchases on there, thought he had already canceled everything on this card

$33 interest charged (409 total so far this year)

On this card with his gf

Blue Business Amex (Card 2) 12'691:

Business card

371 minimum payment

$40 new purchases, $81.47 in interest charged, $1112 interest total for this year

691 above credit limit

Thought he had canceled everything on it

Purchases at two record stores and disney+

Inbody scanning machine thing

63 month term

36'260 total financed, has paid maybe 5000?

$100 monthly payment since May of last year

No interest

Upstart Loan

Savings/Expense:

Business checking:

Does not have any savings?

Pays a $30 subscription to another gym

His personal rent is going to decrease he thinks? Will go down to $675 starting June

Does not currently have health insurance

Car insurance $200

Parents currently cover his phone bill?

- 57

- 75

Jessilyn, 21

Brandon, 32

Springfield MO

There's a pretty good chance I've gotten some of this wrong, there were a lot of numbers getting thrown around.

Husband self-rates: 2-3/10

Wife self-rates: 3/10

!straggots This is our fate

!incels How are you even real

Career:

Jessilyn: Stay-at-home mom

Doordash and uber as side-hustles (about 400 a week after gas)

- Only done these for 2 months so far, started because slow season for car sales right before taxes were due (end of Feb)

"We're financially illiterate. I'd say I'm financially inexperienced, almost too"

Brandon: Car Salesman

All commission based, 49'918 ytd (did 117k pre-tax last year)

Minimum wage or commission based whichever is greater? 277 hours a month?

About 30% for taxes

Only brought home 4'200 pre-tax in March?

- Best months were Jan/Feb, all downhill from here?

End of 2022 "economy just kinda shit the bed" so sales are down

Personal Life:

"We met selling cars and then I got pregnant then we started dating"

Stopped selling cars in the summer because she didn't want to deal with the heat on car lot both fat and pregnant?

"Kind of a dumb decision looking back because they had 6 weeks of maternity leave and they offered to move me to a different position that was hourly based inside"

"From my understanding they will not hire her back because we're married"

started dating last Spring

moved into apartment last May

"over the last month and a half we've moved out of our apartment so we're kinda like in a position too where there's not a whole lot of space to be able to keep stuff"

Jessilyn is still on the mother's insurance

Building a new house that was supposed to be ready middle of May?

- It sounds like they're renting it?

Saving/Debt/Expenses:

"I got denied for Paypal crediting like where they finance your things"

Got most of these cards in June? Not sure I heard that right

"Yeah, the ones I sent you were all the really bad ones"

- not sure what she means by that?

Got a car in April "probably spent way too much money"

"60'000 dollar car"

Still owe 57'891

Might be worth upper 40s, low 50s?

2022 Grand Cherokee

Got some percentage off since he's an employee

4.24%, was offered 3.29% but took that to go out an extra year in term to get the payment below $1000 a month

920 minimum payment

He tries to convince them to sell this one timestamp

Husband's car:

2018 Kia Stinger

$26'850 owed, 11.51% interest

525 minimum payment

$330 for car insurance that covers both

Loan to pay off delivery

30k bill on the delivery, still owe 1668? Another 1800 sitting off loan because insurance may/may not cover it?

- Projected 150 minimum payment, less if it's only the 1668

Card 1:

2917.43

29 minimum payment (they made $43 in purchases on this card this month

)

)Interest free until December

Lots of recurring subscriptions through apple, they've since canceled them?

Chase (Card 2):

"The baby one:

455/500 balance -> made 0 payments -> 523.60

$80 minimum payment

Citi (Card 3):

4752 -> no payment and $258 purchases -> $5039

Had paid 300 off of it to get it down to 4752 prior "And that's so sad" timestamp

She put multiple Afterpays on here

- One was lunch. She afterpaid her lunch

- One was lunch. She afterpaid her lunch

$29 late fee

- "The way I see it is it's not all the way 30 days past due because my breaking point is if it hits my credit you kn-" timestamp

Bluecash Everyday Amex (Card 4):

826 -> -$60 payment, +$192 new transactions -> $961.36/$1000

Minimum $40, interest free

"We actually had that paid off the beginning of February" -

At 857 because she made just a payment on it

"I actually got one [credit card] sent to me in the mail the other day and I was like I don't need another one" timestamp

"My thought process, hear me out, was that my utilization right now is probably like 94, 96 percent and that's godawful don't get me wrong but if I open another credit card technically it would exp-"

- "I don't give a shit"

Discover (Card 5):

$3453 -> -$94 payment, +$155 new transactions, +$83 interest, +$30 fees -> $3627

$134 minimum payment

[indecipherable] Bank (Card 6):

"Furniture loan"

$2534, 0% interest for another year or two?

Minimum payment $150

Apple (Card 7):

$7'988/$8000

255 minimum payment, 29.4% interest ($171 interest)

"I have 3 Affirm loans"

"Big one that we've had since September of last year"

$400 minimum payment, almost paid off, $671 remaining

Financed their wedding rings

"Only reason we did it was it was 0%"

"Two amazon purchases"

"Both like a hundred dollars so they're each like-"

$53 left on one

$120 on the other

Phones are financed

iPad is financed (they bought an iPad for the baby?)

Her apple watch is financed

Child support

- "That comes out of his paychecks out of the gross percentage"

Brandon 17000 in retirement

Jessilyn "I don't have a retirement"

- "I also have like a cash value life insurance policy my mom's been paying in since I was a baby. It's cash value is only 1700 dollars though"

$50 in their savings 2000 -> 50?

- Getting ready to move into a new place, most of that went to deposit

$300 in checking?

Lots of paypals/venmo for eating out timestamp for her being told she cant eat out any more

Lots of Klarnas that are all paid off now

She is one of the only people on earth still subscribed to SiriusXM

- 110 yearly

- 14

- 24

Stephani, 35, Austin TX

Self-rated: 2/10

Personal Life:

"Been in debt since before she hit 18"

"So I also have uhh CPTSD? So I also decided that I wasn't going to have emotions until this year too" timestamp !biofoids please translate this aside into scrotespeak

- "Found out" February of last year? She doesn't say the word diagnosed

- "Found out" February of last year? She doesn't say the word diagnosed

"Somebody got me sent to the hospital for saying I was doing something I wasn't exactly doing"

timestamp

timestamp"They said I was trying to commit suicide? Yeah, I kinda got like attacked, by the cops, and drugged by the EMS"

"Who said this?"

- "This girl I've been trying to avoid for like a year or so...used to be a friend but you know sometimes people have to leave your life because they remind you of other people that make things wild"

Career:

Nurse

"Lower paid nurse" - $32.54 hourly

Works a desk job now so averages 40 hours with a little overtime instead of the 60-80 she'd get otherwise

mostly remote

Tries to do sidehustles

used to bartend for events

Writing jobs, currently freelancing writing curriculum for some company or school in Oregon?

Savings/Expenses:

Checking $4'631 -> $5'639, currently $7400

Savings $725?

Retirement

Rollover IRA 2'189, currently just sitting not invested?

United Health Group 401k $9'515

Had thought she would get married and just have someone else deal with these issues for her

A few $40 coffee trips?

got scammed

55% of regular goes to rent (includes utilities), used to be on a COVID unit grift so her income was way higher when she got it

Phone is $99 but she's supposed to get some credits for being a nurse from them?

Debt:

I didn't catch the monthlies for a lot of these

Lots in collections

Mother had put some bills in her name before high school graduation

A ton of stuff in collections

"I've restarted my life a few times and some of the stuff that's in collections I'm like writing letters to them because I've either never been to some of the places that are charging me or they were like my ex or other things"

Some of the companies are trying for debts that should have already expired or w/e

"Portfolio recovery"

$100 a month, bought a laptop for a sales job?

"An Ashely's account" to buy furniture when she moved 5 years ago?

- $645 left, was just a couch?

IC Systems

- Anesthesiology bill, currently owned by a debt buyer who's willing to give her at least half off

Elevator Recovery $2039

- broke her leg in 2020 and let the medical bills from that go to collections

Credit Card:

- Had to replace a battery around $160 but it's totally paid off now

$30'556 in student loans

Around a $400 minimum payment, thinks she might be on an income based repayment? She's not certain

Some of these loans were for nursing school, some were from an abusive ex-boyfriend who used them to buy "race cars"

Car debt: 9'000, 6 years and 25%?! not sure I heard that interest rate right

"So you what people do when girls go to car lot and try to get cars, they said like- they didn't even show me the original car that I went there for but they just told me the bank wouldn't loan me any money because the bank can recoup its losses easier on a new car than a used car if I were to not pay my car loans but I've never not paid my car loans so-"

$350 insurance payment

Large number of hospital bills coming up

$4-5'000 "of the current ones"

Might get helped out by insurance but she's not counting on it

was thinking of payment planning it

- 22

- 61

Colton Rock Springs Texas, 26

Self-rated: 5/10

Employment: Christian Adventure Camp

Was a summer job, decided to to do full time to avoid living with parents after academic suspension

Govt wouldn't give veteran living stipend if not doing education

Plans to go back to school within next few years

Might stick with this because a director position (30'000) might open up in a few years

Retreat coordinator or host "ministry work"

- "Talk with mens' groups or with churches and things we have them come out, specifically I'm in charge of mens' groups and [indecipherable] groups"

$18'900 takehome

Laterally transferring to another job at same camp will be paid 19'000 flat

Doesn't need to pay rent, food, or utilities

80 hours a week

about $3000 total monthly counting disability

Most of income from disability pay

got 42k when he left the military, half to help move half for savings

was paratrooper in 82nd airborne

"Double parachute malfunction ended up falling from around 1800 feet and I shattered my left femur, 26 different bone fragments"

$1'663 a month

Talking with VA about getting disability upped, would be pulling around 90k from that

Retirement plan from the military gets a plan from the camp when he hits a year, plans to roll it in, camp offers 4% match?

Education:

was free, still has GI Bill and Texas Hazelwood Act (latter will pay for another 150 credit hours)

Academically suspended because grades

Something about maritime? Looking at a 6 figure salary with it? I didn't fully catch this part

He thinks he can get his Bachelors within a year

Savings/Expenses:

$15'000 in an investment account

- Wells Fargo Hedge Fund?

$5000 emergency fund

$10'000 in an IRA

Looks like about a 2x coffee a day habit ($2 each) timestamp

Basically all expenses are subscriptions or mobile games

Low-level whale paypig to one of the supercell games

- lot of transactions for it, probably close to a thousand dollars

http://tcgplayer.com/ - trading card game marketplace (physical), doesn't specify which

- Pretty big purchases on here, one of them was $77

http://cardkingdom.com - Magic the Gathering site

- Paid 570 in one purchase on there

Rents movies on Youtube

Paypigs Blizzard, maybe Diablo Immortal or Hearthstone? Not sure what blizzard does these days

$77.78 on Dr Squatch organic soap timestamp

- Looks like a monthly cost?

$148 at "Bass Pro Shop" timestamp

Learning piano, pays for "Flow Key" (?) ($120 a year)

Debt:

Tried debt consolidation but canceled that when they told him not to talk to creditors and realize it was hitting his credit score. He's on a payment plan with Capital one instead

In therapy

Credit Card 1: $3965 -> $6'817 -> $6633

Put a vacation on it (around 1000), going scuba with some old friends from the military

$116 interest accrued, then $169

Credit Card 2: $4571 -> $3885 -> $3385

$113 interest

152 minimum payment

Opened it when he got out of the military, went NEET mode for a year (2021)

Car is a 2004 F-150 (paid off), had it a decade, 130'000 miles on it, thinks it will last another 6 or more

- $90 a month

Losing $283 interest a month total

- 26

- 59

Duncan 26, San Antonio TX

$57'303 total debt

$880 minimum monthly payments, 41% of his current income

At least $400 interest accruing each month ignoring student loans and stuff in collections

First truly mentally ill person on the show, he weirds me out a little but I might be just paranoid. I don't trust people who cry on camera. I've timestamped some of the oddness, not in chronological order

Self-rated 3/10 financially

Has been watching Caleb for "a couple months" hasn't started budgeting

- cries from stress of his situation? Tries to explain his failures in past attempts to budget timestamp

Diagnosed with "Bipolar II Disorder" plus some backstory, only recently got meds

Career:

Delivery for Tiff's Treats and somtimes on-duty manager on weekends, does Grubhub/Doordash on the side

"I got deactivated from Grubhub for some reason" timestamp

Drives company car so his gas payments aren't bad

Currently making $23 an hour and $18 as the stand-in manager

hours cut, losing insurance in July (sales down year after year)

nervous laughter here timestamp

financially struggling

only 6 stores in his district

Personal Life:

Lost his last credt for film grad because Covid and classes/grades fell apart afterwards near beginning of covid?

Was taking classes last semester? timestamp

Not this semester though so Student Loans are active now

Sudden jump from verge of tears to recitation of the canned youtube comment line about finance needing to be taught in high school timestamp

"I think that's a big detriment to the American education system, nobody gets taught finances, ever"

Wants to go back to school for a business degree but can't because of his current situation

Savings/Expenses:

Nothing in retirement

USAA checking

Monthly balance $225 -> 281

Spent money on Uber Eats, overly self-deprecating statement to dodge timestamp

Same dodge trips to coffee shop/donuts/general eating out timestamp

Shared checking with him and his girlfriend

Pays to do gig work? Not sure if I understood that right

$766 last month just on fast food/eating out (36% of income)

Swipe savings

$7 -> $161.85

$224 car insurance payment since he got into an accident uninsured

Debt:

Says he has a terrible credit score (551)

Was at 630 3 months ago

Found a credit repair company he's been thinking of reaching out to

Student loans (paying interest only) Variable Interest Rates

$13'316 14% interest

10% interest

10% interest

Car Max Loan

$16'584 remaining, 421 minimum monthly payment (he's got another 400 past due with a 21 late fee)

10.45 interest rate

"All three of the credit cards I emailed you are in collections" timestamp

USAA credit card

Some old Visa

Coles Card

Owes $63.23 on "Afterpay"

Also on Paypal, Affirm and Klarna "I made a series of really really bad decisions"

- Affirm is 1k

"And it's just this stupid stupid anxiety of not knowing what I'm gonna have left" timestamp

Personal Loan

took it out a year ago because he was "freaking out about money" at the time

1'400 balance

Personal Loan

$986 "one of those finance app where you pay a certain amount and you get the rest of the loan back"

Not paying this one?

Owes Grandpa $4'500

"terrible situation"

First car he bought died, grandpa co-signed for a new car

- got t-boned and did not have insurance

Has had 2 cars get totaled while on job?

$10 monthly payments, it's informal

- 66

- 57

Some or all of this might be wrong, was listening to this while eating :marseynerd:

Adriannah, 22, Austin TX

Could you fix her !straggots ? I think this one's beyond me

Self-rated: very bad, worst of her life maybe

Is our student loan debt being forgiven or no?

No

For real?

Yeah for real

Okay yeah, because I have 9'000 of that and I don't know how to pay it

Personal Life:

Cut off while she was 17, :marseythinkorino: had to work two jobs in highschool

Went to college full time (lived there)

- 3 jobs in college, part time wedding videographer, streamed on twitch and took a lot of addies (perscribed)

Had addictions at some point, claims to be over them

Trying to save to move (thinking about doing a payment plan with the IRS)

A family friend told offered to be her financial advisor and put her in life insurance ($100 a month)

In therapy "One time I had a really bad incident where I thought the world was ending and I spent $500 at HEB"

- :marseywomanmoment:

"A lot of my financial things are from travelling since my parents are far away"

Career:

"Content Creator"

Tiktok, Twitch, Instagram

- 109k Tiktok, 112k Insta, 15k Youtube, 100 paid subs Twitch

Trying to expand presence on youtube

Income:

$6 a month from Youtube

$4-6k average income across all platforms

Expenses/Debt:

Total minimum monthly payments $983, a quarter of her income

Wanted to consolidate credit card debt but hadn't done her taxes for two years?

- Just got a CPA, doing all her taxes now

Someone else is using her credit card?

- I missed a chunk, not sure what's going on here

Restore "Monthly Payment"

Her IVs? !biofoids please explain, what is an IV?

"I get IVs because I had problem with my hair falling out and when I drink I can't throw up so umm usually I'll get an IV so it restores me"

Tons of eating out, fast food places

$418 on a Salon :marseyfoid:

- "I wanted to look good because there was a chance I would get signed and get a literal salary to this thing that I was literally led on since August to get signed to and they were like 'Come to LA you`ll have a better chance if you come to LA' so I'm like I need to look my best I need to be my best self before I come to LA. So I got my hair I got extensions but they weren't mine they're my mom's so I didn't have to pay for them I just had her put them in and then, those extensions ruined my life. So this is me getting my extensions out and my hair redone because I could show you my bald spot right now but I'm not going to, my extensions literally ripped my hair out and it was like a mess."

$213 on an outfit

Stopped doordashing since she started watching Caleb's channel

Car

"Before you say anything I will not be selling it... but I am going to be refinancing it. But listen-"

Couldn't refinance because she let her out of state license expire and now has to retake the entire test

- Apparently this is an insurmountable process for this egirl as by the time she got her license to refinance she was deep in debt

Land Rover LR4 2011

400 minimum monthly, 9% interest rate, 72 months, got it at 19

Student loans

$900 Federal

$150 minimum maybe?

Didn't graduate, year and a half going to school for film

- "It was a waste of my time because I talked to the lady, I said what, how can I reasonably get a job with this degree after and she said 'you can do wedding videography for a company' and I said 'I already do that' so I dropped out"

Credit Cards

All basically maxxed out

Apple store $6996.24

"When I signed up for an apple card I thought it was just for the Apple Store and I wanted a macbook beacuse I was like I'm buckling in and I'm editing"

Minimum payment- 280.74 (will be paying 20k over 21 years if only doing minimums

)

)3 things financed on this card

- Macbook, iPad, Apple Pen

Wanted a macbook

Still spending on it, bunch of apple bills for buying app subscriptions? "I don't know what they are" "I don't really look at my things"

American Express $10'831 - 27% interest

She loves this one because it sometimes gives her 'free' first class upgrades

"It wasn't my choice to have that limit"

- Customer service told her they love her so she went with it

"I started a show, it's called 'Drinking with Dree' where I invite 3 creators on, and I would like to invite you on' and we [words words words basically a podcast]"

- Was going to use it to prove herself to that company she thought was going to sign her

I think this succubus is trying to get her claws into

's $$$$ and clout

's $$$$ and cloutInteresting contrast between how they approached the eceleb game Timestamp

$50 minimum payment but pays more than that (and spends even more than that purchasing with it)

Mastercard $3356.44/$3500

First card

minimum monthly payment around $40?

24% interest maybe?

Paying it off but spending way more than she's putting on it

Target

"because my other cards were maxed out and I didn't have money for a while I had to use my Target card even though I just paid it off because I needed to buy groceries... And I could this right now if I wanted to"

$153 previous balance now $374 "well because I bought groceries"

Paypal Credit Card?

Used only for stream stuff and editors

646.94/650

normal minimum is 40?

not sure interest rate

Savings:

2000 in a savings

1450 in a checking but 900 of that came out to pay the CPA to deal with the taxes

3000 in a Robin Hood

Never pulled anything out of Robin Hood besides Doge

"I like that it's in Robin Hood because I am impulsive and crazy"

Gets stock advice from some guy on Twitch

Over a year 2900 => 2230 => 3100

- 25

- 51

Fantastic episode today. Guy's incredibly arrogant, typical journ*list. He believes he's famous? He keeps bringing up his degree in Information Systems and spergs a little (timestamp) when fatty says nobody cares. Comments are fire. Schizophrenia? He reminds me of a few I've encountered.

Chads show themselves in the comments

Everything I have written may or may not be right and might be completely exaggerated, don't trust me. I can't even spell right most of the time.

Response to a basic financial plan

'I don't care enough to stop eating taquitos'

Pure undiluted seethe the near the end

- The taquitos are a massive sticking point. Same with being called a baby

Vein goes bulgy

41 years old

Lives in Austin

"What do you do for a living?"

"Too many things"

"Okay, go on"

"I don't even know really, I'm just like hustling every day basically because I have been blacklisted from most jobs [laughing] because [laughing] I have a...[laughing] criminal background"

"woah what did you do?"

"I told Governor Abbot on Twitter that I would eat his heart and... umm.... that like solicited a big reaction"

"Misdemeanor B, terroristic threat," did this in 2018

Background:

Moving in two months to Dallas Fort Worth area

Lots of connections there and way cheaper

- Former client is the mayor of Arlington?

Doesn't have a place lined up yet

Jobs:

At least a 6 year resume gap?

'I've applied for every job in this city'

Wattaburger

- Said no to being a cashier because he was interviewing for a PTA director job

Gets chewed out about picking and choosing jobs instead of actually going for things