- Awoo : Irishphobia

- 43

- 85

This drama from Nairaland, Nigeria's largest forum.

OP's Lament

Ranting. Ranting. Ranting.

I have decided to rant out my predicaments on this forum today.

What is the way out of poverty for me?

One inlaw is even living with us, making it 8 in number, all in one room.

This thing don come big pass me.

I know most of you here would blame me for impregnating a woman to give birth to that number of children but then, life is life. It happens like that sometimes.

They say a poor man's prayer is "e go better" but instead of things to get better in Nigeria, everyday things get worse.

Truth is, except I drive myself out of this mess to a better life for me and my children, this poverty that is so stricken will likely be extended to my children, which I really don't want.

No two ways about it except ...

But like a car without tyres, can it move even if it has fuel? Definitely no.

For 4 days now, I sleep outside in an abandoned car because of financial war at home. I can't go back home and I even feel like never to go back there but should I abandon them like that and run away? To where?

When I went to the market the other day with 5k to buy food items for the house, I was crying and talking to myself on my way back because I came back with almost nothing.

Nigeria have succeed to plug life out of poor Nigerians. The poor cannot breathe again. Let's die and go.

Advice: never give birth when you are not financially strong. Unfortunately, I've learned my lesson the hard way.

5th time's the charm!

Life happens.

How do I help this family better than I am trying?

Wishing you the best in all you do.

Context: 40k naira is ~50 USD

OP is a driver for a farm, earns less than 50 USD/month and has 5 children!

Users Dunk on Him

You are earning low, but your reproduction of living things is high. Imagine, 5kids. Your excuse; 'Children are gifts from God.' You will continue to rant if you don't control your reproductive organ.

You and your wife are mad

If you get a job that pays you 100k, I am sure you will increase the children to 10.. You are productive in bed. I don't have pity for people like you that are insensitive to things happening in the world.

I have zero pity for the likes of you. In fact, even if I had the means to assist, I will NEVER help people like you. Do u know why? I will tell you. It's because some of you have decided not to have sense. Do you think those that gave birth to a child because that's the number they can afford to cater for are fools? I don't know how some of you reason. The hardship you were facing wasn't enough, you choose to drag innocent kids into it. Now, you're running away from your responsibilities. I will tell you the same thing that I always say to 'irresponsible parents'. If you can't train your kids, go and sell them. There will be willing buyers who will help you lessen the burden.

i dont know why youre lamenting. far as i am concerned what youre going through is good for you. what are you doing with such amount of children? you didnt think of economy? you didnt do family planning because you prioritized sexual pleasure and being a sharpshooter instead of living within your means. na you sabi.

I know for sure this can never be true. but if its true, but lets join you to lament. you are the cause we have miscrants in the society. children whose parents are no taking care of them and at that the end sort to robbery and thugery for survival causing nuisance in the society because their parents neglected them. Gone are the days that people will say na God dey give children, uncontrolled sexual appetite gives birth to children when not done properly (protection, family planning) . don't bring children you can not take care of into this world, especially here Nigeria.

Translation  yansh = butt; "junior" = peepee

yansh = butt; "junior" = peepee

We have said this time and time again. Do not give birth to children you cannot take care of. Nigerians make it seem as if you’re impotent if you have 1 or two kids. Thank God the upcoming generation have learnt from their elders. We will no longer be seeing situations like this in 20 years.

They have? I would not be shocked if all of OP's kids go on to make the same "E go better" mistake as OP abeg! We have seen it happen time and time again to at least be able to predict it so. Na generational thingz e be sef.

Give birth to more kids.. make it 21 children. I don't know what is wrong with you Poor people. A rich man despite how wealthy he is will give birth to just 1 kid only..poor men go dey born children full everywhere

While, as human beings, we are empathetic with your plight…Instead of blaming “Nigeria” perhaps you should’ve put a rubber on it! “Nigeria” didn’t impregnate your wife. Over the past couple of years I have been conducting a sort of informal poll…And, of almost all of the upper-middle and middle class people I know, their driver or gateman or cook has MORE kids than they do. Why do the POOREST people in Nigeria seem to have the MOST kids? Our old maiguard had over 20 kids in the 21st century when everyone knows about condoms (or even the “pull out” method).

#TakeResponsibility!

Nigeria's 200m population is projected to hit 400million by 2050 no thanks to dvmb people like the Op and also by that period, Nigeria crude oil proceeds will reduce heavily owning to the massive usage of electric vehicles in EU and North America. A period of super-massive population explosion with lower GDP will mean heck on earth in Nigeria. Hyper crime rates with excruciating hunger and poverty... It's just 27yrs from now. The govt in Nigeria should as a matter of urgency implement 2child policy in the country. Persons like the Op should be arrested and castrated if possible because an arm robber that will kill and terrorize our towns and villages in 10 yrs time maybe be traced to what the op did today.

Some one said "the enjoyment of a poor man is s*x"

fck this country man i swear nigeria issa heck on earth

Wallah brudi

The only question I will ask is why 5kids na??Even many GMDs, CEOs with much money don't have such kids , bros I pray you get what will upgrade you financially because even me as a single guy that receive much more than that I'm scared of getting married due to how things are in nigeria to be honest. Bros you gallant wallahi I CAP.

Some Helpful Advice

You need to stop reproduction, do family planning with your wife. Put your children in public schools and you monitor their studies, check their books from time to time educate them of good behavior and the kind of friends they should have. Your wife has to be working so that she can support you in the house and no relative should be allowed to live with you for now, they can go elsewhere. When you want to buy food, buy in bulk when you get to market you will see other people contributing money together to buy in bag and share, this will also save you money and look for better job. It shall be well with you and your family.

try open a small petty business for ur wife and kids. Any type of business.

Blessed are the poor, for theirs is the kingdom of Heaven. God is hugely invested in the poor and provides light in darkness for us. Pray to the most high, hold him to your word for light and sustenance. If he looks after the sparrow, then we are much more important. God for us all

How can one be living in 1room and born 5 children, ha ba!, Animals self can't do it talkless of a human being

Bros you are not a serious person,. You have a family of 8 and u are comfortable waking up and going to earn 40k every month. You are your own problem, your mindset has already limited you. Break free from the bondage you put urself and go explore. What are u doin wt 40k monthly ? You don't have the spirit for struggle but you have the spirit to struggle when it comes to s*x. If you are in Lagos enter computer village or you enter ladipo or alaba mkt or go and do middle man work , those guys earn something up to that your monthly salary in one day. Go and get keke maruwa on higher purchase,If you have sense you would have learnt a skill . Go and learn how repair a generator , car, learn barbing of hair Oga you are not a serious person. In the meantime take life things jejely, ur family still needs you. You still have enough time to do this things and turn things around for yourself and ur family

But how does your preek rise on top hunger to the point of impregnating a woman 5 times. You must be a drunkard that goes home after so much frustration and highness to force your wife for s*x without your right senses. Even your wife that opens leg to collect on top poverty no dey try. If she had starved you of s*x after two kids maybe you would have hustled well to make something good for the little family. But shooting up to five when you dey no dey work for oil company or you no be politician I no come under.

I understand your predicament OP. It really can be frustrating when you're in this kind of situation. You took the best step by speaking up though. The way forward for you, right now would be to find a solution to your problem. I'm a student and I earn passively by publishing on Amazon. If you're interested, you can start up and begin earning too. At least you'll be earning in dollars and that would remove a whole lot of financial strain off you. If you're interested, you can send a dm. It's well with you and your family

Infighting

Anyways I got tired of laughing and started feeling depressed because we are in the same country and have the same voting rights

You can advise him here but if he didn't learn after 5 kids I don't think he's gonna learn

- 21

- 48

- 52

- 30

The answer is yes btw.

Current gross income: 68k Projected gross income (Starting Jan '24): 118k This huge jump would be provided by a 16% pay raise and about 25 extra hours per week.

OP said they were making $100k until March. Bought a new construction for $586k (88k down) 11 months ago in LV. Paid for a bunch of upgrades. Zestimate says it's worth $522k and mortgage is currently $503k. Also of note is that he referred to the $88k as their savings, but in another post says it's proceeds from a previous home sale. Peak poor mentality.

Not counting our consumer debt, our monthly budget is as follows:

Mortgage-$3,403

HOA-$138

Utilities-$188

Groceries-$1,000

Life Insurance-$95

Auto Insurance-$380

Internet-$93

Cable-$100

Solar-$201

Our consumer debt, with minimum payments are:

Chase (20.24%)-$1,288.86 ($129/month)

Best Buy (0% until July 2024)-$2,150.58 ($35/month)

Credit Union (18%)-$2,701.92 ($68/month)

Wells Fargo (0% until April 2024)-$2,885.86 ($147/month)

Fortiva (0% until March 2028)-3,733.32 ($67/month)

BofA (0% until Feb 2025)-$5,128 ($51/month) A

Amex (7.99% until April 2026)-$7,761.67 ($263/month)

Chase (20.24%)-$10,136.02 ($385/month)

Amex (7.99% until April 2026)-$12,672.53 ($430/month)

Citi (0% until March 2025)-$15,988.07 ($160/month)

Personal Loan (17.24%)-$19,653.63 ($503/month)

Auto Loan (3.79%)-$36,160.77 (549/month)

Wife doesn't appear to work, and MIL is a leech. OP is still posting but it seems like they bought it planning on the MIL paying rent and she basically said frick that.

My mother-in-law (67) has stayed with us since the end of 2020 and we agreed her monthly rent would be $1,100 for 24 months. She still owes us a total of $11,500 (11 months x $1,100), but her workers comp ended, so her monthly income went from $4,800 to $1,800. She hasn't paid anything since January 2022. We recently told her that we needed financial help and she reluctantly stated that she'll have to look for a job. I blocked her IG page, because after constantly seeing her going out (concerts, eating...) and new hair-do's every month, I'm starting to resent her. Not surprisingly, my wife doesn't feel the same. And because of that, the saying "I can do bad by myself" has crossed my mind more than I would like.

Don't worry though, he has another transfer card.

We were also just approved for another 0% transfer card with a 15k limit.

I think a lot of posters are thrown off by his terrible formatting because the responses aren't overwhelming "yes file for bankruptcy".

- 20

- 92

- 34

- 45

- 82

- 161

Main Thread:

https://old.reddit.com/r/antiwork/comments/14x6fr3/35hour_and_still_broke/

OP complains that they're broke making $70K a year. But some enterprising commenters delve into their post history, which demonstrates some very expensive gaming cabinets and consoles throughout OP's large apartment.

https://old.reddit.com/r/antiwork/comments/14x6fr3/35hour_and_still_broke/jrmd6h0/

https://old.reddit.com/r/antiwork/comments/14x6fr3/35hour_and_still_broke/jrmttl9/

https://old.reddit.com/r/antiwork/comments/14x6fr3/35hour_and_still_broke/jrmywyl/

- 139

- 116

- 5

- 19

Highlights:

Really weird take on 401ks

$800/m on Venmo: "We pay $40-60 once a week to babysitter"

$1,600/m on Food (groceries & eating out)

Pays financial advisory $150/m for long term savings. Not sure what this is about

-$1,410 for the month

Doesn't have a car payment despite mentioning it at the beginning of the video (confirmed liar)

- 17

- 26

- DickButtKiss : Slim anus??!? you darn right slim anus, i dont get fricked in mine like you two little flaming cute twink

- D : Juggophobia and seriously mid bitches

- 95

- 138

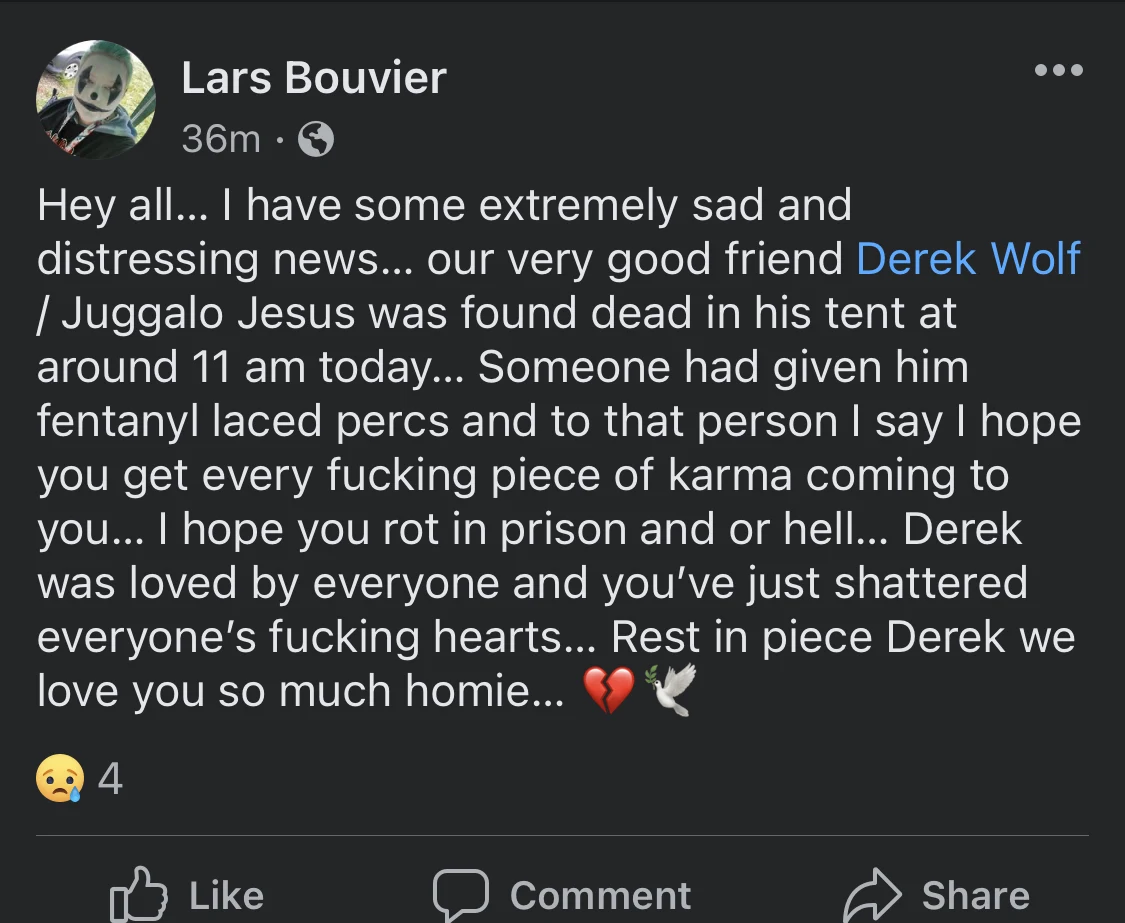

Their Facebook group always has plenty of good shit.

Our boy James can’t make it, his hovel nearly burned down

Jesus fricking Christ

Idk what else to say

You gotta be doing some wild shit to get kicked out of the gathering lmao

Only cool cop is a black cop at the gathering

Absolute monsters eating faygo hotdogs

Really pisses me off

This “woman” hurts me

First casualty this year

What kind of fam kills fam

Smh MCL whoop whoop

Ok and to end the first post here’s some ugly people

Someone pin this or tag someone to pin this. Best thing going on rn

- 1

- 10

- 77

- 82

- 66

- 89

Daniel, 22, Lubbock TX

His other half overrode the financially savvy asian half

Self-rated - 6/10

Personal Life:

"Barely 22"

Why'd you go in to the debt?timestamp

- "Well it's a long process"

Went to a trade school, Universal technical institute

- Automotive, certified in Volvos

Friend encouraged him to come on the show, doesn't watch the show himself

"Last year I got myself into a predicament"

- "I moved out by myself and I was paying so much in rent I didn't really think it through so last year was a year where I really struggled and this year is a year where I really tried to step it up"

Career:

A Volvo technician

52'000 a year pre-taxes

Lives in Lubbock for his job

Expenses/Debts:

Credit Card - $1'628

Not spending on it while paying it off, made $200 payment (way more than minimum)

35% interest, talked them down to 18%

"I honestly don't remember how I got so high up in debt, I think I did pay off some student I think I paid off a class and it really set me behind and then I used my credit card to get a car"

- Put the downpayment on the card

- Put the downpayment on the card

Collections (1) - $972

Medical Debt

When he was living in Arizona, not working at the time, wasn't feeling well

Two years ago, not something that will repeat

Wants to pay credit card off before this

"They can't report medical debt on your credit if it's less than $500?"

Tried to negotiate but failed, only tried once

Been in collections since last year?

Student Loans (4) - $12'000

Federal but he thought they were private

Around a $150 minimum payment

Maco debt toolbox? timestamp

18% interest rate

Toolbox itself was 6'500

Owes 9'500

Minimum monthly is $180

There's something weird later on where he thinks it shows up differently on his credit report timestamp

Missed a payment at some point?

Car Loans (2) - $30'638

"I have two cards, I'm thinking about getting a third, a Tesla"

"Well you save on gas, yuh know, it's always nice to have three cars"

"I have one car, the other ones from my mom, it wouldn't hurt to get another one... it's always an investment"

"My mom needed a car so I bought her a car under my credit"

- "She's in a financial situation as well"

Sion IM 2016

19'000

"I'm pretty sure it's overpriced... it's just my mom really needed a car"

Put down $2'000

13% interest

"That's the cheapest they had on the lot" "I was in a tight schedule with work"

72 months

"Well at the end of it I'm not really paying for it, Mr.. pushes up glasses Hammer, my mom is" timestamp

- The plan is once she buys a house she will buy the car off him with her credit?

Ford Focus 2019

11'703 remaining

103k miles

2 for one deal with the other car

He's not sure about the term or the interest rate

9'000 downpayment?

$312 minimum payment

24.39% interest

Trashes In n out and Red Robin timestamp

Trashes In n out and Red Robin timestamp

Savings/Retirement:

High Yield Savings with Amex:

$866 => $1'066

4% interest

Investment Account

All part of the Acorns

$200 in one

$300 in another

No match

Budgeting Conversation:

Under contract at job, can't leave until it's over, Feb of next year, plans to move back home after timestamp

Putting money into a "Christmas Fund" at work

Doesn't pay renter's insurance timestamp

Apartment is under his roommate's insurance?

Not on the lease, "they didn't approve me" (because of the collections)

- 22

- 33

He's spamming the Caleb Hammer subreddit with posts. He's a bit all over the place but it sounds like Caleb was connecting Zeke with some gay OF guy. Zeke is saying that it was really Caleb, and then claims Caleb sexually assaulted him at some point.

- 24

- 38

- snus : sentient snappy inside

- 30

- 43

Student loans start accruing again on Sept 1st, and payments will be due in October. There are a bunch of new programs and acronyms making a simple transaction (borrowing money, and paying it back) even more convoluted than before. With these $300-$1,500 payments looming over the horizon, student loan posts are starting to pop up. As has been shown on the Caleb Hammer show, a decent amount of people don't even know what their payments will be because none have had to be made in the past three years.

Sometimes going to college and taking out a loan, confident and optimistic that repaying that loan will be manageable and the cost will be offset by the higher salary you can expect to fetch with your fancy degree, will be worth it. And perhaps it will be (maybe even for most) but…sometimes it ends up being the worst decision you will ever make. It will haunt you. It will make you feel hopeless. And it will affect your quality of life for decades. I took out loans back in 1993/1994 in my final year as an undergraduate. $8,000. I took two more in 1994/1995 for graduate school. $17,500. After graduation I landed a job as a waitress. Quickly, ccard debt and loan payments crippled me. I filed a Chapter 13 bankruptcy in 1997. The loans were included in the bankruptcy and received payments (although minimal) throughout the five years that ensued. Upon completion. I was notified that I now owed $38,581 and should consolidate the loans which I did (these were FFELP loans). February of 2003, I start making standard 10 year payoff payments…until 2009 when I discover IBR plans. I was elated. Payments dropped significantly, varying year to year with no rhyme or reason. One year $190/month, the next year $110 with no significant change in salary. Currently it’s at $245. Last night I did a loan consolidation with the Dept of Ed. I didn’t even know you could do that. This is the only way to get “forgiveness” because of the hybrid nature of my loan. Not gonna qualify for the $10,000; this is about riding out the clock. Before last night I owed $30,521. Today I owe just over $40,000 (capitalized interest). I have been given a 25 year timeline, starting in 2/2003. No credit for the undergrad loans, no credit for the six years of partial payments prior to the consolidation. No pause in payments for Covid. New monthly payment $326. I have made 228 payments since 2/2003 totaling $43,000. I paid about $1,500 before 2/2003. I will now pay another $23,000 before this is over. Maybe. It’s all subject to change. Hopefully this cautionary tale will help you avoid the potential catastrophe of poor choices when deciding to take out loans.

OP here managed to jump from basically one IBR program to another to lower her monthly payment over the past three decades ultimately accomplishing nothing.  IBR is a recurring thing you'll see in a lot of posts.

IBR is a recurring thing you'll see in a lot of posts.

A rare story of someone actually paying down their loans. Here are some responses by people who don't know why they've been making payments for years and the balance hasn't gone down:

I'm actually amazed that your principal went down if you were only paying the minimum

I don’t understand how you had made progress in 3 years. I don’t doubt you, i just have been paying for 11 years on an income based plan and still owe more than i borrowed :/

Also in this thread are some future posters of "we've been paying for 20 years but still owe more than we've paid. What's the deal?"

We always viewed as a bill, like you pay a mortgage or electricity etc. we keep the bill as low as possible through the different income based plans and account for it in our budget and live our lives. We don’t view the bill as something that needs to alter our path in life . We both have lots of earning potential and it is recently been realised . It took my husband from a tier 4 law school about 7 years to get there but he always made good money as he had a clinical degree as well (hospital work in compliance and now counsel).

So I think overall figure out how you want to approach this- some people are not comfortable carrying a long term balance and have to get rid of it asap. We don’t even think about, it’s just s bill to us and we pay it. Fundamentally life is short, you don’t get time back, postponing life to pay off debt is not something we value so we didn’t do it.

Final one I stumbled upon.

Advice says to just settle for his soon to be government job for the next 10 years and hope PSLF comes through. Ignoring the fact he didn't really seem to get this guys point, OP really shows how well he's thought this through with this response:

A lot can happen in 10 years. I joined the military thinking I would do 20 years of service and got out after four. I’m currently in the process of getting a job with my local government now, but I’m not waiting around until 2031 to have my debt forgiven. If you have the financial means to pay it off sooner, do it. Public sector has a lot of trials and tribulations in and of itself, I would hate for you to pass up the opportunity to be closer to debt-free under the assumption that you will be working in public sector for the next 10 years of your life, only to have some thing happen with your job or your availability and disrupt your employer.

Your right, hypothetically I would stay the 10 years…. But I’ll still have the 50k handy in case I do leave ( I know I’ll loose a few K to interest)

His balance will be accruing like $7k+ every year on this plan.

- 36

- 50

This woman won't be changing shit, there's no way

Steysha, Nashville TN, 27

Self-rated 7/10

Personal Life:

Vacationaholic

"I actually have two trips coming up but after that I'm done" timestamp

Flying to Houston, then New York

Around 30 minutes in she mentions that she has a daughter timestamp

Father mentioned soon after but that's a lot of vacations to be taking with a kid

Doesn't live there, has his own house, comes over sometimes?

Father pays for most of the groceries?

Career:

Compliance Analyst

Software company

8 months

prior did the same thing at a different company

84'000 a year (including 4k guaranteed bonuses)

Work from home

Contributing 6% matched

Debts/Expenses:

Discussion about her budgeting timestamp

Car Mazda CX-5 $18'818:

Bought in 2021,

46'000 miles

Might be down to 17k now

6% interest

"I didn't put anything down"

482 minimum payment

Ally Loan 10'537

$152 payment, 10% interest

Had to get a new HVAC

- Didn't price shop

- Didn't price shop

Had no emergency fund

Credit Card (No balances?):

Lots of eating out

Lots of Vape CBD stuff, about $50 a pop

Student Loans 34'000

All federal

South College

- Degree in Health Science

"I haven't paid anything... ever"

- Graduated post-pandemic

She didn't ever think about the minimum payment for it

- "400? That's a lot" timestamp

House 123k (deets in savings section)

Thinks $400 a month in gas

Savings/Retirement:

401k for current job

- 5'000

Has taken out her 401k multiple times timestamp

"I regret it now but..."

Did it in both 2020 and 2019

Used some of it when she purchased a house

- IRA lets you withdraw penalty free, 401k does not (Caleb confuses this when talking about it and corrects himself later)

House was 130k

45 minutes outside of Nashville

Put down 3%

Remaining balance on house is at around a 123k balance, refinanced it in 2020

Bought it in 2018?

Was 6% now 3%

$1049 payment on the house

Estimate 242k zillow estimate on the price

Checking

- didn't catch the balance if it was mentioned

Savings - $3'012

- "So I do have an emergency fund

timestamp

timestamp

- "So I do have an emergency fund

Budgeting:

- Umm... Can you add a going out to eat budget timestamp

- 26

- 35

.webp?h=8)